Most consumers are likely to suffer some level of financial distress for the foreseeable future. But while the current series of economic shocks may seem “unprecedented”, the precedents are there. It’s important that we learn from the lessons of the past crises and use them to improve our collections strategies. It will be a failure not to learn from the lessons of the past, and the ability to act on those lessons will determine individual company performances when set against their market peers.

Four Key Collections Factors Shaping Analytic Insights, Strategy, Policy and Execution

Research by FICO shows that customers who entered collections exclusively as a consequence of the economic downturn, before going through the full debt recovery cycle, had a dramatically different return to financial good (RtFG) of nine months, compared to the 2.5 years it took typical collections customers. The insights were challenged and found to be robust, with the reasoning being quite intuitive.

Consumers hit exclusively by an economic downturn typically:

· Have very high financial morality – they are rarely repeat visitors to collections

· Are surprised, concerned and object to being in an arrears’ situation

· Will do whatever it takes to get back to their definition of ‘normal’

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData· Are reluctant to compromise on their financial plans

Given we already know that the vast majority of those customers that will be swelling the collections queue will also be economic victims, we have to challenge ourselves as to whether we are doing enough to optimize collection strategies while supporting customers in a time of need. For instance, are we able to:

· Accurately profile and identify economic victims?

· Adjust policies, collection strategies and treatment paths?

· Apply the right level of tolerance to consistently drive the right outcomes?

The last time there was a significant economic downturn, creditors hadn’t learned this lesson and consequently failed to carry out the actions and collection methods highlighted. As a result, they lost a mass of good customers – at speed and scale – much to the delight of the debt purchase sector. If the so-called ‘economic victims’ could be defined as running an average RtFG within nine months, would they really still be deemed in default, placed or sold at between 90 and 120 days past due?

Currently the UK forecasts that more than 8 million consumers, 18% of the UK’s 52 million working population, are now financially distressed. That volume is expected to increase by another 25% to 50%. Elsewhere, in markets like Turkey, where inflation is running at +70%, it’s only government intervention that’s delaying an indebtedness crisis.

Four Typical Factors Determining How Customer Payment Hierarchies Evolve

· Their own prioritisation of which credit lines enable them to live and not suffer significant harm if defaulted on

· Political or regulatory moratoriums that de-risk the expected significant harm such as breathing space or communication pauses, payment holidays, or moratoriums preventing mortgage foreclosures

· Societal expectation of creditor support

· Prevalence of products that influence payment cadence, such as ease of access to cash flow offerings like BNPL.

Again, those that might have a need, a prevalence or be motivated to change their preferred payment habits can be profiled with proactive strategies deployed to help mitigate risk for both the customer and the creditor. There will also be further opportunities for those creditors with sophisticated debt consolidation capabilities. For instance, clearly signposting those customers that need assistance to debt management companies (DMC), but subsequently offering a ‘return to brand’ agreement with the DMC when the customer is back on their financial feet. Very few creditors have debt sale agreements that encourage the debt purchaser to work towards returning a customer to the creditor from whom the debt was acquired.

The BNPL sector is already showing how it can impact customer payment hierarchy. In the UK, research by the Citizen’s Advice Bureau reports that one in three BNPL customers missed or made a late payment within the past year. Of these:

· More than one in four (26%) also fell behind on other payments

· One in four (25%) fell behind on a bill

· More than half (54%) turned to other forms of borrowing to help pay off their debt

Why Evidence Is Everything

Being able to evidence how your firm arrived at a decision isn’t new or an insignificant challenge. Nearly half of UK companies admit they’ll struggle to achieve the required regulatory transparency of the decisions driving their customer treatment, as set out under the FCA’s new Consumer Duty.

The requirement to evidence the right outcome has been in place for years among credit and lending institutions. It’s simply the absence of either ambition or ability to enable such transparency that drives a necessity for mandated policies.

There is a need for policies, but I often say that a policy is a cover for ignorance — in other words, if you knew enough about the customer, you would have a better treatment than the policy allows. It is not , for example, uncommon to hear of collections policies such as:

· Customer must pay at least one full arrears instalment.

· A promise payment must be within the next 10 days.

· A repayment plan cannot exceed six months or more than one plan per year.

· A maximum three-month extension can only be offered.

· Only one payment holiday per year is allowed.

· A short settlement of a maximum 20% is acceptable.

In fact, many of these policies simply fail to accurately fit the circumstances and situation of the customer at the time of being applied. One customer might be able to afford half a contractual instalment, while another can afford one and a half times their instalment. Another customer may only need a two-month extension, but another may be after four months. One customer might be at the end of their credit term but have no future source of income while having other repayments fully up to date. Another might only have the one product but be at the beginning of a long-term credit agreement — a 20% settlement for either of these is likely to be completely wrong in both instances.

