Covid-19 will impact the banking sector to varying degrees around the world. Douglas Blakey discusses how consumer lending forecasts require to be amended in a number of major retail banking markets post-Covid

As economic recessions brought about by lockdown measures around the world start to bite, one can expect the banking sector to experience a number of hits.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Net interest margins will remain low and fees and commission income will be under pressure driven by decreased retail spending.

Government support, particularly low-cost funding, as evidenced in most markets will help but ultimately can only mitigate the impact.

For banks, the severity of losses will depend on whether lockdown restrictions on individuals and businesses can be lifted without a resurgence in cases, or whether businesses will be forced to declare bankruptcy and borrowers will default on their loans.

The mortgage sector in the US is already under pressure. With tightened mortgage requirements, and the practical difficulties of viewing properties, new mortgage applications declined by 3.9% in the week ending 29 May compared to the previous week.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData, publishers of RBI, have revised its 2020 growth forecast for US mortgage balances to -0.9%, compared with the previous forecast of 3.0%.

US: credit card balances to decline by 3.2% in 2020

Approvals for new loans have tightened as banks’ liquidity has been stretched. Despite low credit rates, personal loan applications are down due to stringent lending conditions combined with cautious consumer behaviour about taking on additional liabilities due to the economic uncertainty.

While there will be a rise in credit card transactions and a decline in cash usage, growth will be hampered by an overall decline in consumer spending. It is now forecast that credit card balances will decline by 3.2% in 2020, instead of previously estimated growth of +5.5%.

On the flipside, retail deposits will benefit from a flight to safety. We now predict that balances will grow by 8% in 2020, compared to a previous forecast of 3.7%.

