The development of tokenisation, in which physical and blockchain assets are stored digitally and sold as fractionalised ‘tokens’, is a new innovation that will make investments more accessible beyond wealthy customers due to the cheaper nature of tokenised assets and efficient online wallets, writes Harry Swain

Thus far, the main uptake and usage of tokenisation has been in equity trading markets. Banks can engage in other markets by becoming potential buyers and sellers of tokenised assets, creating potential for future gain through investment and lending opportunities.

Real estate can be fractionalised and then represented by digital tokens, with each individual token representing a fraction of the property on asset level with all its rights. These tokens can then be bought and sold on the blockchain, with the transaction needing no human intervention.

Tokenisation: banks set to profit

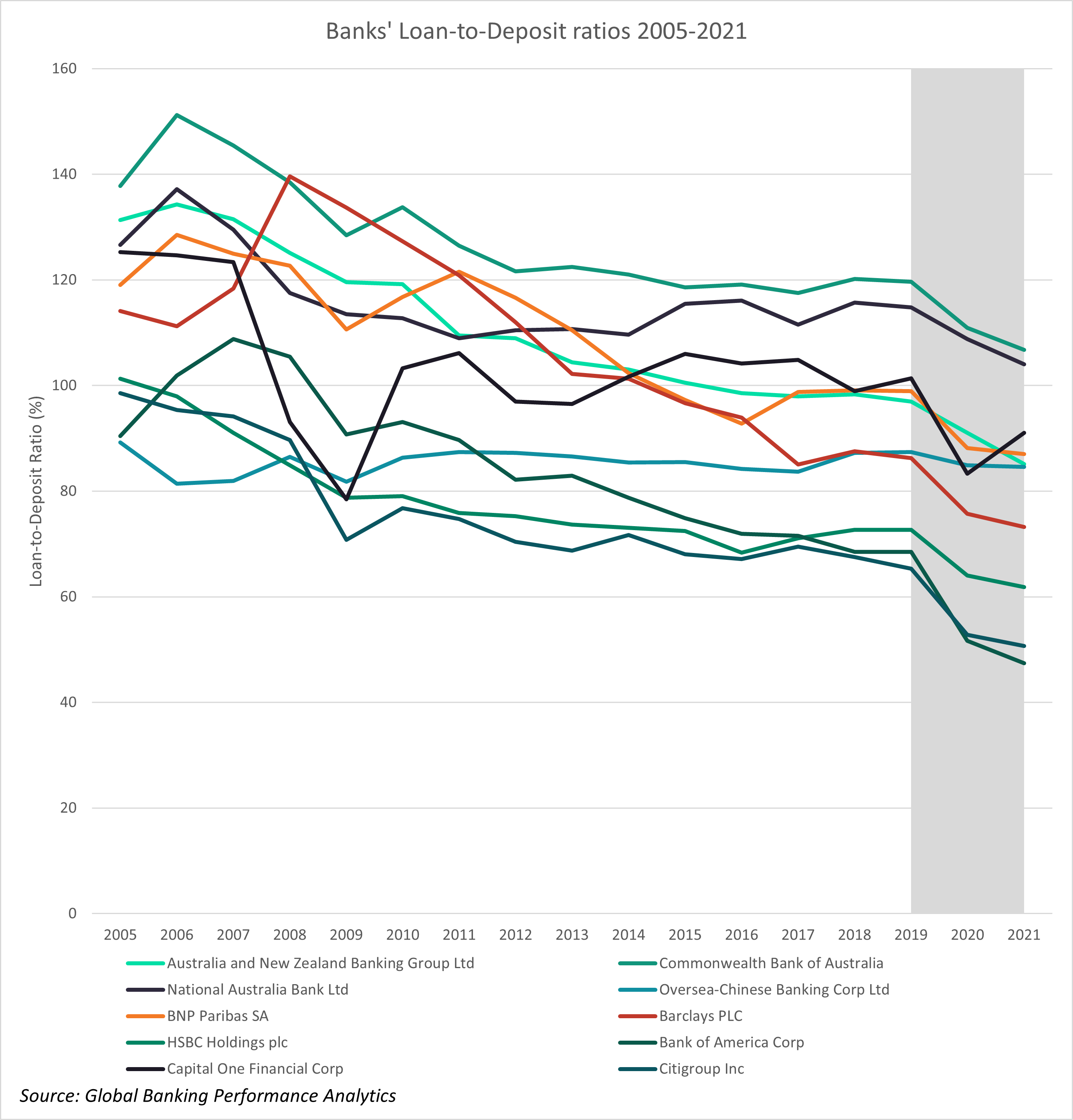

With customer cash totals growing, highlighted through falling loan-to-deposit ratios, investments become more accessible to customers. Consumers can look to take advantage of the growing inflation rates to gain from investments as well as the current low interest rates coupled with borrowed money for funding real estate token-buying. Tokenisation also allows real estate investors to diversify portfolios, owning security tokens in multiple areas of real estate rather than a limited few.

Banks can also look to profit heavily from tokenisation. With the increase in spending from customers, the volume of borrowers using the bank will follow, leading to banks attracting more customers to lend to and ultimately resulting in more liquidity. Signature Bank in the US has partnered with digital securities platform Tokensoft to set off security tokens for real estate investors, highlighting how banks are already beginning to make the change towards tokenisation in the real estate market.

Tokenisation brings help against money laundering, with the ability to trace token origins and the holder of the token, while also bringing in a greater governance element to assets so that they can be controlled in a regulatory manner.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataRegulatory challenge

However, regulation issues may arise as a modern framework will be required for gains from tokenisation to reach their full potential, and it is currently unclear under which umbrella these tokens fall, creating a risk of market exploitation.

It is key that the token market promotion is regulated quickly, highlighting the potential risks that come with investment and that the tokens do not currently have regulatory supervision.

A long-term movement towards tokenisation will be beneficial to all players in banking and financial markets, with more opportunities for consumers to be involved in asset ownership and for banks to benefit from increased liquidity and asset volume under management. Banks should also look to offer new opportunities to customers to take advantage of the growing uptake and encourage consumers to use them by offering specialist help to maximise their asset usage and ownership, as well as standardised reporting to aid consumers in their tax purposes.