First off, well played PayUK. After years in the doldrums, 2023 looks set to be a record year for 7-day switching.

In Q3 2023, 344,195 switches took place through the service, compared to 222,108 in Q3 2022. One quarters figures should never be taken in isolation but for the year to date, the trend is up year-on-year by 67%.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Specifically, total switches for January to September total 1,023,464. For the first three quarters of 2022, switches totalled a mere 610,849. Back in 2012 there were 1.2 million switches and that figure has not been exceeded since the launch of 7-day switching. Since then, annual switches peaked in 2014 at 1.16 million. The annual total dipped then in each of the next four years, to 1,033,939 in 2015 and to 1,010,423 in 2016. By 2017 (931,956) the figure was back below the one million total and fell again to 929,070 in 2018. By 2021, the annual number had fallen even further to 782,223.

It is safe to forecast, that with one quarter to go, 2023 will represent a record year.

9.8 million switches since the service launched

The total number of switches since the service launched in 2013 now stands at 9.8 million. So, it is also a safe bet that the next set of quarterly figures will enable PayUk to celebrate passing 10 million switches. The quality of the switching service has never been in doubt. Relatively modest annual switch rates of just over 2% of adults switching their primary current account has had more to do with customer laziness. In Q3 2023, awareness levels for the Current Account Switch Service sat at 77%, while satisfaction levels totalled 87%. In Q3 2023, 87% of Current Account Switch Service customers were satisfied with the process and 87% would recommend the Service.

7 day switching: winners and losers

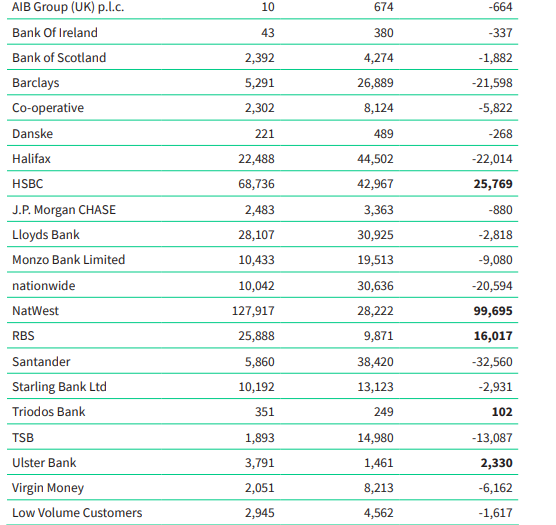

Brand by brand customer date is published three months in arrears so the latest figures relate to the period from April to June 2023. The biggest net gains are reported by NatWest, followed by HSBC, RBS and Ulster Bank.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCitibank, Allica Bank and Rothschild joined the Service in Q3 2023. Their switching figures will be included in the next quarterly stats due out in January 2024. The service now tracks switching statistics from 51 brands in total. The only notable UK current account service provider not tracked by the service, for reasons it has never explained, is Metro Bank. Brands tracked under the low volume grouping include Arbuthnot Latham, C Hoare & Co, Coventry BS, Cumberland BS, Habib Bank Zurich plc, Hampden & Co, Investec, Reliance Bank, Spectrum Financial Group, Think Money Ltd, Unity Trust & Weatherbys Bank.

In Q2, Santander is the biggest loser followed by Halifax and Barclays. For the second quarter in succession, Nationwide is also a notable loser. This follows eight successive quarters reporting net gains. In the four quarters of 2022, Nationwide posted net gains of 111,941, 3,248, 5,598 and 12,503. In 2021, Nationwide posted net gains in each quarter of 33,691, 33,828, 3,601 and 1,474. Until the first quarter of 2023, Nationwide had not endured a quarter of net losses since Q4 2020.