With AI and robot learning increasingly gaining a foothold in financial services, what does this say about the human touch? Surely it will go down, but will this innovation cause problems of its own? Patrick Brusnahan reports

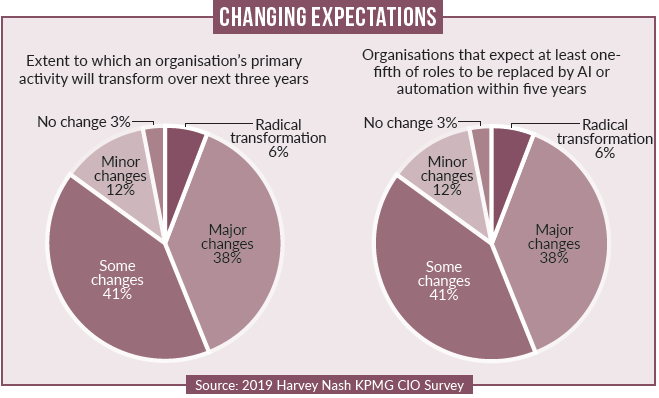

It is expected by CIOs in banking that up to one in every five jobs will be taken over by robots, AI or automation.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

This is increasingly likely, as 17% see automation to improve efficiency as a board priority; however, 69% of CIOs believe new jobs will balance the books afterwards. This is according to the 2019 Harvey Nash/KPMG CIO Survey, which asked over 3,600 IT leaders about IT departments and technology spend.

Almost two-thirds (63%) of respondents now allow technology to be managed outside the IT department. This brings consequences both good and bad. If the IT arm is involved in decisions surrounding around IT, 52% believe it improves time to market for new products, and 38% believe the employee experience is an advantage.

However, a distinct segment (43%) of companies do not involve IT in those decisions. According to the survey, these firms are twice as likely to have multiple secure areas exposed than those who consult IT. In addition, they are 23% less likely to be ‘very or extremely effective’ at building customer trust with technology.

Even more of a concern is that 9% of these organisations are more likely to have been targeted by a major cyber-attack in the last two years. This comes when cybersecurity is at a high priority at board level, with 56% considering it such, up from 49% last year. Skills shortage is a worry, as the right talent is not being found. The three scarcest skills are big data/analytics (44%), cybersecurity (39%) and AI (39%). CIOs are sparser on boards, dropping from 71% two years ago to 58%. This is despite the fact that 66% consider them to be gaining influence.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

“In an age where anyone with a smartphone and credit card can set up an IT system, there are both incredible opportunities and major risks. Those enterprises that get the balance right between innovation and governance will be the winners,” says Harvey Nash CEO Albert Ellis.

“At the same time, boards are asking their CIO and technology team to prioritise automation of jobs. How organisations adapt to automation will increasingly become a priority, and many are not at all ready.”

Steve Bates, global leader at KPMG International’s CIO advisory centre of excellence, adds: “There is no longer business strategy and technology strategy; it’s simply strategy, with technology driving it.

“This research clearly shows that organisations putting technology in the hands of value-creators and connecting the front, middle and back offices are winning in the market. The future of IT is a customer-obsessed, well-governed, connected enterprise.”

Digital leaders were examined as well. Those that considered themselves to very or extremely effective at using digital technology to advance their strategies, in general, performed better in certain aspects.

Findings included:

• Aspects included time to market (53% vs 34% for the rest), customer experience (65% vs 49%), revenue growth (55% vs 43%) and profitability in the last year (50% vs 37%), and

• Digital leaders are also more likely to introduce ‘major new changes to products and services’ in the next three years (55% vs 39% for the rest), and focus on making money: 76% of CEOs in digital leader organisations want their technology projects to ‘make’ rather than ‘save money’, compared to 58% for the rest.

IT and technology are obviously not going away, and investment continues. More technology leads reported increases in IT budgets under their control than at any time in the last 15 years. The jump in budget between years (49% to 55%) is the also largest seen, with the exception of 2010. In addition, for those surveyed with technology projects where the CEO preferred to ‘save money, almost half (45%) reported budget increases compared to just 38% the previous year.