At first glance, the latest US credit card statistics do not look particularly bad; however, as Douglas Blakey reports, a sobering report from Deloitte suggests that bad news is just around the corner

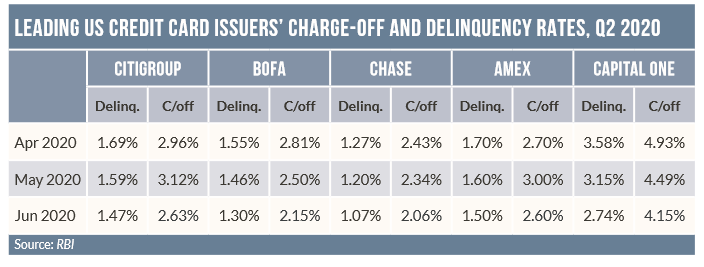

First off, some good news: credit card delinquency and charge-off rates in the US are both down in June, the most recent month for which stats are to hand as RBI goes to press.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

At Chase for example, the delinquency rate falls by 13 basis points from 1.20% in May to 1.07 in June. Meantime, the charge-off rate drops from 2.34% in May to 2.06% in June.

It is a similar story at Citi with the delinquency rate down from 1.59% in May to 1.47% in June. The corresponding chargeoff rate drops from 3.12% to 2.63% in June.

Bank of America brings off the hat-trick with a delinquency rate down from 1.46% to 1.30% in June and a charge-off rate down from 2.50% in May to 2.15%.

As regards the current figures, one needs to flag up that the issuers generally do not include customers in forbearance plans within their delinquency rates. Accordingly, given the numbers of cardholders in forbearance, the effects from Covid on delinquency and charge-off rates will inevitably be delayed.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAnd we know from the Fed that credit card debt in the US is down sharply since the Covid crisis started. For example, total revolving consumer debt – in other words mainly credit card debt – fell to $995.6bn in May from $1.07bn in March, a drop of almost 8% in just two months.

A number of factors are at play, with consumer spending patterns just one factor resulting in a drop in outstanding balances. We witnessed a similar drop in spending in the last financial crisis. Meantime, the US personal savings rate almost doubled between March and May from 12.6% to 23.2%, highlighting consumer caution.

For perfectly understandable reasons, banks are also taking a risk-averse approach, with Chase among leading issuers reported to be cutting credit card limits for certain cardholders. For its part, Amex has withdrawn introductory 0% offers on balance transfers.

Covid-19 impact

With the above figures in mind, it is sobering when a report from Deloitte hits the inbox forecasting charge-off rates of as high as 8.1% as early as 2021.

To forecast the impact of the Covid pandemic on the credit card charge-off rate from 2020 to 2024, Deloitte studied the relationship between the US unemployment rate and banks’ credit card charge-off rate over the past 20 years.

Charge-off rates showed a one-to-one relationship with the unemployment rate during the 2008-09 financial crisis. However, the correlation somewhat weakened following the peak, with a deceleration in charge-off rates. Charge-off rates are expected to show

a lower correlation with unemployment in 2020-24.

As a result, argues Deloitte, the increase in charge-offs will likely be lower in magnitude compared with the rise in unemployment, due to government intervention with unemployment benefits, a financially stronger consumer, issuers’ proactive approach to help distressed borrowers, and nuanced differences in the nature of unemployment compared to the 2008-09 crisis.

The report is titled US Consumer Payments in a Post-Covid-19 World: How to Bolster Payments Institutions’ Growth in Challenging Times, and is well worth a read. Mercifully, away from the headline 8.1% charge-off rate forecast, there are some positive takeaways: it notes that there will be an acceleration of recent trends in the way consumers live, work and pay and integrate real and digital more in the post-Covid world.

And it suggests that there are exciting opportunities for payments institutions to reimagine their roles in a post-Covid world, especially in the areas of driving social impact, modernising the payments system, creating value beyond card payments and reorganising around customers as opposed to products.

Deloitte also makes the somewhat obvious point that card networks need to work with issuers to accelerate the general issuance of contactless cards, and with acquirers to set up contactless POS terminals. Quite why the US has been so dilatory in this area, given the success of contactless elsewhere, is a debate for another day.

Finally, the report rightly flags up Capital One’s nimble, customer-centric offer allowing cardholders to redeem thousands of points accumulated in airline miles in spend categories most relevant to them in today’s stay-at-home environment, such as food delivery, streaming services and mobile phone purchases.

As it is increasingly the norm for all issuers these days to claim to be customer-centric, other issuers might care to consider similar Covid-era offers.