Across Europe, the Middle East and Africa, most countries have moved past the peak of the current Covid-19 pandemic. While the various stages of lockdown being reversed vary, what is almost certain is the harsh economic reality facing consumers and companies as government support lessens or even withdraws completely, writes Bruce Curry, VP for collections and recovery consulting and sales at Fico.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

In the UK alone, the International Monetary Fund predicts Britons will have to borrow more than £400bn in two years as the recession caused by the pandemic delivers a blow to public finances.

Collections departments are now bracing themselves for a tsunami of people unable to meet their financial commitments.

Working with our clients across various sectors and geographies, we have seen first-hand what best practice in collections today looks like. I shared our top tips to help everyone working in debt collection meet this unprecedented challenge in a presentation at the RBI virtual conference.

Tip 1: What data do we need to identify the vulnerable?

It is essential to proactively identify the vulnerable.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIt is worth repeating that collections departments are now tasked with dealing with thousands of customers who are not in arrears for the usual reasons, and without the usual market data to help identify and segment them.

These clients have been furloughed with a rapid, surprising and significant reduction in income, and these dramatic changes in circumstance have yet to be detected by credit bureaus.

As an industry, we have always been proactive about pre-delinquency. But now we need to dig deep across our organisations to capture data and find the vital information needed to clearly separate the economic victims from the steady-state-collections customers.

The data is there – be it from call, collections or communications systems – and we need access to this information as it will inform how we talk to our customers who need to be segregated carefully.

- Information that tells us how reliant on credit the customer is: card utilisation, renewal of UPLs;

- Information that tells us about their financial morality: transactor not revolver, direct debit payer, early settlements of UPLs, takes advantage of interest-free offers, low LTV, lower-than-average balloon payments in terms, number of credit lines;

- For issuers, the changes in card transaction spend type and velocity; • Credit stress: number of new applications for credit internally and at bureau, frequency and degree of overdraft facility, and

- While rare, any information about their industry, occupation, earning potential and stability, as could be identified by the number of address and telephone number changes.

Without much of the above, these customers will end payment holiday periods as low-risk customers. There is a real urgency to understand the true degree of risk on these customers – on which you know little, as they are not normally a collections customer.

Just as this is unlike any other crisis, Covid customers are different. We need to ensure that we have, or can capture at the earliest possible opportunity, in a format that enables empirical use:

- The reason for delinquency;

- The duration of impact;

- The disposable income;

- Affordability over time, and

- Industry sector and role within.

Additional to our standard data, this information is necessary to help us understand not only their position now, but where they are likely going to be for the rest of this year and beyond.

These are customers with whom we are going to have communicate regularly to understand the changing nature of their personal circumstances.

There are three distinct pandemic-related collections phases: tactical, mid term and the more strategic long term. Each requires a different approach to customer segmentation and communication.

- Tactical phase – days 1-90: Capturing the correct data to ensure Covid-19 is registered as reasons for the policyholder being delinquent will be critical in relation to both near-term relief and impairment reporting later in the timeframes outlined;

- Mid-term strategic – days 90-180: As payment holidays expire, customers will require a pre-contact to ensure the right options are put in place for their best outcome in the longer term. Interaction will be essential at this point, and with better segmentation; the customer journey may change to either a standard collections solution discussion or longerterm forbearance options. In either case, validated affordability will be important;

- Long-term strategic – days 180-plus: Multiple touch points with the customer will be required to validate their financial and personal well-being. Understanding the reasons for Covid-19 payment holiday or forbearance will be critical for regulatory reporting.

Volumes will still be high and customer journeys will become more complex as initial volumes flatline. There could be a bigger share of vulnerable customers needing forbearance. Four UK tier 1 lenders have announced an expected £20.2bn increase on impaired loans.

We expect an increased need for digital-led payment plans and a higher demand for loan modification so the longer-term financial impacts can be worked through. Ultimately, companies will have to manage higher impairments and losses, which will attract C-level attention to the overall collections and recovery performance.

Tip 2: How can we better assess affordability?

