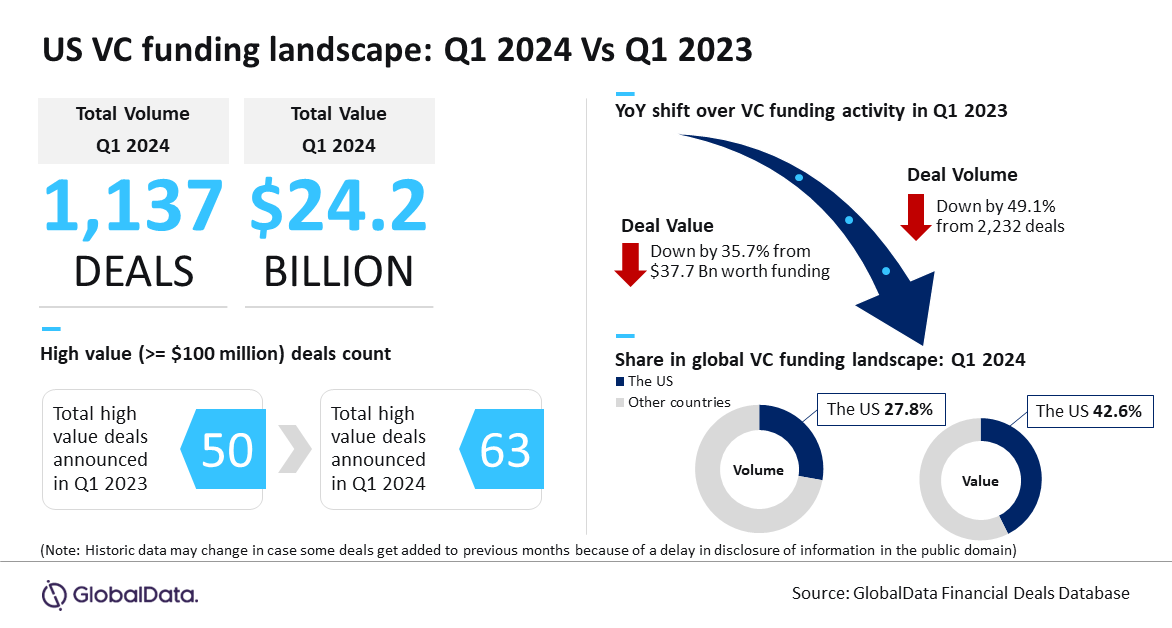

The US startup ecosystem saw the announcement of a total of 1,137 venture capital (VC) funding deals worth $24.2bn during the first quarter of 2024. This represents a decline of 49.1% in terms of deal volume and 35.7% in terms of value compared to Q1 2023. Despite a decline from the previous year, the US maintains its global VC funding landscape dominance, reports GlobalData, publishers of RBI.

GlobalData Deals Database

An analysis of GlobalData’s Deals Database reveals that a total of 2,232 VC funding deals were announced in the US during Q1 2023. The disclosed funding of these deals amounted to $37.7bn.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Aurojyoti Bose, Lead Analyst at GlobalData, said: “The US has been experiencing a month-on-month fluctuating trend in 2024 so far. February experienced a rebound in deal activity after months of decline and March again sees a fall in VC deals volume and value. However, despite the fluctuations or decline, the US continues to dominate the global VC funding landscape.”

The US was the top market globally in terms of both VC funding deals volume and value in Q1 2024. It accounted for 27.8% share of the total number of VC funding deals announced globally during the quarter while its share of the corresponding deal value stood at 42.6%.

Notable Q1 deals

Notable venture funding deals announced in the US during the Q1 2024 included $700m worth of funding raised by Wonder, $675m secured by Figure AI, $400m worth of funding raised by Mirador Therapeutics, $320m raised by Lambda, $300m secured by Rain Technologies and $259m worth of funding raised by Alumis.

Of these startups, Figure, Lambda, and Rain Technologies joined the unicorn club with funding raised during Q1 2024.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBose added: “Q1 2024 revealed a US venture capital scene grappling with fluctuations yet maintaining its global dominance. With notable deals propelling new unicorns, the stage is set for a year of resilience and evolution. Looking ahead, while challenges persist, the underlying innovation and investor interest suggest a landscape ripe for further growth and transformative deals in the remainder of the year.”