During the pandemic, Canada’s top banks have been using AI to support their customers and provide them with financial advice. Imran Khan, TD’s global head of digital customer experience, tells Robin Arnfield how TD uses machine learning and data analytics to provide its mobile banking app users with more personalised customer experiences

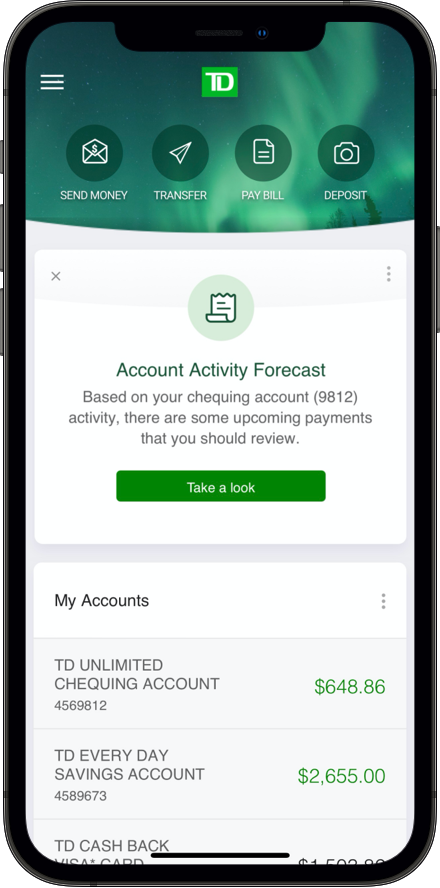

In December 2020, Toronto Dominion (TD) announced that it had upgraded its Canadian mobile app to offer customers advice and recommendations based on their past financial behaviour and transaction patterns. Select TD mobile app users now receive ‘digital nudges’ powered by AI that offer proactive insights which are personalised and contextual to the customer, Imran Khan, TD’s global head of digital customer experience, tells RBI.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

In March 2021, CIBC, another major Canadian bank, launched a similar AI-based feature in its mobile banking app. The CIBC Insights feature offers CIBC clients personalised and actionable data-driven recommendations based on their financial transactions using AI and machine learning.

![]()

AI expertise

Using technology from Layer 6, its internal AI centre of excellence, TD began the process of implementing predictive AI and machine learning technology in its Canadian mobile banking app in 2019 to enhance the customer experience.

TD acquired Toronto-based Layer 6 in 2018 for an estimated C$100m to act as a source of AI technology to all areas of the bank and across its various customer channels. Khan explains that by using Layer 6’s expertise, TD has created an AI ecosystem to help the bank create personalised and connected digital experiences for its customers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“For us to operate as a modern bank, we need to align our data structure in such a way that, regardless of the channel the customer uses, we can bring our total understanding of the customer to bear at that moment,” Michael Rhodes, TD’s group head, innovation, technology and shared services, said in a presentation at TD’s December 2020 Tech Day.

“So, we’re making big investments in data and AI to ensure we really understand our customers, whether they are at a teller line or calling the contact centre or using our digital app. We need to be able to present information to the customer in the right way so they can easily understand it, and to leverage AI and data to power more personalised services and insights.”

Digital customer experience

“We’re evolving our customers’ digital experience to meet the needs of an increasingly digital customer base,” says Khan. “We’ve always had a strategy of driving engagement through differentiated experiences.

“This is more critical than ever before with digital channels, especially with mobile, one of our most important digital channels. It’s very important for us in the future to continue to innovate harnessing the power of data and AI to provide insights to customers that help them make financial decisions with confidence.”

The first digital nudges to be introduced, which help customers identify steps they can take to manage their finances, are:

- Low balance prediction tool – using the predictive capabilities of AI, TD alerts customers who are likely to encounter a low balance in the next two weeks so they can prioritise their spending. These customers are also directed to an insights card providing advice and are given the opportunity to view and understand recent spending;

- Upcoming transactions list – provides a list of upcoming bills within the next two weeks based on recurring transactions from the last two years to help customers who have been identified by AI as having challenges with cash flow. Customers are provided with personalised options for moving money from account to account and viewing their schedule of upcoming payments to better plan for their financial obligations.

“The low balance prediction tool gives customers insights as to whether we think they are at risk of defaulting on a payment or running low enough that this could cause some adverse effect,” says Khan.

“The customer gets a nudge encouraging them to look at their balances and upcoming payments based on our balance predictor algorithm. They can then use this proactive insight to take action. The early results from the balance prediction tool are very good – we’re seeing a very strong engagement with it.”

Proactive insights

When TD gives customers a proactive alert about low balances, it also provides a feedback form. “We always ask customers for feedback when they receive a digital nudge, so we’re almost having a conversation with them,” says Khan.

“Customers may tell us that they weren’t aware of the problem and are going to take action based on the options we suggested to them, or they may say they have already taken care of the issue. So, we’re starting to engage with customers using data and insights right within our primary banking app.”

Khan says that the balance prediction tool uses a mixture of data analytics and machine learning technology. “Balance prediction is quite a complex machine learning problem,” he notes.

“We’re taking the customer data that we hold and our digital group’s internal digital design and experience capability plus Layer 6’s machine learning skills and pulling this together to create an industry-leading experience for customers.”

Having introduced its proactive insights tools in Canada, TD plans to add them to its mobile banking app in the US but hasn’t specified when this will take place. The bank’s strategy is to launch a new service in one jurisdiction first before rolling it out in its other market.

Khan also explains how TD has several additional use cases for proactive insights that it intends to add to its mobile banking app at some point in 2021.

“We won’t rush these features out the door, as we want to focus on using our agile methodology technology to ensure they offer highly relevant and personalised experiences to customers,” adds Khan.

