Banks forked over a total of $15.13bn (€12.79bn) in aggregated bank fines last year, according to data from the Bank Fines Report 2020. The fines covered the period of January 1st, 2020 to December 31st, 2020.

The Financial Conduct Authority (FCA) has fined Barclays Bank £26m for failures in relation to their treatment of consumer credit customers who fell into arrears or experienced financial difficulties.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

“Barclays has pro-actively redressed these customers, paying over £273m to at least 1,530,000 customer accounts since 2017. The redress programme is close to completion,” the FCA reported last month.

During the calendar year ending 2020, the FCA published fines totalling £192,6m.

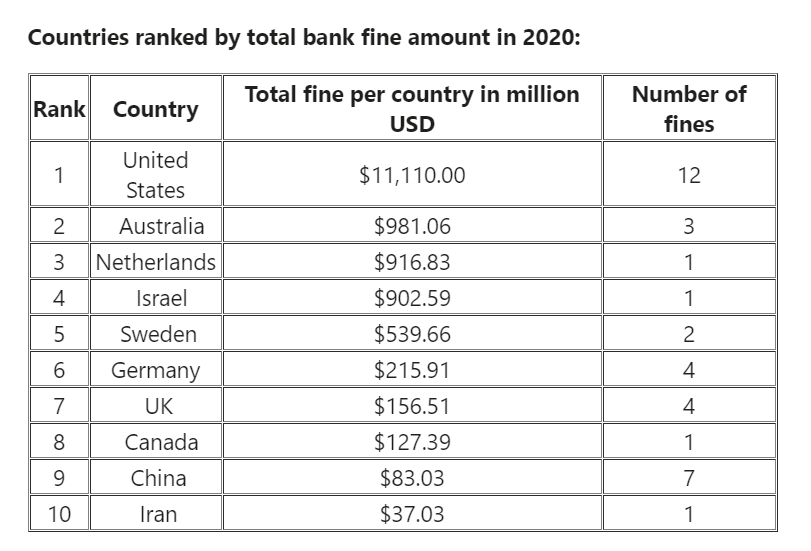

US banks account for the highest fines from 12 violations in 2020

According to the findings, the United States accounts for the highest fines at $11.11bn or 73.4% of the issued fines. The fines emanated from 12 cases.

Australia ranks second with $981.06m in fines from three cases.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe Netherlands is third with $916.83m from one case, while Israel is fourth with $902.59m bank fines also from a single case.

With two cases, Sweden had $539.66m in fines to rank fifth, while Germany follows with $215.91m from four cases.

The United Kingdom is seventh, with banks amassing $156.51m in fines from four cases, followed by Canada at $127.39m from a single case.

With seven cases, China saw authorities fine banks a total of $83.03m while Iran ranks tenth with $37.03m from one case.

The largest single fine was issued to Goldman Sachs at $3.90bn. In total, the facility amassed $6.25bn in fines. Wells Fargo had the second-highest from a single case at $3 billion. Goldman Sachs accounted for the third-highest fine from a single case at $2bn.

“Fines on financial institutions are projected to grow in the coming years”

Finbold.com chief editor Oliver Scott commented:

“Fines on financial institutions are projected to grow in the coming years, as the U.S. and other countries reforms existing regulations while increasing sanctions with anti-money laundering regulations remaining a key enforcement priority.

“However, banks are spending more on conforming to changing regulatory requirements. Overall, new and complex regulations are proving to be a challenge for the compliance departments of many lenders.”

Authorities from different countries issued the fines due to varying violations, but failure to adhere to anti-money laundering protocols was the leading violation.

The report includes fines higher than €500,000; the real numbers of violations can be drastically higher.