US record-high levels of unemployment, record low interest rates and increased reliance on digital interactions is putting consumer lenders to the test like never before, reports Douglas Blakey

Lenders’ ability to build trust and provide seamless, easy-to-use online tools during this heightened period of consumer anxiety will define their brands for many years to come, according to the JD Power US Consumer Lending Satisfaction Study.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

“Brand image is very important to consumers, and they’re making it clear that lenders need to foster trust in the brand and the lending experience,” says Jim Houston, managing director of consumer lending and automotive finance intelligence at JD Power.

“To accomplish that, lenders need to provide secure, easy-to-use web-based tools and focus on aligning product offerings and terms to the specific needs of their customers during this challenging period.”

The 2020 study: key takeaways

Repayment terms and reputation are key drivers in lender selection.

The two most important variables driving the selection of a consumer lender are repayment terms and reputation of the lender.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAdditional factors weighing heavily on the decision process are quick application and approval processes; the ability to speak with a live person via phone and quality of mobile and digital capabilities.

Most customers plan to keep making payments on personal loans and HELOCs.

Based on additional JD Power research conducted, fewer than 15% of personal loan and HELOC (home equity line of credit) customers feel they will be unable to make their minimum monthly payments as a result of the COVID-19 pandemic. However, 42% say they feel the worst is yet to come in terms of the effect of the pandemic on their personal finances.

Documents are the enemy of customer satisfaction: the ideal number of documents required to apply for and receive approval for a consumer loan is zero.

Overall satisfaction with lenders is 893 (on a 1,000-point scale) when no documents are required. That score falls to 865 when one or two documents are required.

Customers will consider alternative products. As the market for personal loans continues to gain new entrants from traditional retail, e-commerce and technology sectors, 58% of consumers say they did consider using alternative products for lending.

Study Rankings

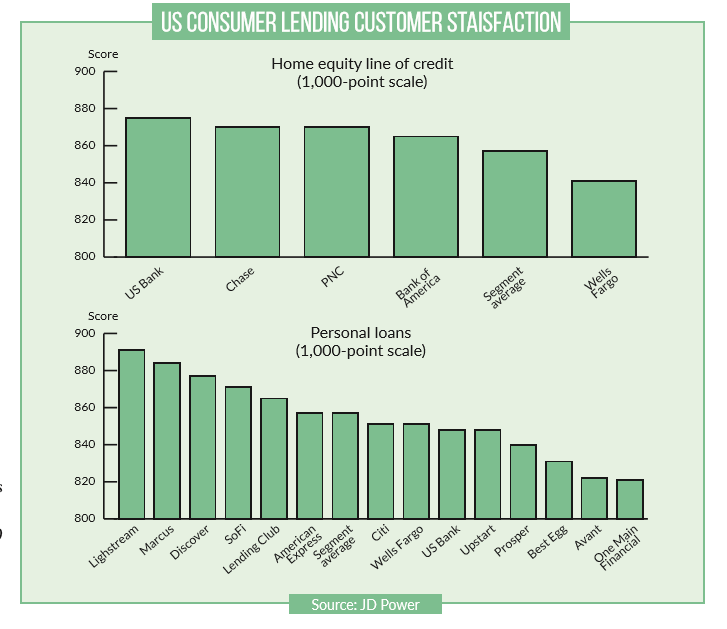

US Bank ranks highest among HELOC lenders in overall customer satisfaction with a score of 875. Chase (870) and PNC (870) rank second in a tie.

Lightstream ranks highest among personal loan lenders in overall customer satisfaction with a score of 891, followed by Marcus by Goldman Sachs (884) and Discover (877).

The JD Power US Consumer Lending Satisfaction Study measures overall customer satisfaction based on performance in four factors: application and approval process; loan management; offering and terms; and closing (HELOC only).