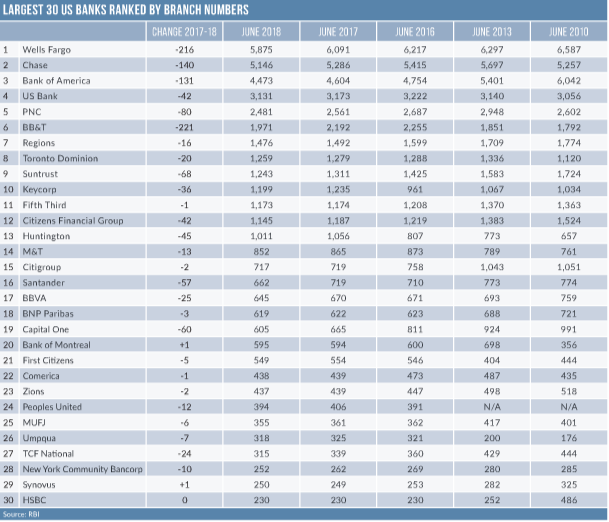

Only 13 banks in the US operate branch networks of over 1,000 outlets. While US bank branch closures have been slower than their Western European peers, the 13 banks closed more than 3% of their branches in the year to end-June, a net reduction of 1,058 outlets, reports Douglas Blakey

All bar three of the largest 30 banks in the US ranked by branch numbers reduced their networks in the year to end-June 2018.

BB&T was the most active branch closer, with a net reduction of more than 200 outlets – more than 10% of its branch network. BB&T reduced its network to 1,971 outlets in the 16 states in which it operates.

According to BB&T, the axed branches are all within a 10-minute drive of BB&T branches that remain open. In the same period, BB&T reduced total employees by 6% – a net reduction of 2,100 full-time employees.

For the eighth year in succession, Capital One’s branch network has slimmed down, with 60 units closing in the year to June. Capital One ended the first half with 605 branches.

Almost two in five Capital One branches have closed since its network peaked at 991 outlets in 2010. Of the other major US retail banks, only Citi and Bank of America (BofA) have reduced their networks as aggressively since 2010. One in three Citi branches have been shuttered since then – the network reducing to 717 from over 1,050 in 2010.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCiti branch closures have slowed, however, with a net reduction of only two in the past year. BofA has closed one in four branches since 2010 – a net reduction of over 1,500. At the end of the first half, BofA operated 4,473 branches – a net reduction of 131 in the year to end-June.

The 13 US retail banks with more than 1,000 branches have a combined branch network of 31,583 – representing more than one in three of all US bank branches. At the end of June there was a total of 88,062 US bank branches, down by a net 1,786 branches in the past year.

US Branch Density

Only one in 10 US branches have closed since the financial crisis a decade ago.

US bank branches peaked at 99,544 in June 2009. With a population of around 326 million, the current branch density in the US is 27 branches per 100,000 of population. By contrast, with a population of 66 million and around 7,500 bank and building society branches, the UK has a branch density of 11 branches per 100,000 of population.

A number of US-based banks are bucking the trend of shrinking branch networks. The country’s fourth-largest bank by branches, US Bank, has a network of 3,131 outlets – largely unchanged in the past five years. US Bank is now eyeing up the launches of branches in four major states where it currently has no physical presence: Florida, North Carolina, Texas and Florida.

PurePoint has also been busy opening physical locations in the past 18 months. A digitally led hybrid digital bank, MUFG Union’s PurePoint has opened 22 financial centres in the New York, Chicago, Dallas, Houston, Miami and Tampa areas. In the 10 years since the crisis, MUFG Union’s branch network has inched down by only 45 outlets to 355 branches.

Canadians target the US

BMO Bank of Montreal started to take the US seriously with its 1984 acquisition of Harris Bank, and expanded its US franchise in 2011 by acquiring the 385-branch-strong Marshall & Ilsey.

Prior to that deal, in 2010, a mere 10% of Bank of Montreal’s earnings were derived from the US. In 2018 that figure has risen to 28%, and BMO forecasts that it could earn onethird of its earnings from the US by organic growth.

Bank of Montreal’s US branch network is currently 595 outlets, down from a peak of just over 700 at the time of the Marshall & Ilsey deal. BMO is regularly linked with further potential M&A activity in the US, and has capital available to fund a deal if an opportunity arises.

The seventh-largest US bank by branches is the local unit of Toronto Dominion, with 1,259 branches. Its US branch network peaked at 1,336 outlets in 2013.

Toronto Dominion has only been active in the US for 13 years, expanding rapidly with the 2008 acquisition of the 445-branch-strong Commerce Bank. Since then it has made a number of small acquisitions in the south-east.

With a mere 74 branches, Royal Bank of Canada’s City National franchise does not feature in the largest banks by branches ranking, but by any other metric, City National is on the march and now ranks at around the 35th-largest US bank by deposits. City National ended the first half with US deposits of $46.7bn, up by 57% from $29.7bn a mere three years ago.

Account opening

Despite huge growth in mobile banking, the branch remains the dominant channel in the US for current account opening.

According to research from consultancy Novantas, 60% of US customers open a checking account in person at a bank branch rather than by telephone, tablet or PC.

The research found that while 40% of US consumers say they would prefer to open a current account digitally, only 10% actually end up doing so. The ongoing importance of the branch channel is highlighted by plans from BofA and Chase as they target new markets.

Branch numbers overall will continue to decline at BofA, with closures outnumbering new openings. However, the branch channel will be a key weapon for BofA as it targets growth in Ohio and Pittsburgh; this will mirror the bank’s new branch openings when it expanded in Denver, Minneapolis and Indianapolis.

Meantime, Chase is targeting new bank branches in markets where it punches below its considerable weight, including Washington DC, Boston and Philadelphia.