Payments platform, PPRO, has partnered with Block’s BNPL provider, Afterpay. The companies reference record high BNPL usage in the US. On Cyber Monday 2023, BNPL usage soared to an all-time high, increasing by 42.5% from the previous year. In addition, they reference merchants benefitting from increased average order value since consumers can spread the cost of their purchases over time.

BNPL: a no-brainer for merchants

Eelco Dettingmeijer, Chief Commercial Officer, PPRO, said: “With the popularity of BNPL in the US expected to increase, offering it at checkout is a no-brainer for merchants looking to sell to US consumers. Now merchants from the US, Europe, China, and Hong Kong, can tap into Afterpay’s platform and provide flexible payment options, which will attract more consumers and boost sales.”

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Afterpay is currently available in Australia, Canada, New Zealand, the US and the UK, where it is branded as Clearpay.

Afterpay pulled the plug on its BNPL operations in Spain, France and Italy last year. Block Head Jack Dorsey told analysts: “These required significant investment. The markets have not seen the growth and profitability we had expected over the past several years.”

Block share price woes

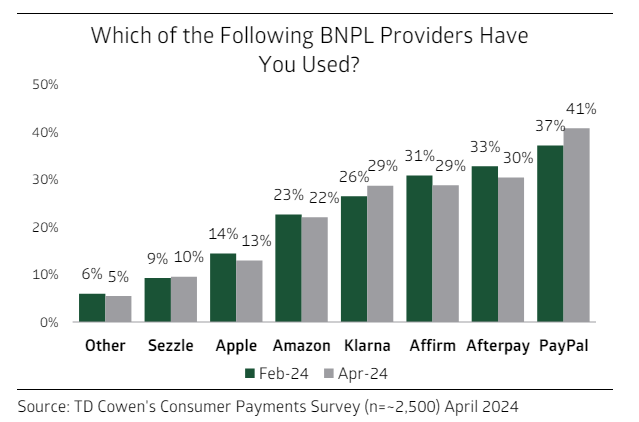

Afterpay continues to outperform Sezzle, Klarna and Affirm in the US in terms of usage. In TD Cowen’s Consumer Payments Survey, Afterpay ranks second, just behind PayPal (see table). However, Block grossly overpaid for the perennially loss-making Afterpay. In August 2021, it announced the deal to snap up Afterpay for a whopping $29bn. By the time the deal closed, the Block share price had fallen to the extent that the Afterpay acquisition was valued at $13.9bn. Block’s share price is down by 7% for the year to date. Since August 2021, the Block share price has fallen by 75%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCFPB ramps up BNPL scrutiny

Earlier this week, the CFPB announced its much forecast regulatory crackdown on the BNPL sector in the US. The CFPB proposes that BNPL lenders must provide consumers some key legal protections and rights that apply to conventional credit cards. In a market report, the CFPB revealed that over 13% of BNPL transactions involved a return or dispute. In 2021, people disputed or returned $1.8bn in transactions at five firms surveyed.

Moreover, further regulatory scrutiny of the sector is forecast. Erin Bryan, of international law firm Dorsey & Whitney told RBI: “This is just the beginning of the CFPB’s regulation of the BNPL industry.”