Toronto Dominion (TD) has teamed up with Uber to help customers unlock more value on transportation, meals and more. The new relationship means eligible TD cardholders will be able to enrol to receive a free Uber One membership for up to 12 months.

Benefits of the Uber One membership include:

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

- $0 Delivery Fee + 5% off eligible restaurant orders over $15;

- $0 Delivery Fee on eligible grocery orders over $40;

- 5% off on eligible rides including UberX, UberXL, and

- Member-only perks including special offers and promotions.

“We know our customers are always looking for opportunities to save money and introduce more convenience into their lives. That is why we’re so thrilled to be working with Uber to offer our customers this new benefit.” said Meg McKee, Senior Vice President at Canadian Card Payments, Loyalty & Personal Lending at TD.

Bringing enhanced and valuable rewards to cardholders

“This collaboration is just one of the many ways we’re bringing enhanced and valuable rewards to our cardholders. We continue to deliver the benefits our customers want most.”

TD cardholders are eligible for 6 or 12-month free Uber One membership by setting their card their Uber payment source.

The free membership extends until six or 12 months from the initial sign-up date. Customers have until 23 May, 2024 to enrol.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“With Uber One, Canadians can go anywhere and get anything while saving with $0 delivery fees, discounts, and other membership perks,” said Lola Kassim, General Manager of Uber Eats Canada. “With today’s announcement, we’re excited to have more TD customers experience the magic of going wherever they need to be, getting anything from their favourite dish to groceries, and saving money with a free 6-month or 12-month Uber One membership.”

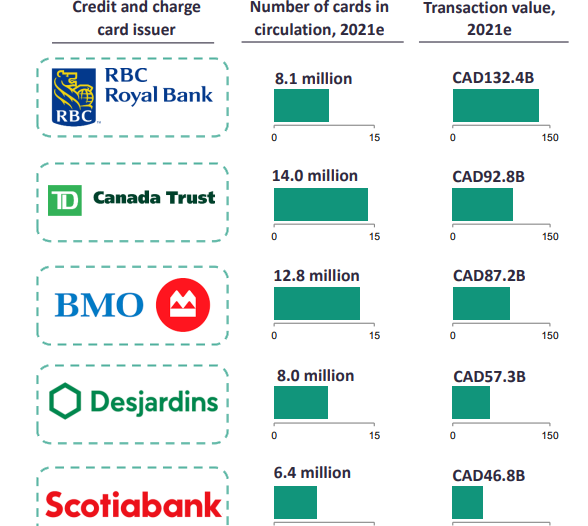

Canada credit card sector: top 5 banks dominate

Credit cards account for 67.3% of cards in circulation in Canada. According to GlobalData, publishers of EPI, every Canadian held nearly three payment cards in 2021. Credit and charge card penetration in Canada stood at 211.2 cards per 100 individuals in 2021. This compares to its peers, US (227.7), UK (92.7), Spain (79.5), Sweden (67.1), Germany (52.3), France (51.0), and Italy (47.3).

According to Payments Canada’s Canadian Payment Methods and Trends Report 2021, in 2020 “receiving discounts or loyalty points” was the key reason for using credit cards. This was cited by 62% of Canadian credit card holders. Visa accounted for 59.2% of total credit and charge card transaction value in 2021 in Canada.

Canada’s credit and charge card market is concentrated. The top five banks accounted for 64.5% of total credit and charge card transaction value in 2021.