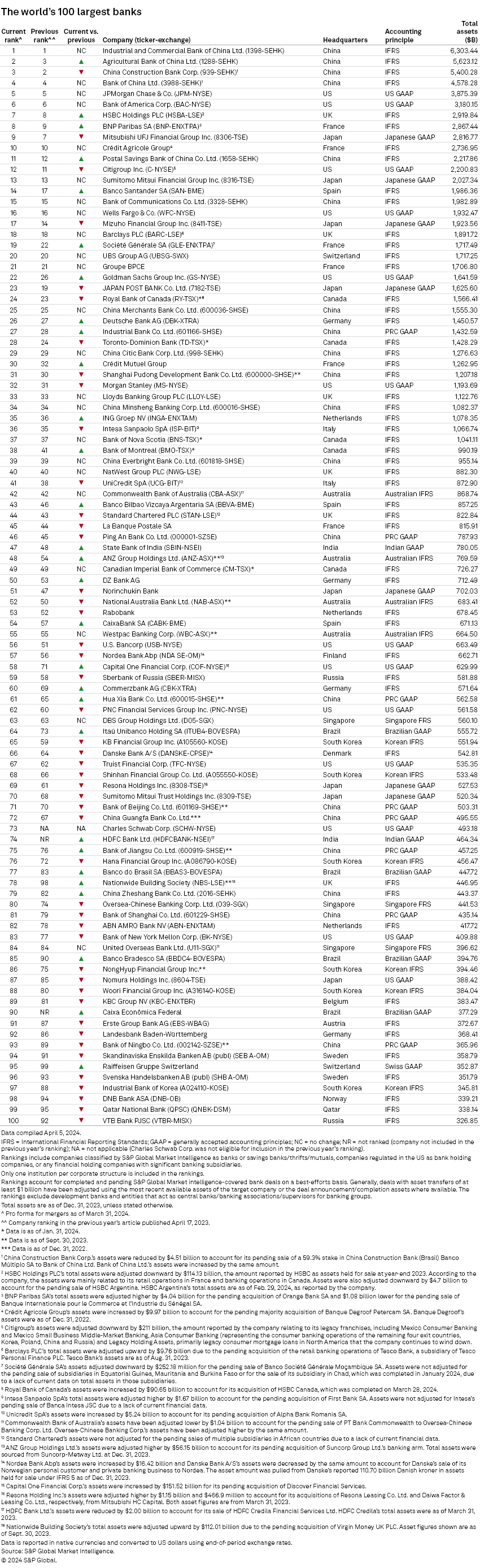

Chinese banks maintain their dominance in the global largest lender rankings of 2023. This is despite a downturn in the property sector, according to the Global Bank Ranking published by S&P Global Market Intelligence, an annual ranking of the 100 largest banks in the world by total assets.

Chinese banks retain 20 positions in the ranking, including the top four. This showcases the continued strength of China’s banking sector. Industrial and Commercial Bank of China remains the world’s largest bank, with assets of $6.3trn. Agricultural Bank of China surpasses China Construction Bank to claim second place, with 14.5% loan growth in 2023.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

This is driven by a national strategy to bolster the agricultural sector. It is the only change to the top six spots from a year ago.

“Elevated inflation and higher interest rates served as headwinds to global economic growth and the commercial real estate sector. Despite a downturn in the property sector, Chinese banks retained their place as the largest in the world,” says Nathan Stovall, director of financial institutions research at S&P Global Market Intelligence.

47 banks fall in the ranking, 29 rise and 24 maintain their positions

“Loan growth slowed as borrower demand waned in the face of higher interest rates, while banks tightened the reins on new originations in the face of liquidity pressures and concerns over future credit losses,” Stovall adds.

In the Asia-Pacific region, seven of the eight Japanese banks on the list decline in the ranking. The exception is Sumitomo Mitsui Financial Group, which maintains its place at 13. India-based HDFC Bank enters the list at 74, following a merger with its parent company, driving its assets to $464.3bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataJPMorgan Chase remains 5th largest

Among US banks, JPMorgan Chase, with assets of $3.9trn, remains the fifth-largest bank in the world, followed by Bank of America. Meanwhile, Citigroup dips one place to 12th as it continues to sell non-core assets as part of a restructuring.

European banks also experience weaker loan growth in 2023. Some of the biggest banks in Europe shed assets in 2023 and continue to do so in 2024. UK-headquartered HSBC—the seventh largest bank in the world—sold its Canadian operations and its retail business in France. It also agreed to sell its Argentine business. France-based Société Générale rises to 19th place from 22nd last year despite selling some businesses in Africa and mulling sales of other assets.