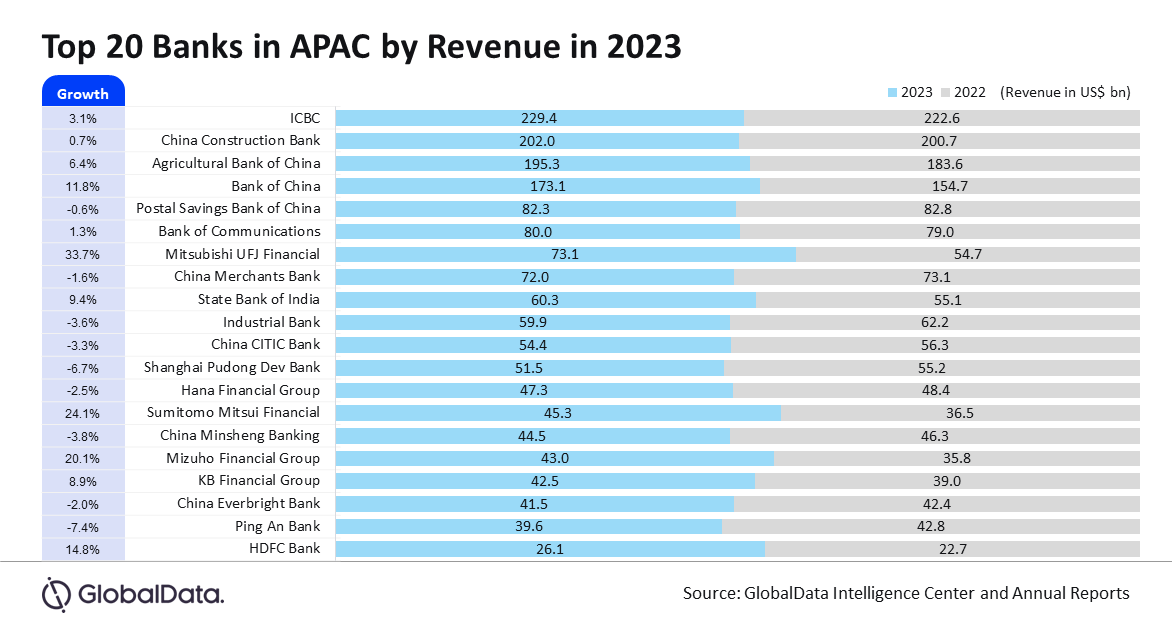

The top 20 Asia-Pacific (APAC) banks saw a 4.3% increase in combined revenue, reaching $1.67trn in 2023, up from $1.6trn the previous year. This growth was fuelled by a surge in interest income due to tightened monetary policies, robust economic recovery, and improved asset quality, despite a decline in non-interest income amid economic volatility and heightened competition, reveals GlobalData, publishers of RBI.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Murthy Grandhi, Company Profiles Analyst at GlobalData, said: “Out of the top 20 banks, 13 were from China, and they reported an average year-over-year revenue decline of 0.4% due to weak credit demand and real estate crisis.”

According to GlobalData, only three APAC banks were able to record more than 20% revenue growth in 2023, and all three of them were from Japan: Mitsubishi UFJ Financial (33.7%), Sumitomo Mitsui Financial (24.1%), and Mizuho Financial Group (20.1%).

Mitsubishi UFJ Financial’s impressive growth was due to a 104.8% growth in interest income, mainly due to the gains on cancellations of investment trusts, improvement in loan spread, and an increase in earnings from foreign deposits.

Sumitomo Mitsui Financial recorded a 24.1% growth in revenue due to the depreciation of yen, an increase in interest income from loans for both domestic and international corporate customers, and an increase in fees and commissions due to good results of ancillary businesses.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMizuho Financial Group registered a 20.1% increase in revenue owing to a 99.5% rise in interest on loans and bills discounted.

The top Chinese bank in 2023 was Bank of China, which reported a 11.8% growth in revenue on the back of a 15% rise in loans and advances to customers and rising interest rates.

With a 0.6% decline in interest income and a 10.9% fall in non-interest income owing to a decrease in fee income of credit card business and decline in fee of wealth management and trade financing, Ping An Bank was the worst performer among the top 20 banks in APAC.

Grandhi added: “In 2024, the performance of APAC banks will hinge on various factors. Economic growth across the key APAC economies, such as China and India, will significantly influence lending and investment activities. Central banks’ decisions regarding interest rates will impact net interest margins and loan demand. Regulatory changes, including adjustments to capital requirements, will shape banks’ profitability and operational strategies.

“Technological advancements, particularly in digital banking and cybersecurity, will continue to reshape the industry landscape. The ongoing geopolitical tensions and trade relations may introduce volatility, affecting market stability and economic activities in the region. Maintaining credit quality and managing non-performing loans will be critical for banks’ financial health amid potential economic downturns.”