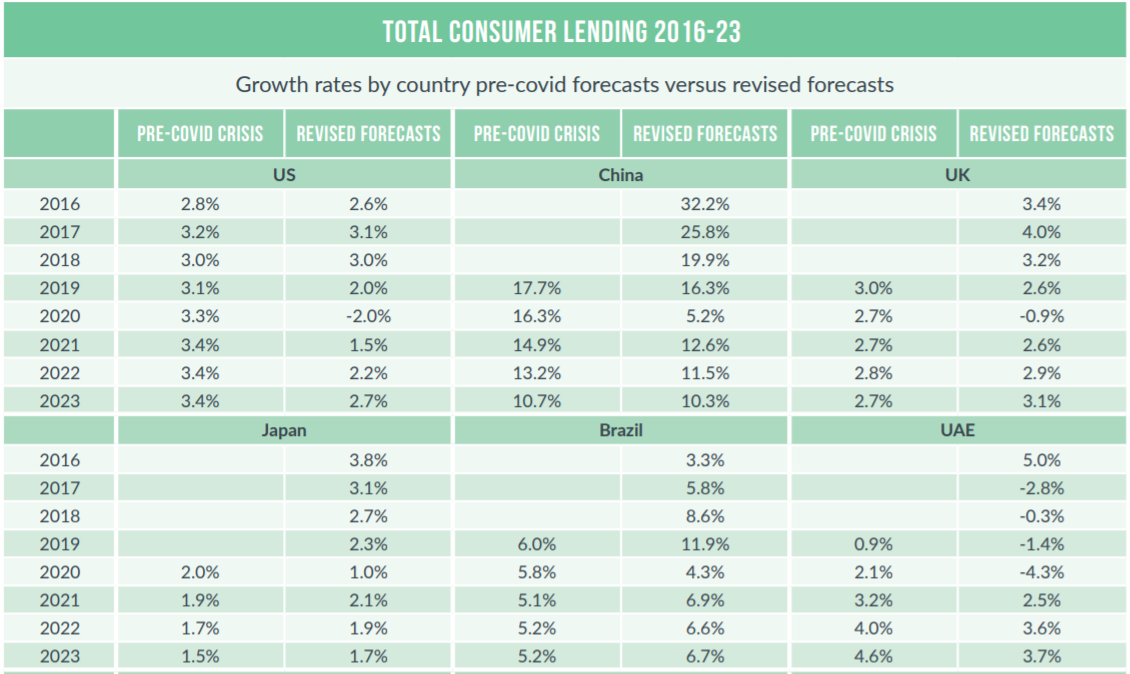

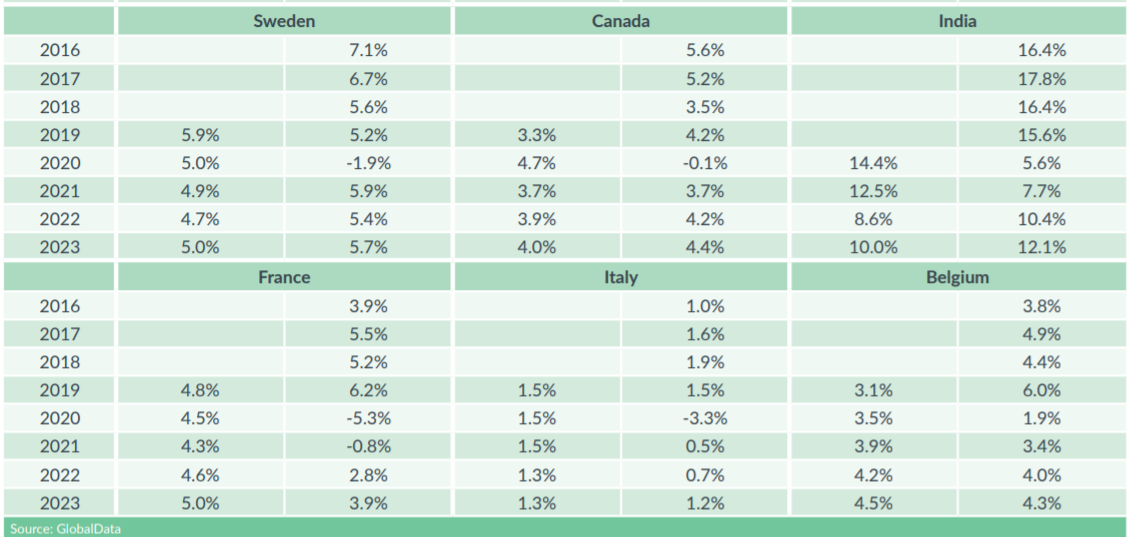

Total consumer lending in 2020 is forecast to fall by 2.0% instead of pre-covid growth of 3.3%.

China: huge liquidity injections

The jury remains out regarding the effectiveness of the central bank’s liquidity as well as interest rate cuts. There are however early signs of a quick recovery in residential mortgage lending.

According to the National Bureau of Statistics, the average prices of new homes in 70 major cities increased by 0.5% in April 2020.

On the other hand, lending growth will suffer, despite the Chinese government’s efforts to maintain lending to businesses and households. To regulate the loan market, the China Banking and Insurance Regulatory Commission mandated that online consumer loans without collateral per person cannot exceed CNY200,000 ($28,723). Furthermore, the term of the loans cannot be more than one year and any loan provided cannot be used for investment in riskier assets including property, stocks, bonds, other asset management products, or immoveable assets.

The overall decline in consumer spending will be partially offset by a rise in online spending, as wary consumers stay at home and use online channels to purchase goods and other essentials. While there will be a rise in credit card transactions at the cost of a decline in cash, the growth will be hampered by an overall decline in consumer spending.

Pre-crisis, total consumer lending was forecast to grow in 2020 by 16.3%. That is now revised to a much-reduced growth of 6.2% for 2020 (see table).

The crisis will impact retail deposits more modestly than in some markets. Retail deposits in 2020 are now expected to rise by 11.5% against a pre-Covid forecast of 9.5% growth.

UK: credit card spending under pressure

In the UK, mortgage payment holidays will support outstanding balances in the short term, as banks are offering relief on mortgage payments for up to six months.

Personal loan applications will see a drop as consumers become more cautious in taking additional liabilities due to the economic uncertainty.

However, the pandemic is making UK consumers more comfortable with digital banking channels, and emerging digital-only challenger banks will benefit. Reduced economic activity is already showing their impact on credit card spending.

The pandemic is set to hamper growth and will cause a shift in consumer spending behaviour as wary customers cut down on purchases of non-essential items. Moreover, increasing unemployment and reduced consumer spending will impact the ability and desire of consumers to purchase goods on credit.

Hence, credit card balances are expected to grow by only 1.1% against the previous forecast of 3.4%. However, card usage is expected to recover once the lockdown is lifted.

Total consumer lending in 2020 is now forecast to fall by 0.9% against pre-covid forecasts of +2.7%.