When there’s an obligation to directly control what collectors or digital channels are doing, without accurate insights to determine the right outcomes policies simply become the default decision-maker. But many policies drive the wrong outcome far too often.

Leveraging existing capabilities that drive the data and analytic insights needed for customer-centric decisioning Is by far the most effective way to maximise the value of an agreed outcome for both the customer and creditor and to the satisfaction of the regulator.

Regardless of whether a regulator wants to see evidence ofrRight outcome, or the company’s boardroom wants to ensure the positive value of appropriate customer treatment it will always be necessary to leverage the very best data, analytics, insights, decision execution and reporting capabilities that exist today. Because, if it’s not possible to accurately identify and strategise for the treatment of financially stressed customers, then in all likelihood they are being lost at scale.

The Wrong Forbearance Is Costly

The global pandemic has clouded the clarity around customer risk that was expected to be provided in part through reporting under IFRS 9. In most markets, the response to Covid hinged on financial protection to both society and business. It ran for the first full period of reporting under IFRS 9, prompting many discussions about the real degree of risk.

A predicted tidal wave of debt didn’t materialise, thanks to the financial protections that were thrown up, while collections’ portfolios were reduced as lockdowns limited discretionary spending, allowing a greater level of debt servicing.

But the emerging economic downturn is now being aggravated by a combination of inflation, interest rates and rising energy costs. The fiscal protection will not be the same as provided during the pandemic. As a result, lenders’ collections’ books are already growing.

Creditors which don’t have scalable and agile orchestrated digital channels will struggle to manage the high volume of activity already emerging at the pre-delinquency and early collections’ stages. In fact, some customers will get pushed to Stage 2 and Stage 3, simply because the volume of later-payers simply cannot be effectively managed, rather than because the risk is greater for these customers.

Instances of customers being given the wrong collections or forbearance solution at the outset is likely to have a significant knock-on effect with higher volumes becoming delinquent. It’s a situation that can only be resolved through the dynamic, appropriate and smart use of data, analytics and insights. Those that fail to enable the required capabilities will not identify high-quality customers, will treat all in line with pre-set policies and will be unable to evidence or offer the right treatments.

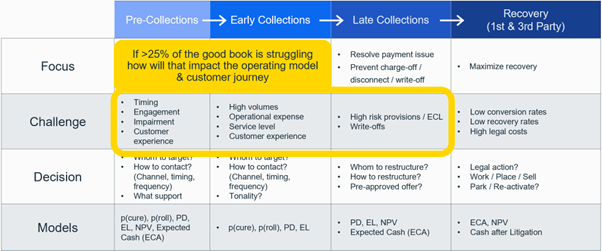

If the increase of financially stressed customers exceeds 25% of the total portfolio, then is it still a collections problem? The competitive collections and customer retention battle ground simply moves to another area of the cycle. This has ramifications for the operating model and customer journey.

The volumes are unlikely to be well-managed at a reasonable cost if pre-delinquency and early collections are predominantly dealt with by call centres. But if there are strong digitally orchestrated omni-channel treatments available then how will those customer journeys be best managed?

Collections teams will be reviewing operating models to understand how they best meet the challenges raised from the lessons learned – financially vulnerable customer volumes will come at pace, there will be sizeable cohorts therein with differing RTfG profiles, many will involve a changing payment hierarchy and all will have a detrimental impact on the balance sheet if we fail to resolve those that do not need to reach stage 2 & 3 status.

Organisations that are able to apply insights and determine appropriate action to ensure the right outcome for the numerous customer segments will have (or be looking for) more capabilities to ensure they can position collections as a competitive advantage. When considering the go-forward segmentation, strategies, range of forbearance solutions and means to determine the right outcomes, reflecting on the past lessons learned as well as the BAU collections challenges will ensure more success than those that do not.

Bruce Curry, Senior Principal Consultant, FICO

Bruce Curry is a senior principal consultant at FICO, helping clients across Europe, the Middle East and Africa improve performance in collections and recovery. Bruce has worked directly with dozens of businesses in 27 countries across EMEA and APAC. Before joining FICO, Bruce held successive senior operational management positions over 16 years with Barclays vehicle asset finance (Dial Contracts), Marks and Spencer Financial Services and Royal Bank of Scotland Cards. Prior to his commercial career Bruce undertook a successful career in the Armed Forces where he worked across the world in many varied roles. Bruce Curry has been named to the Credit 500 in 2020, 2021 and 2022.