RBS 2018 results are a mixed bag.

First off the positives. RBS pre-tax profits increase by 50% year-on-year to £3.4bn for fiscal 2018.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

On the other hand, revenues rose by only 2% to £13.4bn.

In 2018, the UK government reduced its stake in RBS to 62.3% and says it plans fully to exit its ownership of RBS by 2024. If that target is met, it will post a substantial loss on its stake.

RBS share price fell by 11% during 2018 resulting in a market cap of £29bn.

The UK government will however receive a RBS shares divided of almost £1bn for fiscal 2018. The bank is paying a total dividend for 2018 of £0.13 per share.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataRBS 2018 results: other highlights

- RBS CET1 ratio of 16.2% Is by by 30 basis points year-on-year

- Digital growth, in particular a 16% y-o-y rise in active mobile banking customers to 6.4 million;

- Digitally active users, online and mobile, rise by 6.1% to 8.6 million, and

- Expenses are down by 3.6% for fiscal 2018 to £7.36bn;

RBS 2018 results: less positive metrics:

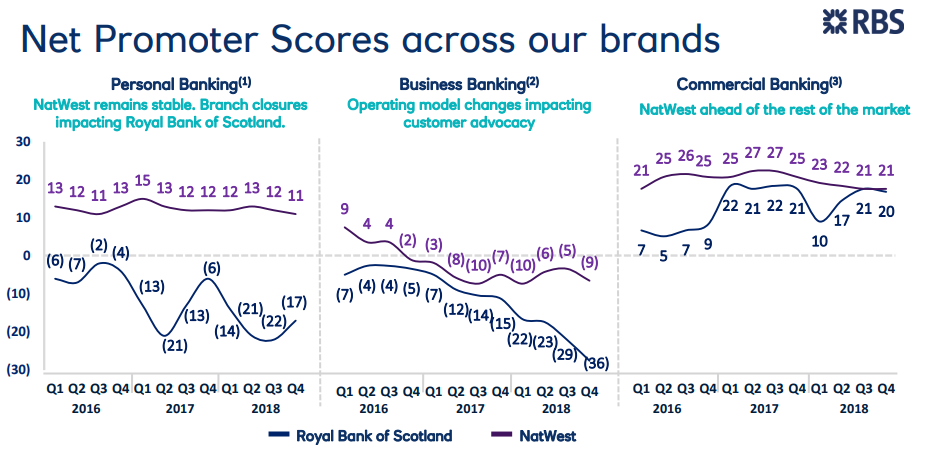

With masterly understatement, RBS results presentation states: “We know that we still have much to do. Our recent programme of branch closures has had a detrimental impact on NPS.”

And how.

The NPS for RBS business banking is -36 at the end of 2018, possibly the worst ever reported by any major bank. RBS retail banking NPS is little better, It fell from -6 a year ago to -17 at the end of Q418.

Margin pressure is also apparent with a 2018 net interest margin of 1.98% down by 15 basis points from 2017.

On costs, there remains much to do. RBS cost-income ratio is moving in the right direction, down by 7.3 percentage points to 71.7%. But its 2020 target of a 50% cost-income ratio looks implausibly ambitious.

RBS branch estate: 1 in 2 branches axed since end 2016

RBS axed 409 branches in Great Britain during 2018, one in three branches, ending the year with 797 outlets. That followed a major closure programme in 2017 when the network was reduced from 1,537 to 1,206.

The current branch estate comprises 648 NatWest branches in England and Wales and five in Scotland. In Scotland, there are now only 91 RBS branded units with 53 RBS branded branches in England and Wales.

RBS CEO Ross McEwan says: 2018 was a year of strong progress on our strategy. We settled our remaining major legacy issues. We paid our first dividend in ten years and delivered another full year bottom line profit. However, while our financial performance is more assured, we know that a significant gap remains to achieving our ambition to be the best bank for customers.”

And he acknowledges that RBS has much work to do improve its appalling net promoter scores.

He says: “We are very aware that we need to deliver better service, more consistently. The Competition and Markets Authority results, which now provide the public with a ranking of banks’ performance for customers, bring this into sharp focus.

“With the large major legacy issues behind us, we are putting all of our focus into improving our customer experience.”