Retail deposits are set to benefit from a flight to safety. GlobalData now forecast that retail deposits will grow by 5.0% as investors shift away from risk assets. The corresponding pre-Covid estimate was for deposit growth of 3.7% in 2020.

Japan: decline in consumer lending to be short-lived

GlobalData now forecast mortgage balance growth of 1.2% in 2020, revised down from a previous forecast of 2.0% growth pre-the pandemic.

Covid-19 will see a significant drawdown of existing credit lines. Total consumer loans growth will be lower than previously forecast in 2020 as consumers cut back on discretionary spending and become more cautious about taking on additional lending. In 2020 total consumer loans are now forecast to rise by 1.0% instead of 2.0%. However, the growth in lending will recover to match pre-Covid estimates by 2021.

Card issuers stand to benefit from the surge in e-commerce, as Japanese consumers switch to using cards online.

Retail deposits are set to benefit from a flight to safety. An increase of 2.2% in retail deposits is now forecast in 2020, as opposed to a 0.3% decline initially forecast before the onset of Covid.

Brazil: reward programmes encourage increased card usage

Covid-19 has effectively brought new Brazilian mortgage lending to a halt. Local banks are offering deferrals on loan repayments, providing some relief to borrowers. Mortgage balances are now forecast to grow at an annual rate of 2.8% in 2020, compared with a previous forecast of 5.1%.

Card issuers are adapting their reward programmes to encourage increased card spending online. On 26 March Santander announced it would offer double reward points on online purchase made via its cards. The bank also announced a 12% discount on online purchases of medicines via its cards. Caixa reduced the interest rate on credit card instalments from an average of 7.7% to 2.9%.

While credit card transactions will rise at the expense of cash, growth will be hampered by an overall decline in consumer spending. To reflect this, GlobalData has revised its forecasts for credit card balances for the next four years, anticipating a reduction in growth for 2020 followed by a recovery from 2021 onwards. In 2020, total consumer lending is estimated to grow by 4.3% instead of 5.8% forecast prior to the pandmemic.

Meantime, retail deposits are forecast to grow by 14.4% in 2020 against a pre-Covid estimate of 3.9%.

UAE: partial lending recovery in 2021

Leading local banks including Emirates NBD, Dubai Islamic Bank, Emirates Islamic Bank, Mashreq, and Commercial Bank of Dubai have rolled out various relief measures for customers affected by the crisis. Some of these include interest-free instalment plans for purchases with no processing fees for up to six months and 50% discounts on cash advances via credit cards. But as in other markets, overall credit card spending will shrink in the short term.

In 2020, total consumer lending is now forecast to decline by 4.3%, compared to a pre-crisis estimate of +2.1%. By 2021, the market will largely recover with consumer lending estimated to return to growth of 2.5% against a pre-Covid forecast of +3.2%.

Retail deposits are set to benefit from the same flight to safety, again as in other markets. Growth of retail deposits of 10.4% in 2020 is the revised forecast compared with a pre-Covid estimate of +4.5%.

Sweden: consumer lending to return to normal in 2021

Sweden has ploughed a lone furrow in Europe by eschewing a general lockdown. Gatherings of over 50 people were discouraged but bars and restaurants remained open.

Although there will be an overall rise in credit card transactions in 2020, the pandemic is set to hamper growth and will cause a shift in consumer spending behaviour. For 2020 credit card balances are now forecast to decline by -3.5% in 2020, compared to the previous estimate of +0.9%.

Total consumer lending is now forecast to decline by 1.9% in 2020 compared with pre-Covid estimates of growth of 5.0%.

The relatively stable deposit holdings of Swedes are expected to grow at a slightly faster rate in 2020 than previously forecast as investors prioritise wealth conservation in light of the volatile securities markets.

Specifically, retail deposits are forecast to grow by 6.2% in 2020 against a pre-Covid forecast of +5.9%.

Canada: retail deposits to grow by double digits in 2020

With consumer income shrinking thus reducing purchasing power, along with tightened mortgage requirements, new mortgage applications will drop. To reflect this, GlobalData has revised its forecasts for mortgage balances, now expected to grow by 1.2% in 2020, compared with the previous forecast of 4.7%.

The overall decline in consumer spending will be partially offset by a rise in online spending.

To ease the debt burden and help customers who are struggling to pay their bills, Royal Bank of Canada reduced credit card interest rates by 50% for customers affected by Coronavirus, effective from 6 April.

