UK 7-day current account switching is off to a strong start in 2024. Between January and March 2024, the Current Account Switch Service facilitated 320,364 switches. The figure is however down by 6% from the first quarter of 2023 when 341,075 switches were completed. The first quarter numbers follow a record year for switching, with 1,457,165 switches in calendar year 2023.

UK 7-day switching launched in 2013 and until last year, annual switches peaked in 2014 at 1.16 million. The annual total dipped then in each of the next four years, to 1,033,939 in 2015 and to 1,010,423 in 2016. By 2017 (931,956) the figure was back below the one million total and fell again to 929,070 in 2018. By 2021, the annual number had fallen even further to 782,223.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The total number of switches since the service launched in 2013 now stands at 10.6 million.

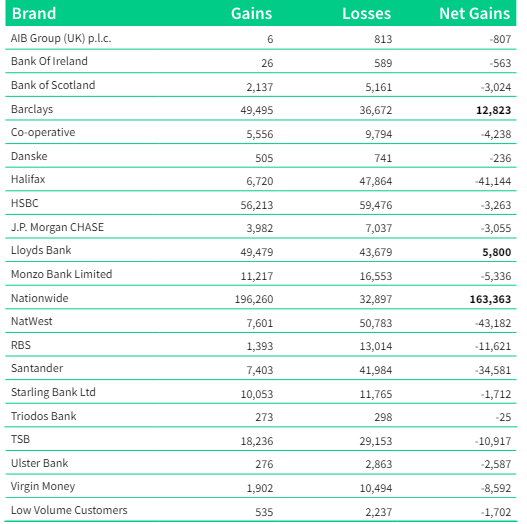

End user switching data, highlighting brand-by-brand net gains and losses, is published three months in arrears. So, the latest quarterly numbers show net gains and losses by brand for the period between October and December 2023.

Nationwide top for net switches

Nationwide had the high net switching gains (163,363), followed by Barclays (12,823) and Lloyds Bank (5,800). By contrast, Nationwide was a notable loser in the quarterly switch statistics for Q3 of 2023. Over that period, Nationwide was not offering switching incentives. It followed eight successive quarters when Nationwide reported net gains. In the four quarters of 2022, Nationwide posted net gains of 111,941, 3,248, 5,598 and 12,503. In 2021, Nationwide posted net gains in each quarter of 33,691, 33,828, 3,601 and 1,474. Until the first quarter of 2023, Nationwide had not endured a quarter of net losses since Q4 2020. With the return of a switch incentive, Nationwide is the biggest net winner by brand by a distance.

The ongoing success of cash incentives to switch

John Dentry, Product Owner at Pay.UK, said: “People and businesses have more choice than ever when selecting a banking provider. We now facilitate switching between 53 different banks and building societies. Cash incentives continue to be a highly effective way for banks to attract customers. But as we repeatedly see, online or mobile app banking remains the top reason why people prefer their new account.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“The end of the financial year may have contributed to a spike in switching from businesses. Many spring clean their finances and set themselves up for a successful year ahead. The importance of having the right account for your business should not be understated. With our easy, free and guaranteed service, businesses can rest assured that their account will be safely transferred if they find an account that better suits their business needs.”

Switch incentives disappear from the market

Alastair Douglas, CEO of TotallyMoney, added: “The latest figures show that over three months, 196,000 people opened current accounts with Nationwide. With a £200 signup offer on the table, it could’ve cost the bank a whopping £39m. Meanwhile, having topped the table in the previous quarter with 59,000 new accounts, the latest figures show that 43,000 customers then left NatWest. Which prompts the question, ‘Are people just taking the money and running?’.

“What we do know is that recently the offers have been drying up. Just a few weeks ago, there were five banks fighting for customers, offering attractive cash bonuses. But just this week, the final one was withdrawn. And now, the best incentive you might get is an interest-free overdraft, or cashback on your spending. Have we passed peak current account switching? Are big bonuses simply a race to the bottom?

“If, and when cash bonuses return to market, let’s just hope they’re simple and easy to understand. Recently, we’ve seen some banks ask customers to jump through multiple hoops to secure the headline offer, including minimum transaction numbers, app logins, and even setting up a separate savings account.