More than 20% of UAE branches have closed in little over four years. That trend is set to continue as merger and acquisition activity gather pace and customer preferences for digital banking accelerates, writes DouglasBlakey

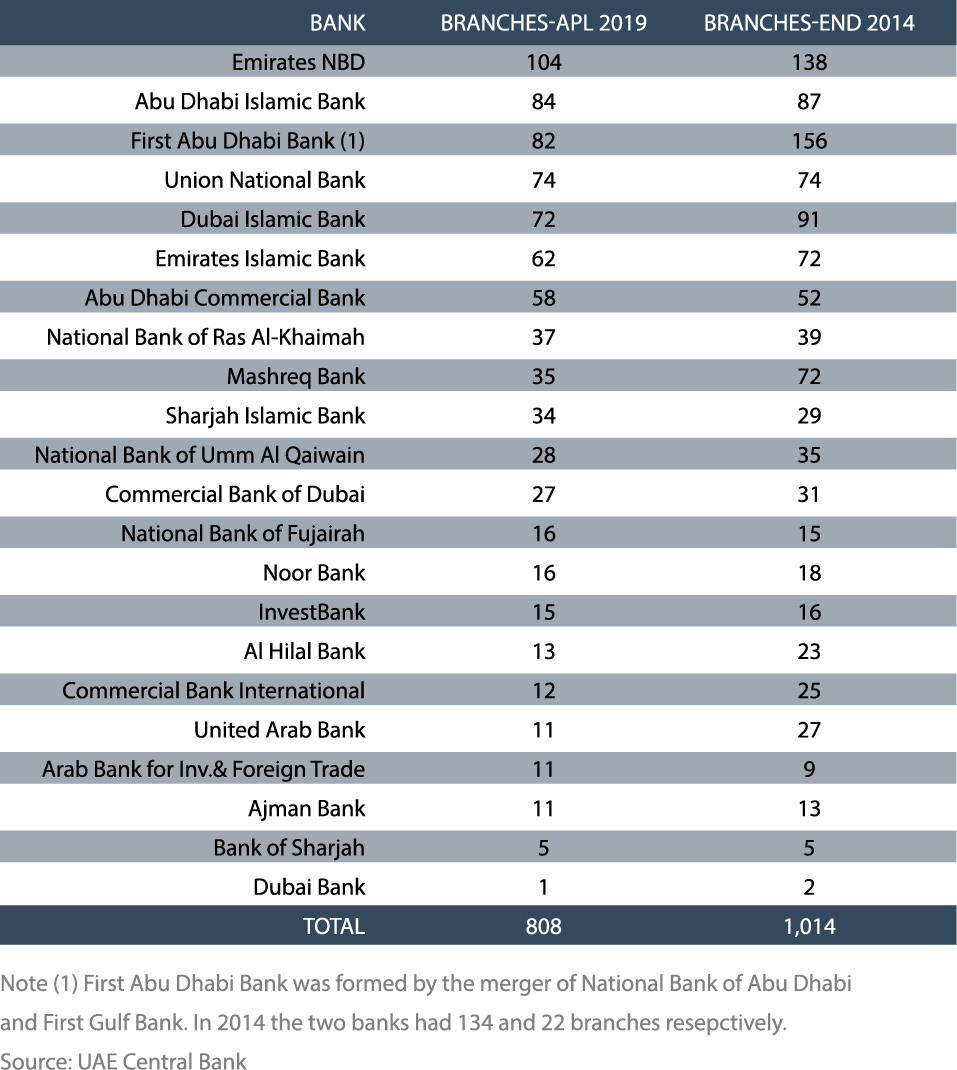

Across the UAE there are currently 808 branches, a net reduction of 206 outlets since the end of 2014. And the branch closure trend will continue as banks continue to cut costs aggressively and tap into consumer preference for digital channels

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Take First Abu Dhabi Bank for starters. The bank formed by the National Bank of Abu Dhabi and First Gulf merger leads the way for branch rightsizing.

In late 2014, NBAD’s branch network comprised 134 outlets. First Gulf operated 22 branches. Today, First Abu Dhabi Bank’s estate totals 82 branches.

Emirates NBD is also aggressively shrinking its branch estate. It has axed one in four branches since the end of 2014, reducing from 138 to 104 branches.

But it is Mashreq Bank that is attracting local headlines for branch optimisation.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSince the end of 2014, the Mashreq branch network has halved from 72 to 35 branches. As part of its ongoing digital transformation drive, Mashreq’s network will drop below 30 branches this year.

At the same time, Mashreq is opening two new digital branches in 2019. Mashreq’s outlook for the sector remains positive. It forecasts banking sector growth in the UAE of around 6% asset growth this year.

Other notable branch rightsizing examples include Dubai Islamic Bank. Its network has reduced by a net 19 units to 72 since the end of 2014.

Over the same period, Commercial Bank International and United Arab Bank have halved their more modest branch networks.

UAE: M&A ACTIVITY SET TO ACCELERATE

Combined, the new bank runs 145 branches. This number inevitably will be reduced as the three brands come together under the ADCB umbrella.

The new ADCB will serve over 1 million customers and has a market share by loans of about 20%.

The next possible M&A activity involves a possible acquisition of Noor Bank (16 branches) by Dubai Islamic (72).

If such a marriage proceeds, the resultant bank will have total assets of almost AED300bn. A number of mooted mergers have proved to have no substance. For instance last October, Invest Bank was linked with a possible three way merger with Bank of Sharjah and United Arab Bank .No business resulted and in April, the government of Sharjah injected AED1bn into Invest Bank.