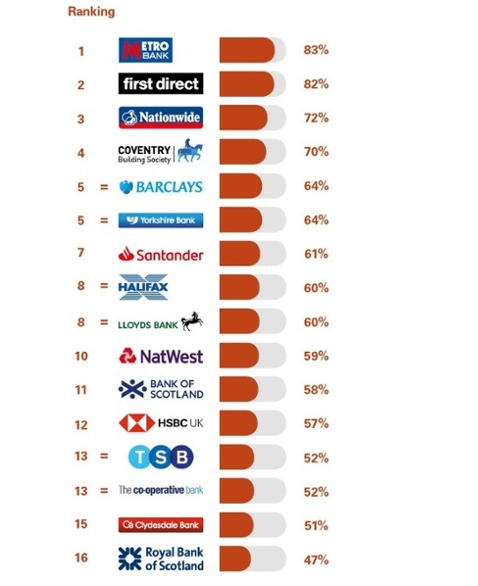

Metro Bank, first direct and Nationwide top the second CMA survey ranking UK banking service quality.

And to the surprise of few in the industry, RBS again ranks bottom.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Since August 2018, UK banks are required to publish information on how likely people would be to recommend their bank. This includes its online and mobile banking, branch and overdraft services to friends and relatives.

The results show the proportion of customers for each brand’ extremely likely’ or ‘very likely’ to recommend each service.

For overall banking service quality, Metro is top with a score of 83% just ahead of first direct on 82%.

Nationwide rounds off the top three with 72%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe top three ranking brands remain unchanged from the original CMA survey but the top two swap places. Last August, first direct ranked top with 85% ahead of Metro (83%) and Nationwide (73%).

Banking service quality: RBS ranks last

RBS brings up the rear with a miserable 47% behind Clydesdale (51%) and Cooperative and TSB (both 52%).

Again, there is little change at the bottom. In the original survey, RBS was joint last with 49% along with Clydesdale, with Coop on 55%.

RBS admits that it has much work to do to improve its dire net promoter score. The RBS 2018 full year results presentation reveals dismal NPS scores.

The NPS for RBS business banking is -36 at the end of 2018, possibly the worst ever reported by any major bank. RBS retail banking NPS is little better, It fell from -6 a year ago to -17 at the end of Q418.

In the online and mobile banking survey, TSB is unsurprisingly last with 59%, 5 percentage points behind Coop with 64%.

Given the disastrous and much publicised IT failures suffered by TSB last year, its poor rating is no surprise.

Ranking top for online and mobile banking is first direct 83% ahead of Barclays and Metro Bank, both with 81%.

Banking service quality: branches

Metro Bank also ranks top in the branches survey with 85% ahead of Coventry Building Society (80%). The strong showing for the Coventry is not a surprise.

Coventry is currently reinforcing its commitment to the branch via a

significant investment programme designed to transform its network.

Approximately 1,000 customers a year are surveyed across Great Britain for each provider. Over 16,000 people were surveyed in total.

Handelsbanken: in a league of its own

The survey also asks customers how likely they would be to recommend their business current account provider to other SMEs.

In this survey Handelsbanken is in a league of its own.

It ranks top with 85% some way ahead of Metro Bank (71%) and Santander (67%).

At the bottom of the survey there is much work to do for RBS (46%) and TSB (42%)