AI-driven technologies can deliver highly personalised user experiences. Mohamed Dabo reports on how intelligent machines are reshaping how banks interact with clients

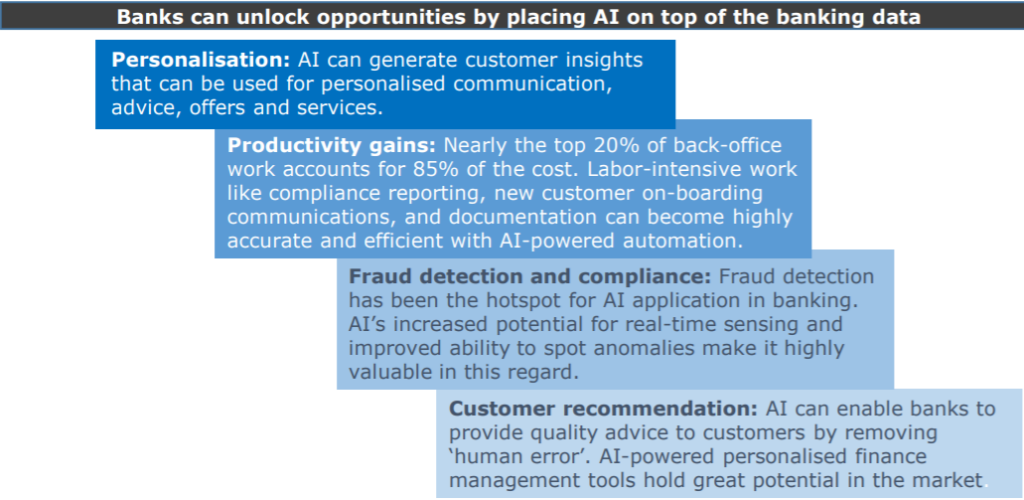

Many business processes in retail banking are readymade for automation with artificial intelligence (AI). Whether for credit scoring, fraud detection, or customer service chatbots, the use of AI will enable to retail banks to improve their consumer banking services.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

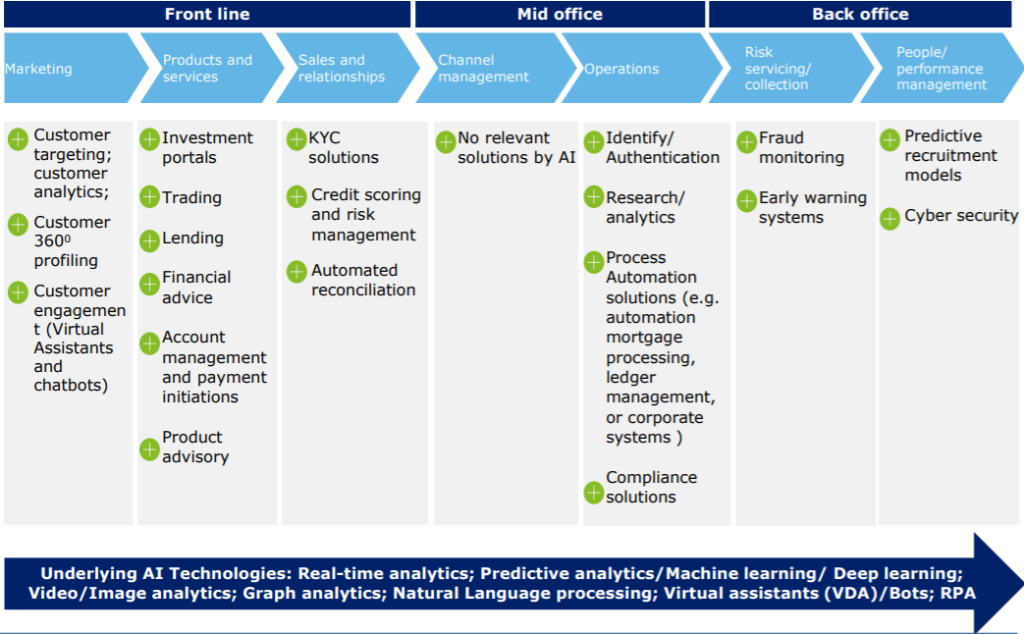

Indeed, all the three main channels of banks can use artificial intelligence to save on costs. From the front office (conversational banking), to the middle office (fraud detection and risk management) and back office (underwriting).

