Driven by the prospect of higher interest rates and lower fees, new customers continue to flock to online-only direct banks. For the most part, the direct banks delivered on their end of the bargain. However, struggles with customer service and timely problem resolution dragged down overall satisfaction scores in the 8th annual JD Power US Direct Banking Satisfaction Study.

“Customers of online-only direct banks have higher levels of satisfaction than customers of traditional banks. But satisfaction among direct bank customers declined this year. This is particularly the case with checking accounts,” said Paul McAdam, senior director banking and payments intelligence, JD Power.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

“Despite significant increases in deposit interest rates for both checking and savings accounts—but decreases in the proportion of customers who had to pay a fee or experienced a problem—overall satisfaction still declined. That’s because customers who experienced problems had a very tough time resolving them in a timely manner. This causes satisfaction with the ease of problem resolution to decline sharply.”

JD Power 2024 US Direct Banking Satisfaction Study key findings

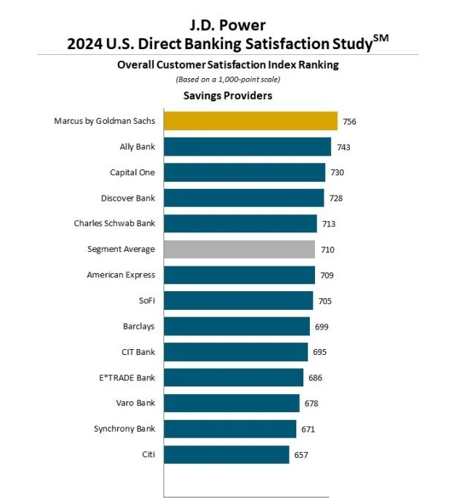

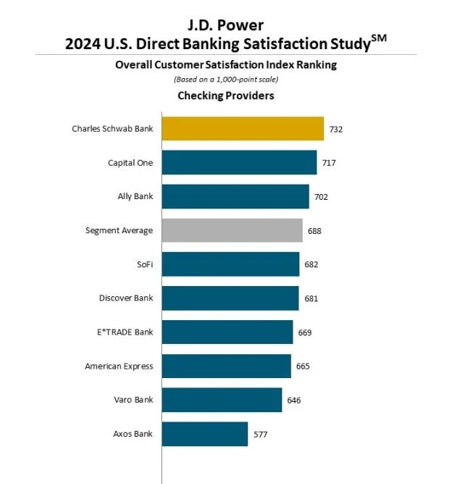

Satisfaction declines year over year, but the scores are still higher than traditional banks. The overall customer satisfaction score for direct bank current accounts is 688 (on a 1,000-point scale). This is down 27 points from 2023. Overall satisfaction for direct bank savings accounts is 710, down 8 points from 2023.

Problem resolution is dragging down customer satisfaction. While fewer problems were cited in this year’s study, the problems customers did experience were more complicated and took longer to resolve. This causes satisfaction with the problem resolution process to fall 67 points. The total amount of time required to resolve a problem grew to 2.6 days in 2024, up from 1.9 days in 2023.

Problems with debit cards and fraud are mounting. The most significant declines in problem resolution satisfaction are focused on problems with debit cards, fraud and unauthorised account activity and problems with interest rate paid on a deposit account. The number of customers indicating that it was convenient to reach and interact with live phone representatives declines 3 percentage points.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMobile apps and websites need a refresh. Use of mobile app and website features also declines this year. Even among customers who have not experienced a problem with their direct bank, the visual appeal, the range of services that can be performed and clarity of information provided via digital channels had significant declines.

Study Rankings

Charles Schwab Bank ranks highest in overall satisfaction among current account providers with a score of 732. This marks the sixth consecutive year of the bank being top ranked in the study. Capital One (717) ranks second and Ally Bank (702) ranks third.

Marcus by Goldman Sachs ranks highest in overall satisfaction among savings providers with a score of 756. Ally Bank (743) ranks second and Capital One (730) ranks third.