TSB CEO, Paul Pester stepped down on 4 August following several IT meltdowns.

The resignation came less than a day after TSB found itself burdened with yet even more IT chaos. It has been a long five months of continuing technical faults for the bank. The questions still remains about what exactly went on.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

In a statement, Paul Pester said: “The last few months have been challenging for everyone at TSB.

“However, I want to thank all my colleagues across TSB for their dedication and commitment during this period and for their focus on putting things right for TSB customers.

“It has been a privilege to lead TSB through its creation and first five years. I look forward to seeing the next stage of our bank’s history evolve.”

TSB IT Chaos timeline

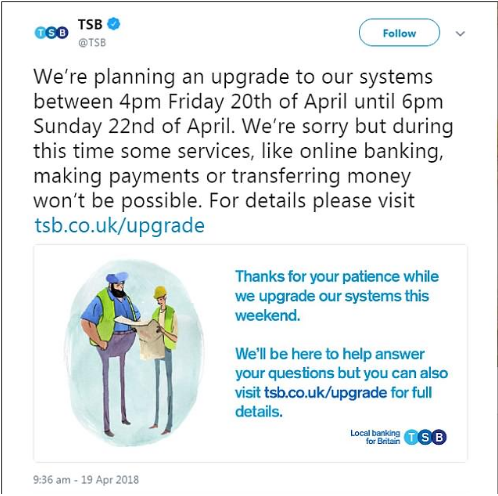

20 April to 22 April

Between Friday 20 April and Sunday 22 April, TSB notified its customers that upgrades to its systems would be carried out. During this time, users would not be able to access services such as online banking, making payments and transferring money.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIt all seemed very normal. TSB started an IT upgrade, migrating the accounts of its customers from the previous system that was operated by Lloyds Banking Group over to another system that had been designed by TSB’s current owner, Banco Sabadell.

Unfortunately, on the Sunday, it appeared that the transition was not going to plan with technical faults arising as customers attempted to log on at 6pm that evening to view their accounts.

TSB users took to social media with several complaints, including customers stating they could see other people’s accounts and incorrect balances.

23 April

On Monday, the TSB IT chaos continued. The bank played the issues down stating that, “We are currently experiencing large volumes of customers accessing our mobile app and internet banking. This is leading to some intermittent issues with people accessing our services.”

However, customers increasingly announced continuing faults on twitter including one man who reported that he could view other customer’s accounts, totalling more than £20,000 ($28,000).

Banco Sabadell joined the discussion by pre-emptively publishing a statement that said the migration had been successful.

The failed migration saw up to 1.9 million customers blocked from their accounts.

2 May

After continuing problems, Pester appeared at the Treasury Committee, led by MP Nicky Morgan to answer questions. Alongside Pester was Richard Meddings, TSB chair and Miquel Montes, chief operations officer at Sabadell.

At the hearing, Morgan questioned whether Pester was acknowledging the impact of the faults.

“What we are hearing this afternoon is the most staggering example of a chief executive who seems unwilling to realise the scale of the problem that is being faced.”

Pester attempted to reassure the panel and those watching by promising that no TSB customer would be “left out of pocket.”

6 June

One of London’s top regulators, Andrew Bailey stated that Pester had downplayed the IT problems. Furthermore, the bank is accused of not being transparent with TSB customers. The FCA announced that is investigating the migration process alongside the Prudential Regulation Authority.

TSB IT chaos still ongoing

The TSB IT chaos caused the bank to suffer an overall of £107.4m for the first six months of the 2018. Originally the migration was meant to go ahead back in November 2017 but failed to take off.

Around 26,000 customers closed their accounts with TSB as a result of the problems caused by the migration.

Between 1 and 2 September, TSB followed up with another upgrade and, yet again customers found themselves locked out of their accounts.

The bank has certainly taken a beating and it’s far from over.

What’s next?

Now that Paul Pester has resigned, it raises the question of what happens next. Currently, Pester is on gardening leave will receive £1.2m ($1.5m) for his 12-month notice period.

Richard Meddings, TSB chairman, will temporally take on the role of executive chairman with immediate effect. Banco Sabadell is currently looking for a new boss.

Although TSB has taken most of the criticism, Sabadell also has questions to answer. It was Sabadell’s system that TSB was migrating customers to. Whether we get those answers is still unknown.

TSB has commissioned law firm Slaughter & May to compile a report into what happened during the transition.

Even with his departure, the Treasury Committee still has deep concerns about the transparency of the bank. Nicky Morgan said in a statement:

“The Treasury Committee remains concerned about the continuing problems at TSB, including unacceptable delays in compensating customers who have been badly let down.

“Hopefully Dr Pester’s successor is able to restore the confidence of the bank’s long-suffering customers.”