We need to triage assessment levels. We need to know the degree of assessment necessary for someone who feels a short-term collections solution will suffice, versus the amount of validation required for a customer seeking a long-term forbearance solution.

Dig more deeply into household balance sheets and cashflow. Where it is available, use open banking data to determine accurate affordability assessments. Credit bureau data and other behavioural indicators will signpost trouble with current debt, as will the use of forward-looking analytics to detect the effect of incremental debt on default risk.

There is not a single generally accepted measure of over-indebtedness or affordability risk, and a combination of criteria and approaches should be applied to evaluate whether a person is overindebted.

Again, Covid customers are different, as we do not usually know what caused them to default. Credit scores do not tell us, so we need to collect more data to gain a deeper understanding of the household balance sheet and investigate past financial behaviour data for signs of affordability challenges.

Tip 3: What data do we need to collect to manage performance and regulations?

The additional data to capture in context of Covid-19 includes:

- Reasons for hardship: Unemployed, furlough or reduced income, medical, quarantined;

- Type of relief applied: Payment holiday, reduced instalment – what relief the customer had and when did it stop, and

- Industry sector, so you can estimate need for prolongation. This is not a static process, but a dynamic one. Communication is key to achieve an update on the customer’s circumstances and to segregate those falling into delinquency.

Tip 4: What is the best engagement strategy?

The best engagement strategy should be led by the customer – so how open can you make your systems to customers?

The ideal is an omnichannel approach – contacting the right customer through the right channel at the right time. Can you change your contact strategies quickly to enable customers to auto-resolve on omnichannel platforms including auto voice, iSMS/WhatsApp, digital direct API, email, mobile app, online or through e-docs?

Tip 5: How should we manage payment holidays ending?

The key here is to keep reviewing, as the customer debt profile will change significantly. Covid-19 customers will have a higher financial morality and be uncomfortable about being in debt, with a higher intent to maintain their standard of living and service their debts.

Review your restructure toolkit. Can you optimise the selection using the right tool for the right customer segment? For example, can you provide a temporary solution that can be automatically reviewed frequently and perhaps free up creditor teams to focus phone capacity on those with most need? It is essential to maintain contact to understand situational change and generate monthly updates via open banking, or chatbot to identify any changed circumstances.

This is a balance, as you do not want to over-structure your procedures. Ask yourself these questions:

- Is your process fit for purpose? Can you save consumers and creditors multiple calls whilst also ensuring appropriate forbearance that enables continued debt servicing, which in turn will mitigate the long-term impacts on individuals, businesses and the economy?

- Can you protect consumers’ credit ratings during the crisis to enable access to credit? When the crisis ends, can you prove validity of credit scores and plan for a controlled way to enable people to return to ‘normal’?

- As we move past the crisis, can you offer an updated budget to enable seamless transition from Covid relief – such as payment holidays – into mainstream creditor repayments?

- Finally, for those with longer-term financial stress, can you enable a seamless digital transition into debt solutions through a virtual agent? In other words, can you take all the data insights, information validation and decisioning into your customer auto-resolve tools? Can you do so to the satisfaction of the regulator, the customer and your portfolio performance?

Tip 6: How can we better segment customers for treatment?

Segmentation is a vital dynamic process. We need to look at pre-delinquency segmentation, lockdown and payment protection segmentation, and post-payment protection segmentation, and how the segments change across these categories.

Our decision science teams need to provide regular insight as to what they are seeing and how these insights should influence customer treatment decisions.

