The shape of the coronavirus’ impact on finance in Asia Pacific is coming into focus, with leading indicators of sector health turning red. March appears to be the month in which banks in the region pushed the panic button, closing a record number of job postings. Banks around the region are putting the brakes on hiring, constraining growth and expansion plans.

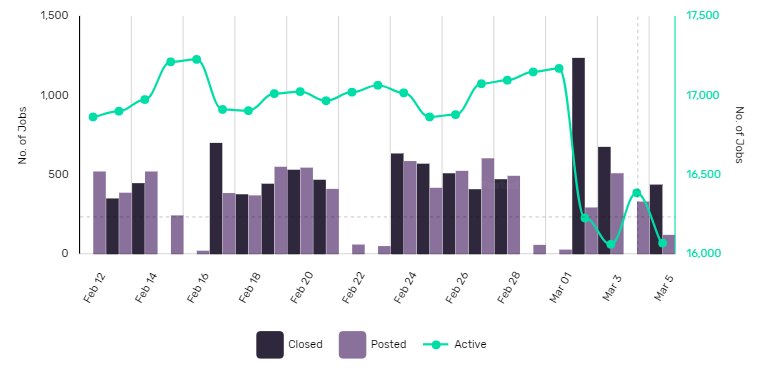

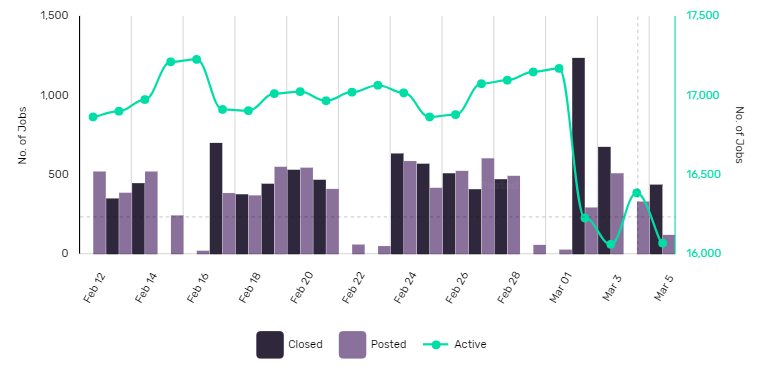

While we know the coronavirus pandemic is going to negatively impact banks around the world, the first signs of this impact will not be seen until months after the fact. However, we can already see the loss of confidence and health in the banking sector through GlobalData’s Job Analytics, which tracks job trends across Asia and the banking sector.

The start of March saw a spike in listed banking jobs being closed, with over 1,200 closing in one week – more than twice the typical 500. Newly posted jobs were also down to less than 300 positions.

Clearly, the appetite for new personnel has dried up. With major banks in the region facing a hit to revenue from the drop-off in consumers’ demand for credit and even their desire to consume more than bulk purchases of toilet paper, most banks are reluctant to take on new staff.

A number of banks have announced emergency support to their clients, which – while entirely welcome – will come with a cost. For example, Australia’s Big Four (ANZ, CBA, NAB, and Westpac) have announced various plans to help customers hit by the virus, including deferred loan repayments and other hardship relief. Even if the pandemic is moderate and contained early on in March and April, these will hit the bottom line and so the hiring freeze will not soon let up, slowing growth for the entire year.

Many regional players and international giants had prioritised expansion into the Asia Pacific market, as highlighted in our 2020: Trends to Watch in Wealth Management report. An effective hiring freeze in the region will set back any expansion plans that wealth managers had for their Asia Pacific operations and will likely see targets for client inflows missed en masse, along with the heavy losses on invested client assets under management. Plans to increase digitisation in the retail banking sector typically require the hiring of new staff with the relevant skills. This, too, will be slowed. Expect product launches, upgrades, and project timelines all to be delayed.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOne of the few bright spots in the gloom will be the growing ranks of purely digital banks popping up around the region. With many of these neobank brands (most are part of wider financial services groups) still able to take on new customers entirely remotely and automatically, they will have a distinct advantage over any bank still requiring a trip to the branch while the pandemic continues. Being able to extend credit and payment services without having to involve a person directly will also be a boon at a time when many bank employees are likely to be ill or self-isolating.

Regardless of how you look at it, the leading indicators like withdrawn job postings suggest a big impact on the financial services industry in Asia Pacific is already underway. This month we can see it in Asia, next month it is likely to be seen across the world.