CBA has revealed a series of innovations and technological advances designed to improve personalisation. The bank said that it is updating its strategy to reimagine the banking experience for retail and business customers.

According to CBA CEO Matt Comyn, CommBank’s app 5.0 will deliver individually tailored content. New dynamic navigation will make it simpler, better and easier for its 7.7 million users.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

CommSec share trading through CBA app 5.0

Customers will be able to buy, sell and hold Australian shares and exchange traded funds through the app from next month. This will be available to CBA retail customers and existing customers of online broker, CommSec.

Around one in five CBA customers have a CommSec account. CBA research has shown that 45% of customers would value the opportunity to invest in the stock market through their banking app. CommSec has seen an inflow of more than one million new customers over the past three years.

“CommSec share trading through the CommBank app is a distinct proposition not offered by any other bank in Australia.”

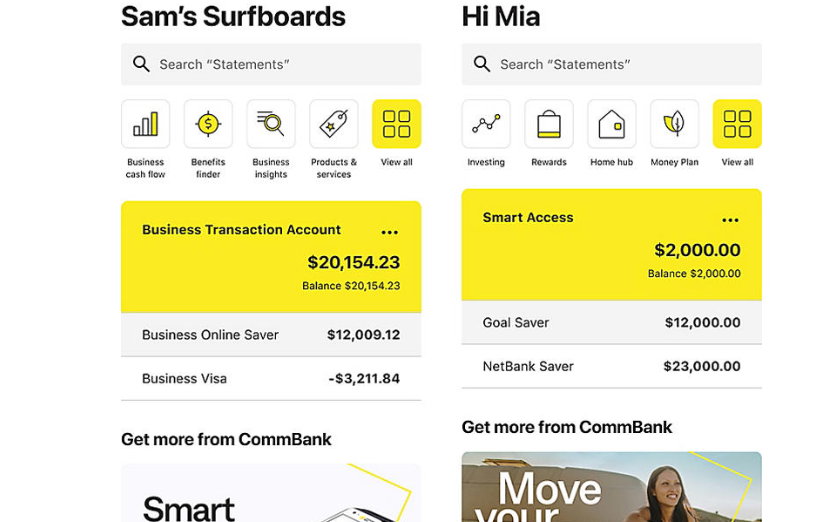

Meantime, new functionality will enable business customers to switch between their personal and business accounts.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“As the trusted partner of one in three Australians and a quarter of all businesses, our strategic approach to building tomorrow’s bank today is clearly focused on supporting, strengthening and deepening the relationships with all of our customers,” said Comyn.

He said that the app utilises AI and builds on the bank’s digital investments in recent years.

“We are now able to better understand the needs of our 8.3 million digitally active customers. We will deliver more tailored and relevant services, and offer more choices and highly-differentiated benefits than ever before.”

CBA currently uses predictive artificial intelligence. This is primarily utilised through the bank’s Customer Engagement Engine (CEE). Launched in 2016, CEE now utilises approximately 1,000 machine learning models and 157 billion data points in real-time to improve the customer experience.

CBA teamed up with Silicon Valley-based H2O.ai two years ago. With H20.ai, CBA is exploring and building out capability to experiment with new generative technologies. CBA says this results in more personalised customer offerings, such as the benefits finder service and improved fraud and scam detection systems.

“The combination of CommBank’s Customer Engagement Engine and the relationship with H2O.ai is a great example of the way we are using artificial intelligence to create richer, deeper and more personalised experiences for our customers,” added Comyn.

CBA app 5.0 – offering business customer account switching

Launching next month, the app’s 7.7 million active customers will be presented with an individually tailored home-screen, services and product information when logging on, compared with the current version. On average, customers accessing the app make combined payments of C$63bn a month. CBA says it will be easier to make transactions, book appointments, find and access services, and utilise money management tools.

CBA has 800,000 business banking customers who are active users of the app. They will now be able to switch seamlessly from their business accounts to their personal ones. The challenge of account switching is one of the main friction points for business customers. CBA says that the change allows customers to better manage their personal and business lives.