“If you start to engage with customers, but what you offer isn’t relevant or personalised to their needs, they will start to tune out.”

Digital nudges

During 2021, TD plans to introduce three digital nudges containing insight cards to its mobile banking app:

- Retirement ready tool – this uses AI-powered insights into how customers can save and invest to prepare for their retirement, and connects them to useful content, resources and support to help them reach their financial goals;

- Direct investing engagement – when customers sign up for a new TD direct investing account, AI can be used to predict the customer’s need for support and offer a tailored onboarding experience. AI-powered nudges are provided in the mobile app that lead to insight cards offering step-by-step guidance and educational materials to help build customer confidence with trading;

- International transfers – customers needing to send money to family abroad can receive an AI-powered nudge about the new TD Global Transfer Marketplace, where they can learn about new transfer options available to them and cost-savings for international transfers.

For banks, the advantage of using AI to provide wealth management advice is that customers can be encouraged to keep more of their assets with their bank rather than moving funds to specialist investment firms.

Khan said that, during Covid-19, customers have had diminished opportunities to spend money so have been saving more. “They haven’t been able to go on vacation or go out for meals at restaurants,” explains Khan. “So, as they are saving money more than they used to, this is a strong catalyst to use our mobile app to help them understand how they can use savings to support other needs they have.”

For Canadian banks, gaining a share of the international remittance market is an important source of revenues. “The international transfer tool is intended to help people who send money abroad but, for whatever reason, still use physical money transfer stores,” says Khan.

“The tool also explains the money transfer options we offer in terms of services with lower fees or faster delivery of funds.”

TD’s Global Transfer Marketplace offers customers the choice of sending funds for cash pick-up via Western Union, card-to-card transfers via Visa Direct, and bank account-to-bank account transfers using TD’s own global transfer service.

Digital growth

During Covid-19, TD has seen significant growth in mobile banking app adoption and of two other apps, TD MySpend and TD Clari.

As of January 2021, TD had over 14 million active online and mobile customers in Canada and the US. According to an investor presentation, in Q4 2020 TD had a total of 16 million Canadian customers and 9 million in the US, of whom 5.9m were mobile banking users in Canada and 3.7 million in the US.

“We’re seeing more usage of our mobile app across all demographics,” says Khan. “The pandemic spurred a lot of growth across demographics that might have traditionally not used digital as much. So, we’ve seen very good digital usage growth from seniors during Covid-19.”

Mobile engagement

According to Khan, TD has the highest engagement in mobile of all the top five Canadian banks. Digital audience measurement company ComScore’s Mobile Metrix, Financial Services – Banking (Mobile Apps) report said that TD had the largest growth in unique mobile banking app visitors in Canada between July-September 2020.

TD’s North American digital adoption rate is currently at 57%, which means that over half of TD customers are also digitally active customers.

“As part of this trend, we’ve had over one million digital enrollments throughout the pandemic in North America. This enrollment figure is based on both new and existing customers signing up for our digital services, many of whom are using digital banking for the first time,” says Khan.

“With the increases we’re seeing in digital transactions such as bill payments, direct deposit, money transfers, and mobile remote deposit capture, we estimate that the pandemic has accelerated our digital self-serve customer strategy by approximately two years.

“This is based on the acceleration of our North American customer self-serve numbers – we were on track for customer self-serve to increase by 2% this year and 2% next year, but by Q3 2020 it had already gone up by almost 6%.”

TD MySpend and TD Clari

TD MySpend offers real-time tracking of purchases and transactions on TD Canada accounts and financial goal setting, automatically grouping purchases into categories to help customers understand how they spend their money. Launched in 2016, MySpend is based on technology from US-based fintech Moven.

TD Clari, an AI-powered chatbot launched in January 2019, gives customers in-the-moment personal spending insights on the previous six months’ transactions by leveraging banking chatbot/AI vendor Kasisto’s conversational AI platform.

Clari can answer questions on a wide range of topics including Covid-19 relief programmes and direct deposit options for the Canada Emergency Response Benefit.

TD Clari is directly integrated into TD’s mobile banking app, while TD MySpend is a standalone app with the same authentication credentials as the mobile banking app.

However, where customers are using TD MySpend plus the AI-powered digital nudges provided by TD’s mobile app, TD is able to integrate insights from both apps in a single insight card.

“MySpend is an example of a partnership with a fintech, that has been very successful for TD,” says Khan. “We have good relationships with fintechs, as we take the approach that we prefer to partner with fintechs and we see a lot of innovation in the marketplace.

“Bringing together the innovative capabilities and speed of development of a fintech with the scale we have as TD and our access to our customers, is very powerful.”

Finicity

In August 2020, TD entered a North American data access partnership with US-based fintech Finicity. According to the deal terms, customers can request TD to transfer their financial data to other financial services providers they want to use, including personal financial management apps supported by Finicity.

“Our partnership with Finicity is about account aggregation,” says Khan. “It is accelerating our work to create a technology infrastructure which will increase the comfort level that customers have about accessing digital services outside TD. We want them to be able to conveniently and securely access non-TD services without using screen-scraping.”

TD can transfer its customers’ data as per their request using API technology, which removes the need for customers to share their login IDs and passwords.

The agreement also entails protocols needed to be followed by Finicity while accessing the financial data of TD Bank customers.

TD partnerships

In September 2020, TD announced a North American data access agreement with Intuit, enabling customers to request that TD transfer their financial data to Intuit in exchange for the services they need.

TD is a founding member of the US-based industry consortium Financial Data Exchange (FDX). Launched in Canada in 2020, FDX also uses API technology to better protect customer data.

In 2020, TD invested in US-based Akoya which operates an API-based network offering a more secure way of sharing financial data.