One thing that new digital banks and fintechs always claim to offer is a new, more positive customer experience for the customer. However, it seems that many of the new kids on the financial block are actually delivering, especially in comparison to the long-standing incumbents in the sector. Patrick Brusnahan reports

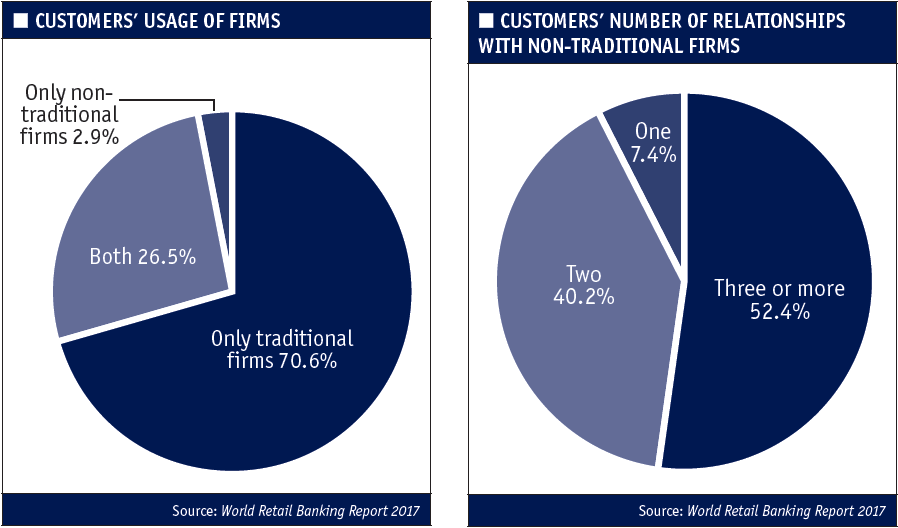

Non-traditional providers are moving the needle in terms of attracting customers. This is according to the World Retail Banking Report 2017 published by Capgemini and Efma, which states that nearly one-third of banking customers are already banking with at least one non-traditional provider. However, they are yet to grasp significant market share.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The search for a positive customer experience

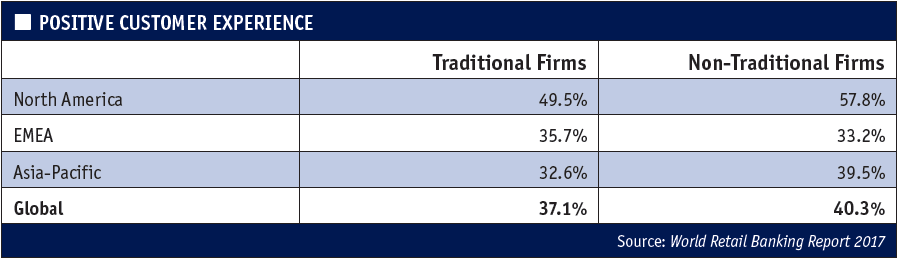

Fintechs, while new to the sector, are already offering higher levels of positive customer experience than banks. Focusing on specific areas of the banking value chain, and using the latest technologies have helped them deliver frictionless, personalised and attractive offerings to customers.

This is putting added pressure on the traditional relationship between a customer and a bank.

Banks are struggling to respond to the new batch of competitors due to heightened customer expectations, a large amount of regulation, a cultural resistance to change, pressures on profits, and legacy infrastructure.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTech-driven firms reached the most potential in North America, as they delivered positive experiences to 57.8% of customers, compared to 49.5% for banks. Fintech firms in Asia-Pacific gave 39.5% of their customers a positive experience, a higher level than the 32.6% for banks.

While the global average is 40.3% for tech-driven firms and 37.1% for banks, the Europe, Middle East and Africa (EMEA) region bucked the trend as 35.7% of customers at banks had positive experiences, but only 33.2% of tech-driven firms’ customers felt the same way.

Overall, 29.4% of banking customers also used products and services offered by the newer players. In addition, 52.4% of customers that engage with non-traditional operators have relationships with three or more of them.

Younger, tech-savvy consumers are the most likely (42.6%) to embrace the non-traditional providers, but only 12.8% of the non-tech-savvy crowd wants to approach them. Furthermore, 37.2% of Gen Y customers use non-traditional banks, but only 22% of other age groups did.

The report states: “Banks are no stranger to competition, having faced incursions from credit unions, post offices, brokerages, internet-only banks, and other entities seeking a piece of the multi-billion-dollar global retail banking market.

“However, the variety and severity of forces disrupting traditional banking are now reaching a new pitch, threatening to dismantle long-held ways of doing business.

“Most significant is the advancement of much tougher, technology-driven competition. The new wave of digital banks and fintech companies are wisely putting their efforts into the front-end customer-facing experience, knowing that winning the customer interface primes them to also win over customer relationships, loyalty, and fees.”

One aspect that tech-focused firms often get right is turning the banking experience into something relevant for more technically aware users. Atom Bank in the UK was stated as an example for its use of gamification, while mobile-only Starling Bank encourages users to record videos of themselves for biometric identification.