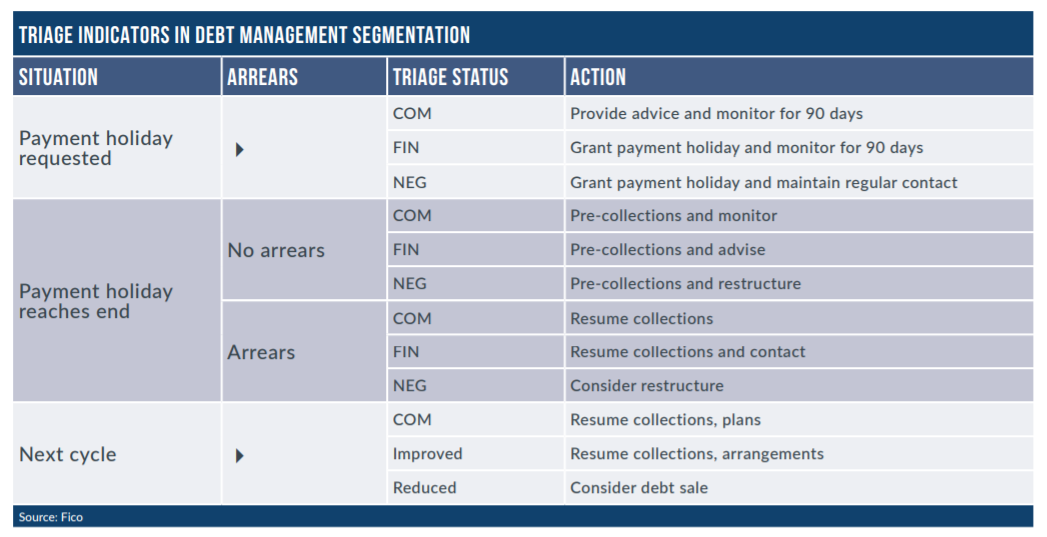

In the segmentation above, we can see how, as the phases progress, we are segmenting not necessarily by risk but more specifically by who we can let run with no need for help, who we need to assist or provide advice and stay close to, and who we need to assist and periodically monitor. This is about really strong prescriptive analytics.

Tip 7: Advanced – how do we use data-driven strategies?

The current debt tsunami provides the perfect opportunity to use mathematical optimisation, which has long been available to debt collectors but too rarely used. This is the most sophisticated analytics available to determine decision strategies and specific actions that will best meet objectives given all the data available and given the constraints.

Optimisation in collections can be applied across the different stages of the C&R lifecycle to solve different problems at each stage by defining the decisions that need to be made.

Optimisation helps evaluate and discover successful decision strategies which meet your business objective and cater to conflicting constraints. It can be used to explore different analytic techniques varying in sophistication, but it is vital to capture the right data for each technique and overlay decision modelling to optimise collections actions.

In early-stage collections, the key objective is to prevent accounts or consumers from rolling forward by being laser-focused on high-risk but collectable accounts, and identifying low-risk self-cures for relaxed or no action.

So in early stages, collections treatment strategy is about optimising which channel, channel timing and channel messaging should be most suitable to which account to achieve these objectives while also knowing who will accept and pay using the auto resolve channel, and who will go outside the channel. Also, who will not accept and roll forward?

In late-stage collections, the focus is more on collections and less on retaining customers. Management of non-performing loans and the identification of consumers that require related restructure or settlement is a key focus in this stage.

You need to design the process around the decisions. Optimisation of restructure and settlement offers will include reviewing take-up and expected level of default in order to aggregate the impact on the portfolio quality in order to optimise what restructuring or settlement offers should be given to individuals.

Post charge-off, the objective is to maximise recoveries by determining which accounts to work, which to place and which to sell.

When it comes to third-party placement, optimisation can be used to determine which accounts to best place to which agency in order to maximise recoveries, based on the performance of each agency on different quality and types of debt placed with them and the commission rates charged.

Optimisation can also assist in strategies to determine which accounts are best to be worked internally versus those that should be placed or sold, keeping in mind the expected value of the account, the probability to pay and the cost to work or place the account.

Tip 8: What should we look for in a review of our operations?

A comprehensive analysis of policy, insight, people, processes, tools, technology, data, management information and data and analytics and strategy will deliver the path from current state to desired state.

One of the best examples of operational negation is when analytics insight is ignored in order to gain operational efficiency – for example, ignoring the risk segmentation of accounts to build a larger dialing campaign!

There are many common areas of poor practice because few organisations really have sight of policy, process and execution from data to insights, through workflow into operational execution and performance measurement. Given the cost of bad debt on the balance sheet, it is still surprising how many organisations do not do a full annual assessment of their C&R capabilities and actual versus potential performance to plan and forecast.