Tracom Services offers a range of adaptable payment systems and banking solutions for the retail finance sector.

We specialise in alternative banking channel technologies, automated cash management, banking automation software, card production, signature capture and e-Signing technologies.

Point-of-sale terminals for the retail market

Tracom is a partner and exclusive distributor of leading point-of-sale (POS) terminal manufacturer Ingenico Group in East and Central Africa.

Fulfilling all the latest security certification requirements, Ingenico smart terminals are adapted to all market segments and payment applications such as mobility, contactless, signature capture, smartcard, magnetic stripe and self-service.

Modular credit and security card printers

Tracom Services is a partner with Evolis, a specialist manufacturer of card printers and security cards.

Evolis aims to make plastic card printing widely available, offering cost-effective solutions for printing high-quality cards easily, quickly and efficiently.

Mobile and internet banking software packages

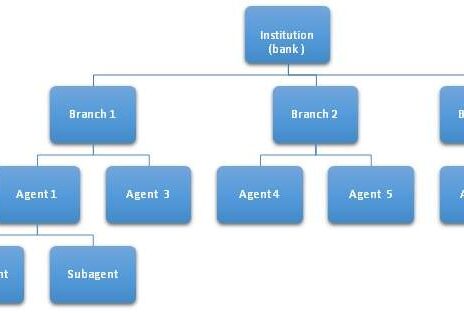

The Tracom Mobile Financial Services (MFS) suite comprises state-of-the-art mobile and internet banking technologies.

Designed to serve both banked and unbanked populations, the components of each channel are modular and the MFS can be deployed as a standalone system if necessary.

Banking automation technologies

Tracom’s bespoke banking applications are not only designed to complement the shortcomings of core banking applications but also help automate heavily manual processes, minimise or eliminate inefficiencies, enhance interoperability of divergent systems and provide innovative customer-facing solutions.

The Electronic Data Interchange (EDI) software that works with the bank’s internet banking system to process mass payment files from customers’ financial systems, undertake validation and re-format customer files into the specific format that is admissible by the core banking system.

The Automated Audit Reports Generator (ARGEN) system generates audit-related information pertaining to customers in line with the bank’s internal regulations and customer requests. In addition to improving customer satisfaction, the solution helps eliminate the risk associated with furnishing the customer with erroneous information drawn from manual processes.

The Automated ATM Reconciliation tool facilitates ATM reconciliation and generates informative reports, both at branch and head office levels, in a timely manner. We aim to upgrade the solution to be able to debit and credit affected accounts in an automated fashion.

The Tracom Mobile Mass Payment Engine (MMPE) suite includes a comprehensive mobile mass-payment engine that processes mass payments and collections to and from a bank account, via a mobile operator’s money system. MMPE offers in-built reconciliation and reporting modules and is designed to adhere to a bank’s requirements.

Hardware security modules for the financial sector

Tracom’s hardware security module (HSM) can be easily integrated into your current infrastructure and enhance the security of your IT ecosystem.

An HSM is a dedicated, standards-compliant cryptographic appliance designed to protect sensitive data using physical security measures, logical security controls, and encryption.

The HSM performs:

- Point-to-point encryption

- Tokenisation

- Data encryption

- One-time password generation for online security

- Message authentication and data integrity

- Digitally signing documents and emails

- Generation of identity cards

- Securing online transactions

- PIN issuance and printing

- Prepaid card issuance

- Database encryption

- EMV card issuance and transaction processing

In-house hardware maintenance services

Tracom has a fully equipped service centre with highly experienced personnel to deploy and manage all the hardware sold and supplied to customers.

To reduce operational costs, banks are looking for ways to manage ATM and POS terminal installation systems (TIS), more cost-effective replacement options and maintain/service the terminals quicker and easier.

We offer a one-stop shop solution/alternative to ATM and POS service management system, which focuses on customer requirements, service results and customer satisfaction.

Tracom Lab will be the central hub for importation, storage, installation, repair, maintenance and servicing for ATM and Ingenico POS terminals.

The POS Repair Centre is an Ingenico-authorised POS repair facility. We aim to complete repairs within 24 hours and perform satisfactory tests after repairs to ensure high-quality device performance. Our qualified team of certified technicians provide POS repairs and maintenance requirements.

Functions include:

- Logistics: terminal purchase, deployment, user training and after-sales service

- Terminal repair: involves diagnosis, resolving software and hardware issues, quality assurance and terminal cleaning

- Preparation of terminals for application loading (initialisation): we load the relevant files for the application to work as expected and do a field/site follow through to ensure the systems are working as required

- Maintenance: terminals are scheduled for periodical maintenance checks to ensure they are working as required

The ATM Management Centre is a Diebold-certified centre where ATM workshops take place, providing a single point of contact operating full bank installations and service for ATMs.

About Tracom

Based in Kenya, Tracom Services has two research and development centres, one in Tanzania and another in Kenya.

We work closely with our partners in France such as Ingenico, Alios Cards, and Leixem Security Consultants, in order to build capacity and stay up-to-date with financial technologies. Our software development house is operated by local experienced professionals, which provides us with a unique innovation platform for our clients.

We aim to provide comprehensive, high-performance solutions to both private enterprises and the public sector in East Africa and beyond.

We have assisted organisations by developing cost-effective bespoke applications that streamline daily operations, including reporting and statutory requirements, as well as increasing productivity and obtaining leverage within specific market segments.