Banks could be considered to be lagging when it comes to these innovations, especially considering that huge operators such Apple, Amazon and Facebook have been utilising these developments for years. As a result, customers expect the same level of service from their bank that they get from other providers.

The report continues: “Merely keeping up with other banks’ interest rates on saving accounts or providing mobile apps will not suffice. Today’s competitive landscape requires a broader focus as well as a greater appreciation of new ways of doing things. Fintechs have been fast and successful at demonstrating this, and herein lies the threat for banks.”

Moments of Truth

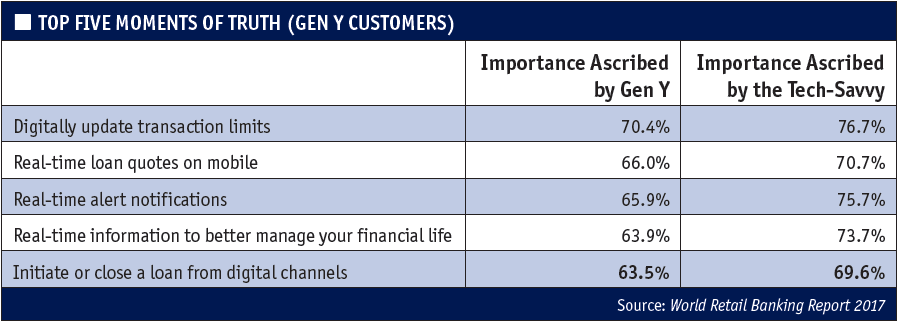

Crucial for anyone’s success is the ability to create a Moment of Truth.

The report defines Moments of Truth as instances when customers interact with their financial services provider and form or change an impression about that provider, product or service.

Gen Y and tech-savvy customers placed most importance to the moment when their transaction limits are digitally updated. Both groups gave higher marks to traditional banks for providing those moments.

In addition, real-time notifications were highly ranked and traditional banks received more credit for that as well.

On the other hand, non-traditional firms made the best impressions in loan-related transactions. This was attributed to providing real-time loan quotes via mobile and initiating, or closing a loan from a digital channel.

What can banks do?

Banks do not need to completely fear the up-and-coming firms just yet.

Banks have huge reservoirs of knowledge on how to navigate banking networks and regulations. They also know of all the technology newer firms employ, despite being slower to implement them. Large banks have the scale and resources that no new fintech can match. And, crucially, the banks have the customers.

However, this will only last for so long. Customers are quickly heading moving away from the usual interactions they have with financial companies. Banks need to keep pace with the frictionless experiences that the more technically cutting-edge firms can offer. Convenience is key.

Having said all that, there is one remaining area that could change the balance entirely, and that is application programming interfaces (APIs).

The potential of APIs

APIs would help the rapid deployment of banks’ digital agendas and collaboration with non-financial services providers to create a value-based marketplace and increased long-term loyalty.

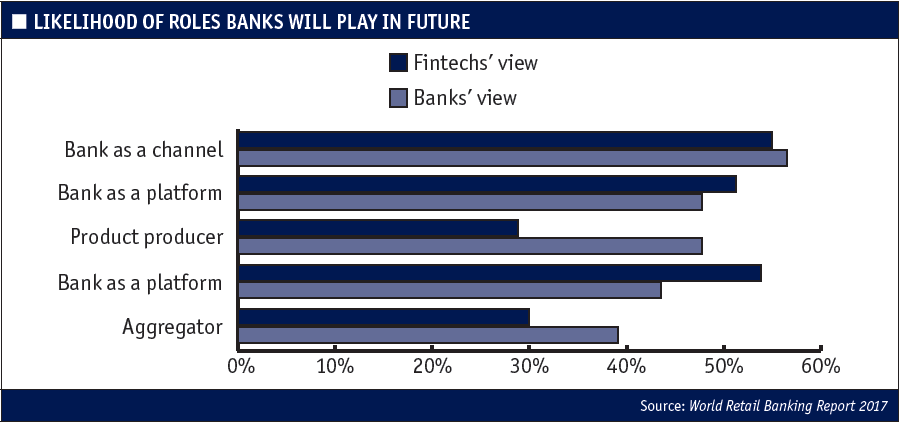

Collaboration is expected to be a big part of financial services in the future. Some 91.3% of banks and 75.3% of fintechs say they expect to partner each other; both expect this to improve customer experience, bring new revenue streams, and reduced time to market for new products.

However, there are concerns with data security and customer privacy with open APIs; nearly three-quarters of banks and fintechs cited these concerns.

Banks are the holders of extremely large amounts of customer data that can be used to their benefit. These benefits include enhancing customer engagement and creating new revenue sources.

If banks monetise their APIs, that is one new revenue stream instantly. Overall, 43.5% of banks stated that they preferred a model in which they charge a fee per API transaction.

However, banks are more enthusiastic about revenue-sharing models than fintechs (47.8% versus 27.2%).