Serving as a hub for international investment potential, the technological sector of Europe is showing extraordinary resilience and innovation, recovering to a staggering valuation of $3trn. This inspiring revival marks Europe as a strong player in the global technology scene.

The detailed analysis presented in this article has been prepared by the research team of Zubr Capital, a private equity firm specialising in investments within rapidly growing companies in the TMT sector. The analysis draws from several significant 2023/2034 investment reports, including the Investment Report and the EIB Investment Survey by the European Investment Bank, the European Investment Fund VC Survey, the International Finance Corporation’s Annual Report, as well as Atomico’s “State of European Tech” Report.

A new era for Europe’s tech sphere

According to the European Investment Bank Investment Report 2023/2024, the European tech sector, despite global investment challenges, has demonstrated impressive strength, bouncing back to a spectacular $3trn value. This recovery shows Europe as an a determined player in the global tech scene, characterised by an increase in startups and a large pool of tech talent. Europe’s robust tech revival is fueled by various factors including a surge in local capital, successful tech companies attracting investor interest, and a commitment to sustainability.

Driving future-ready innovation in health and sustainability

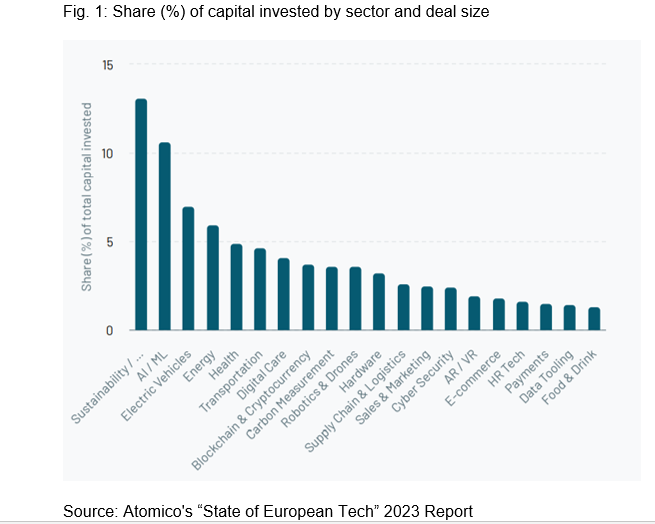

Europe’s tech sphere isn’t just surviving; it’s thriving, highlighted by the profound entrepreneurial spirit driving a rise in startups. Amid decreased global investment, the value of Europe’s tech ecosystem has impressively rebounded. With focus areas such as sustainability and health relying on renewable energy, digital healthcare, and AI-centric solutions, Europe’s tech firms are cultivating a sustainable, healthy future.

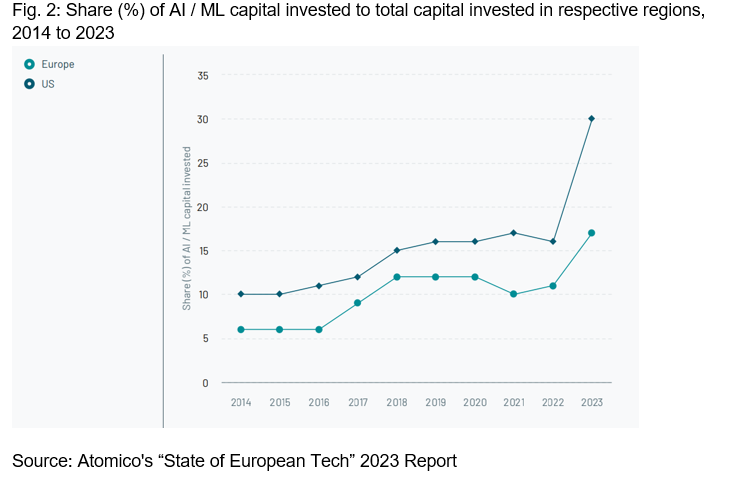

Europe’s dominance in AI and Generative AI

The increasing AI talent pool

Europe stands tall as a global front-runner in AI, utilising its large pool of AI expertise and demonstrating notable growth in AI positions over the past decade. According to the EIB Investment Survey 2023, the AI talent bank in Europe is robust and flourishing. With tech hubs like the UK’s Silicon Fen and Germany’s Silicon Allee providing international recognition, the region’s tech workforce has swelled to over 2.3 million in just half a decade. The influx of talent is boosted by cross-border mobility, infusing the sector with fresh insights and experiences.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe investment opportunities in AI

Europe’s tech market is full of profitable opportunities for investing in AI. According to Atomico’s “State of European Tech” 2023 Report, the region is experiencing a significant rise in purpose-driven tech investments, especially those centred around sustainability and climate-oriented companies. Despite some capital access challenges, Europe’s contribution to global capital for purpose-driven tech surpasses the US. Europe’s AI companies are uniquely equipped to address global issues via innovative solutions, making it a compelling prospect for tech investors.

European startup funding: challenges and opportunities

Despite a lively ecosystem, European startups struggle with funding, receiving 40% less venture capital than American startups according to the European Investment Fund 2023 VC Survey. This concern is particularly acute for women and underrepresented founders, leading them to rely more on seed and Series A bridge rounds to optimize their products towards market demands.

Access to capital is still crucial for this region, even though it falls behind in this regard. Despite these struggles, there are promising signs of growth, especially in sectors such as Carbon & Energy. A striking shift is seen in deep tech investments, which reached a record-high, accounting for 44% of total capital in 2023.

Challenges for LPs and VCs

Limited partners (LPs) and venture capitalists (VCs) are wrestling with an increasingly challenging fundraising environment in Europe. This complexity is driven by a rich blend of factors, including the traditionally minimal venture capital commitments from European pension funds. Furthermore, a mutual misunderstanding between LPs and VCs remains regarding the obstacles faced by LPs in their venture capital commitments, as shown by the survey. As a result, investors’ attitudes towards European venture capital are constantly changing, reflecting the evolving fundraising situation.

On a brighter note, venture capitalists are boosting their cash reserves, indicating they are ready for these changes in fundraising. This increase in available capital shows they’re strengthening their financial positions to deal with uncertainties and to take advantage of profitable investment opportunities.

Trends in IPOs, mergers & acquisitions, and alternative market routes

The European IPO scene remains relatively calm, with companies increasingly favoring mergers and acquisitions (M&As). As observed in the survey, the M&A domain is predominantly driven by private European buyers, while public European buyers maintain a comparatively low profile. Meanwhile, Private Equity firms and corporate buyers are bustling with significant cash balances. Notably, the technology public market displays clear signs of recovery, potentially leading to the reopening of the IPO window.

Interestingly, once European companies are listed, they tend to remain in Europe. This contrasts with the often observed delisting of US tech companies. Moreover, growth-oriented firms are exploring alternative market routes, such as direct listings and reverse mergers. Europe is strengthening its role as a key player in B2B tech disruption, boasting a strong pipeline of potential billion-dollar exit candidates.

Wrapping up: Europe’s tech potential in a sustainable future

Europe’s tech ecosystem is currently worth an outstanding $3trn, reflecting its resilient recovery and innovative spirit. From a booming AI talent pool to startups pioneering sustainable solutions, Europe’s tech landscape offers lucrative investment opportunities. Despite fundraising challenges, a focus on impactful tech and a rising trend in alternative market routes keep Europe at the forefront of global tech investment.

Oleg Khusaenov is CEO and founder of Zubr Capital Investment Сompany, an international private equity fund management company with $250m of assets under management