If you thought the switching rate stats for 2016 were modest, prepare for a shock.

With only two more monthly figures to be released, 2017 is looking even worse and for the year to date the switch rate has declined by a disappointing 12.6% compared with 2016.

In all of 2016, 967,351 UK customers used the 7-day switching service to switch their main current account provider.

For the 10 month period to the end of October 2017, the most available stats, a mere 728,839 customers have switched. At the end of October 2016, 834,298 switches had taken place.

The figures do not do justice to the service itself-no criticism is intended of 7-day switching. The service enjoys a seven day switching success rate of 99.4%, while 95% of those surveyed during the third quarter of this year who have switched their current account in the last three years said that they were satisfied with the process.

In excess of four million (4,204,446) successful switches have taken place since the service launched in 2013 – an average of around 1 million a year.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThat average figure will be missed for 2017 on current trends.

So the service works – and has been well publicised. A major national marketing campaign, including TV, radio, and national print and online advertising, kicked off in September.

The number of current account providers is at a record high. There are currently about 140 different current account products on offer from around 35 different banking brands.

Those figures are set to rise in 2018 with current account product launches planned by start-ups such as Monzo.

Banks’ marketing efforts have been energetic, though in many cases largely ineffective.

The focus has been on trying to find new ways to appeal to customers prepared to switch provider, such as offering tangible rewards including savings interest on positive balances and cashback, as opposed to cash bonuses upfront to switch.

The task for the new current account providers such as Starling was never going to be easy. If customer inertia remains at present levels – with less than 3% of UK adults with a current account changing provider each year – the task for the new players will be even harder than they think.

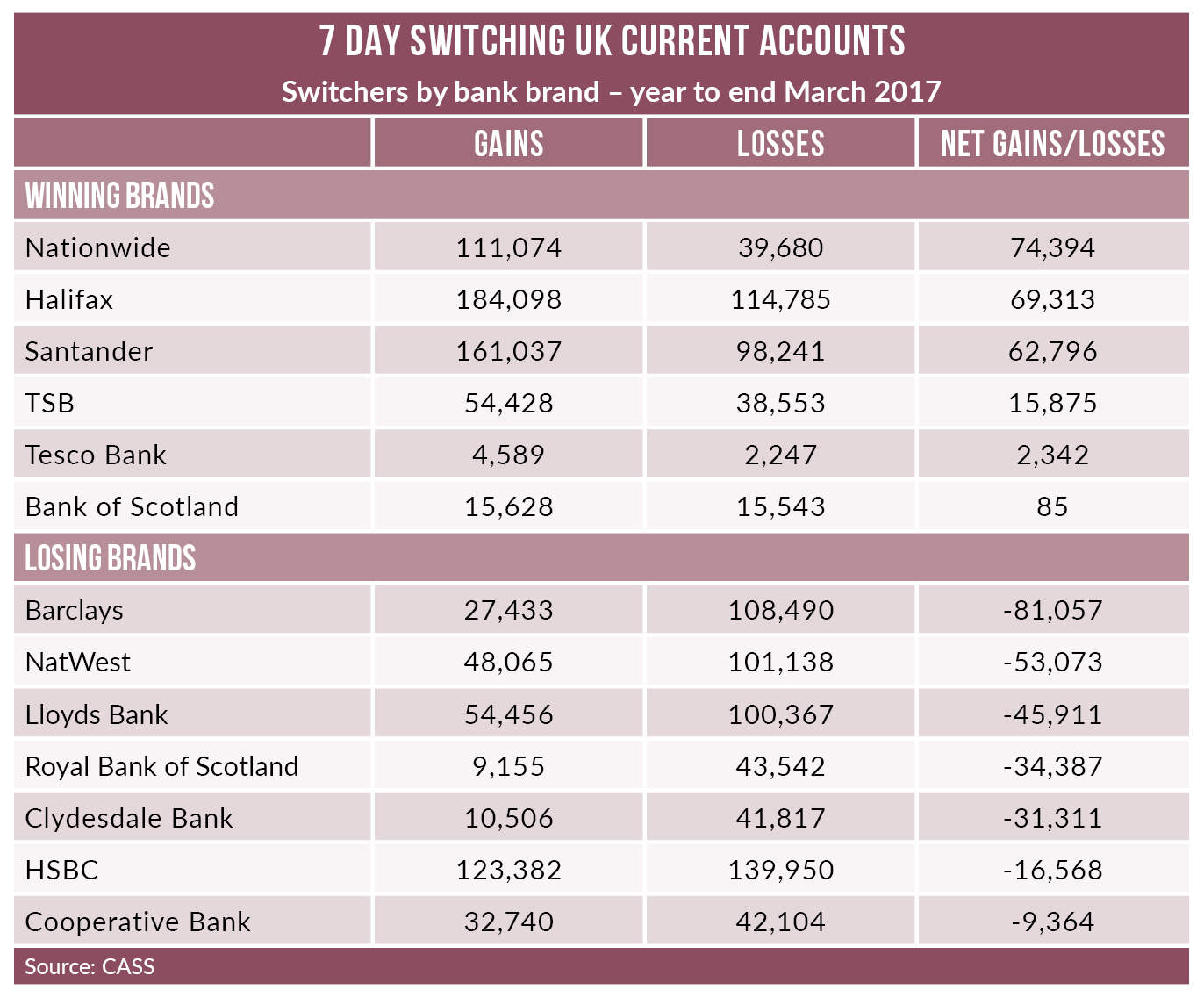

Switching statistics by brand

The switching service releases data, with a six months delay, showing which brands are the switching winners and losers. The latest data available covers the 12 month period to the end of March 2017.

Of the 13 largest banking brands, four standout as winners for the year to end March.

Winners

Take a bow Nationwide. It gained a net 74,394 switchers (111,074 gains against 39,680 losses).

Halifax net gains exceeded 69,000 just ahead of Santander with a net gain of almost 63,000 switchers.

TSB gained more than 54,000 new switchers against 38,500 losses for a net gain of almost 16,000 customers.

The only other brands to show positive gains were Tesco, up by a modest 2,300 and Bank of Scotland up by 85.

Losers

Barclays remains the biggest 7 day switching loser. In the year to end March it gained 27,000 and lost almost 109,000, a net loss of more than 81,000 customers.

NatWest and Lloyds net losses were 53,000 and 46,000 respectively with Royal Bank of Scotland and Clydesdale also suffering net losses of 34,000 and 31,000.

Of the incumbent brands, HSBC’s net loss of 16,500 was the most modest while troubled Cooperative Bank suffered a net loss of more than 9,000 customers.