Touted as the next major disruptor, AI is making inroads across the banking value chain.

Although most banks are still in the early stages of AI adoption, immediate applications involve achieving productivity gains and developing proactive compliance and risk management systems.

The magnitude of potential benefits, however, remains largely to be tapped.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAI is driving innovations

The banking sector has been a pioneer in the adoption of new technologies and resulting innovations but their ability to realise the full potential of data has been limited so far.

AI is data-hungry, and the banks now generate an extraordinary volume of data.

According to the Australian Government Productivity Commission’s report, “the amount of digital data generated globally in 2002 (five terabytes) is now generated every two days, with 90% of the world’s information generated in just the past two years.”

In the last couple of years, global financial institutions have started to use AI to improve customer engagement and product and service personalisation.

Despite all the eagerness to reap the benefits of AI, banks are slow to adopt new solutions. According to McKinsey estimates, banks do not realise the value of more than 80% of the total data collected by them.

Also, during the last decade, banks across the globe have gone on strong digitisation drives, which have laid the pillars for AI adoption.

While the foundations are in place, the banks have been following a watch-learn-act approach, which makes them slow partners to work with startups.

Source: The Financial Brand, Citi, CbInsights, KX Research Services analysis

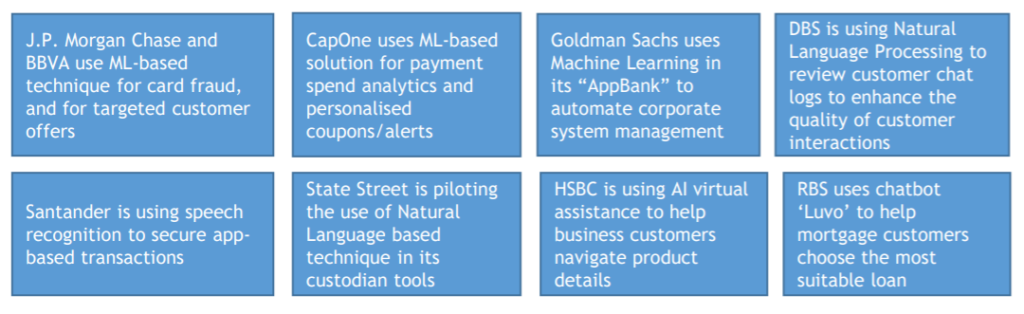

Despite the nascent stage of AI adoption, its benefits are already being realised at many large banks across the globe.

Source: The Financial Brand, Citi, CbInsights, KX Research Services analysis

According to TCS research, “banking and FS executives found that investment in AI helped them reduce production costs by 13%. Additionally, executives reported a 17% average revenue increase in the area of their AI initiatives.”

At one European bank, the shift from pure statistical regression to machine learning for credit analysis increased mortgage collections by over 30%.

JP Morgan’s new machine learning based system is estimated to save over 36,000 hours of lawyer and loan officer work every year.

In Australia, NAB expects to save up to A$16m ($12.4m) in 2020 by using AI in customer interaction tools. And similar examples are spread across the globe…

AI use cases are spread across the banking value chain

AI integration in the workplace can deliver cost and efficiency results, particularly for customer service and back-office operations in banking.

Besides, customised fraud detection, risk management and compliance solutions can transform the scope of efficiency for banks.

Source: Pitchbook, CBInsights, KX Research Services analysis

VC funds are bullish on potential growth for AI startups

AI innovations and increasing commercial adoption have been rewarded by accelerated funding in recent years. VC funding in AI tech has grown up to ten-fold in the last five years; and 2017 looked exceptionally good.

In 2017, the US remained the most attractive region for VC funding in AI. Driven by China, Asia has also emerged as an exciting region. In 2017, Asia managed to surpass Europe by funding volume.

Oceania’s AI funding peaked in 2016 and the region now presents itself as a potential hotspot. However, in 2017, the region was not able to keep up the momentum.

Industry-agnostic AI solutions have been a preferred area of investment, followed by cyber security, IoT, and BI solutions.

It is interesting to note that three-fourths of every invested dollar is going to a subsector that has strong credentials to serve the financial services industry.

According to funding numbers, Fintech and Insurance are emerging as the hottest category of AI, having recorded over 30 deals before close of the quarter. AI in banking is promising and investing in right AI technologies can have a significant impression on banking tools in future.

This would not only improve productivity but also deliver an exciting story of customer impact.