Similarly, Bank of Montreal temporarily reduced credit card interest rates to 10.99% for personal and small business customers. Therefore, credit card balances are now forecast to decline by 2.2% in 2020, compared to the previous estimate of 4.5% growth.

Total consumer lending in 2020 is now estimated to decline by 0.1% in 2020 against a pre-crisis forecast of 4.7% growth.

Retail deposits are forecast to surge as consumers go into capital preservation mode during the crisis. We estimate deposit growth of 12.1% in 2020 in a flight to safety compared with pre-Covid estimates of 4.3% growth.

India: consumer lending growth to halve in 2020

India’s mortgage market is experiencing mounting pressure on supply and demand. Weak consumer demand combined with rising uncertainty over credit availability results in revised mortgage balance forecasts. Growth of 6.8% is now estimated for 2020 compared with the previous forecast of 17.4%.

Total consumer lending in 2020 is now forecast to rise by 5.6% against a previous estimate of 14.4% growth.

The overall decline in consumer spending will partially be offset by a rise in online spending. GlobalData now forecast credit card balances to grow by 11.7% in 2020, against a pre-Covid estimate of 20.8%. Retail deposits are now forecast to grow by 12.5% in 2020 up from a previous estimate of 4.3%.

France: consumer lending to decline in 2020, 2021

As in other markets, there will be a rise in credit card transactions, but this growth will be hampered by an overall decline in consumer spending. To reflect this, GlobalData has revised its forecasts for credit card balances to decline by 1.5% in 2020, against the previous estimate of 4.0% growth.

Meantime, retail deposits are forecast to grow by 5.3% in 2020 as opposed to 3.6% forecast initially before the onset of Covid.

Total consumer lending is now forecast to decline by 5.3% and 0.8% in 2020 and 2021 respectively. This compares to pre-Covid estimates of +4.5% and +4.3% in 2020 and 2021.

Italy: sharp fall in consumer lending

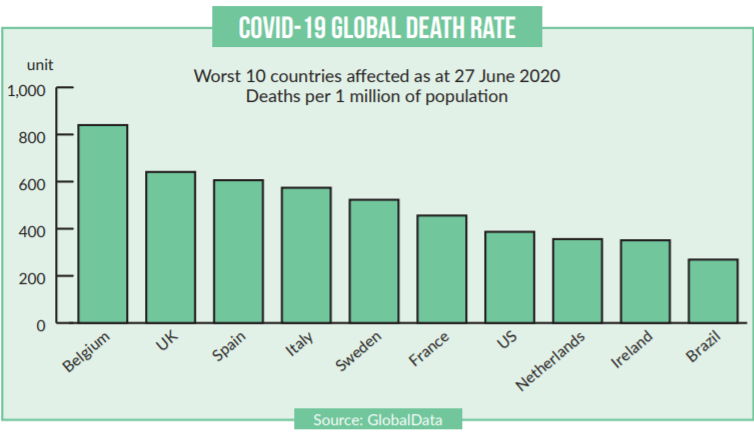

Italy is among the worst affected countries by the pandemic. As of 27 June, the Italian death toll has risen to almost 35,000, only exceeded by Brazil, the UK and US.

The imposition of a strict lockdown brought the Italian economy to a near standstill.

GlobalData has revised its forecasts for mortgage balances as they are expected to decline at an annual rate of 3.1% in 2020, compared with the previous forecast growth of 1.0%.

Total consumer loans are estimated to decline by 3.3% in 2020 against previous forecast growth of 1.5%.

Retail deposits are forecast to grow by 5.1% in 2020 compared with a previous estimate of 1.4% growth.

Belgium: sharp drop in credit card balances

Belgium is taking quite a hit and has the regrettable distinction of the highest death rate per head of population (see table) with 840 deaths/1million population as of 27 June.

On the other hand, Belgian banks have good capital buffers to cushion against the potential longer-term impact of Covid.

Less positive metrics include disruption to the local credit card sector. Credit card balances are expected to decline by 4.8% 2020, compared to the previously forecast growth of 11.1%. This steep decline in performance for 2020 will gradually recover by 2023.

In 2020, total consumer lending is now forecast to 1.9% against pre-Covid forecasts of a rise of 3.5%. Meantime, retail deposits are expected to grow by 7.3% in 2020, compared with a pre-Covid forecast of +2.7%.