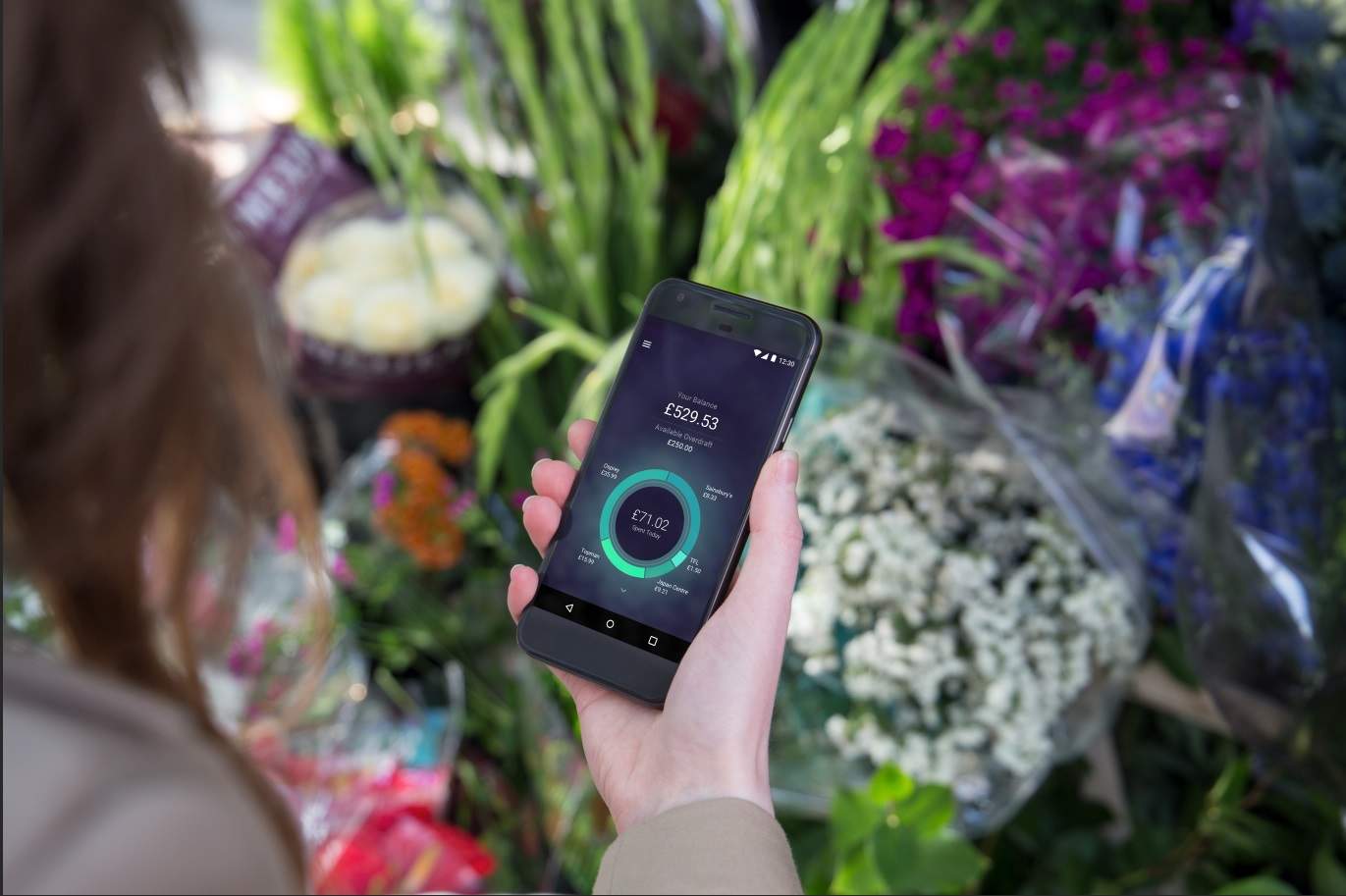

Digital challenger Starling Bank has raised £30m ($38.5m) in a new funding round and aims to use it for expansion.

Merian Chrysalis Investment Company led the round and contributed £20m and Starling’s existing investor JTC added £10m.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The funding will support Starling’s financial retail and SME bank accounts as well as B2B banking services. Furthermore, it will accelerate a European expansion for Starling.

Since launching in the UK in 2017, Starling has opened 930,000 accounts. In addition, the bank expects to hit one million customers within weeks.

Anne Boden, founder and chief executive of Starling Bank, said: “We’ve come a long way since Merian Global Investors’ first investment of £50m earlier this year, adding new products and features and accelerating our rate of customer acquisition.

“This latest investment of £20m from Merian Chrysalis will support Starling’s rapid growth and help us reach one million customers and £1bn on deposit within weeks. It will also help us accelerate our global expansion, starting in Europe, so that even more people can benefit from the Starling app.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataRichard Watts, co-portfolio manager of Merian Chrysalis, added: “Starling is already proving to be a disruptive force in the banking industry, with its efficient, user-friendly platform gaining popularity among digitally savvy consumers and businesses. The new capital secured in this funding round will allow its management team to pursue its ambitious development programme and we’re delighted that we’re able to provide additional backing for this exciting business.”

This latest investment brings total funding raised by Starling to £263m. Merian Global Investors led a funding round in February 2019.

Starling also gained £100m from the Capabilities and Innovation Fund in the same month. Starling is using the CIF award to continue the expansion of its SME account.

Starling is not the only UK digital challenger raising money. Digital bank Tide has raised £44.4m ($54.3m) in a first-round of Series B funding led by specialist fintech investors.

The funding was led by the SBI Group and Augmentum Fintech plc to help Tide increase its shares. Tide hopes to increase its share of the UK business banking market, and expand internationally.