Overall satisfaction with national US banks has improved this year according to JD Power’s annual national banking satisfaction study.

Specifically, the satisfaction score inches up by 5 points, on a 1,000-point scale to 653 from 648 in 2022. On the other hand, higher deposit interest rates at other financial institutions are driving customers to investment/wealth management and internet-only financial services providers.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Among the growing proportion of national bank customers with secondary deposit accounts, those with a secondary account at an investment/wealth management or internet-only financial company increased 6 percentage points to 50% in 2023.

“Deposit interest rates surely matter. But there are steps large banks can take to help minimise the deposit flow to secondary providers.

“Customers want banks to help them grow their money and save them time. Banks that ensure the banking process is easy for their customers, such as having an intuitive and easy-to-use mobile app, understandable credit cards and seamless processes for opening new accounts, are more likely to retain deposits, particularly among customers who have balances greater than $10,000,” said Paul McAdam, senior director of banking and payments intelligence, JD Power.

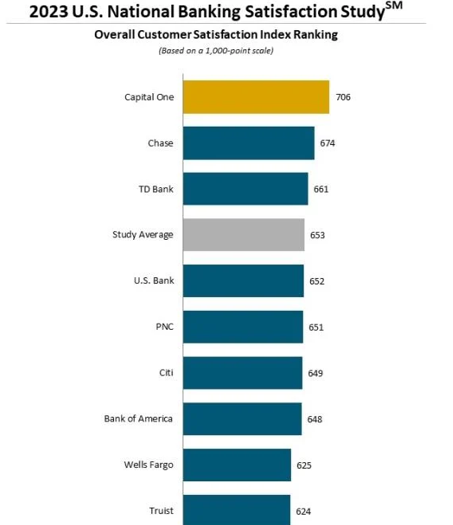

JD Power US National Banking Satisfaction: Study Ranking

Capital One ranks highest in overall satisfaction for a fourth consecutive year, with a score of 706. Chase (674) ranks second and TD (661) ranks third.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAt the other end of the scale, Truist ranks last (624) behind Wells Fargo and Bank of America, 625 and 648 respectively.

The study is now in its seventh year. It provides a comprehensive view of the customer experience across retail bank product lines for nine national US banks. It evaluates bank customer experience across seven factors: trust; people; account offerings; allowing customers to bank how and when they want; saving time and money; digital channels; and resolving problems or complaints.