How Sanctions Impact Russia’s Banking Sector & Tinkoff’s bank Future

Russia’s largest lender Sberbank shares are down 50.4% hitting its lowest price in six years, while VTB shares dived by 51.6%, to an all-time low. And that is just for the week commencing 21 February, the week of the Russian invasion of Ukraine.

Sanctions Impact Russia’s Banking Sector & Tinkoff’s bank Future |

Meantime, Tinkoff’s London listed shares are down by 43%; indeed the Tinkoff share price is down by 61% since peaking last November, for a current market cap of $7.2bn. Founded in 2006 by Russian entrepreneur Oleg Tinkov and listed on the London Stock Exchange, Tinkoff Bank has been one of the shining stars of global digital banking in 2024.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

It is a rare reverse for Tinkoff Bank and Oleg Tinkov; his personal wealth is down by an estimated $2bn. It caps a bad four months for Tinkov. Specifically, last October he was sentenced by the US for a tax conviction arising from a scheme to evade tax while renouncing his US citizenship.

The Tinkov plea deal cost him $508.9m, more than double the sum he had sought to evade and that was due to the US Treasury.

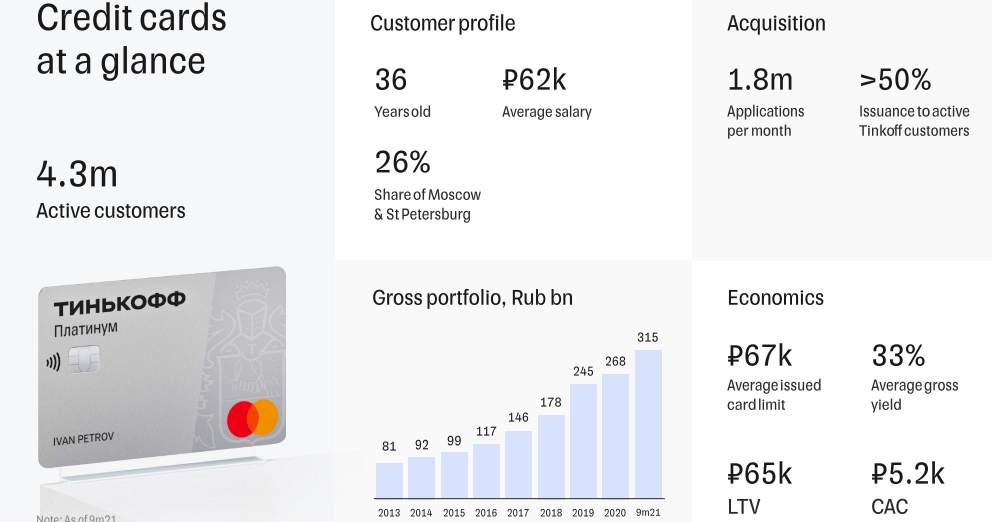

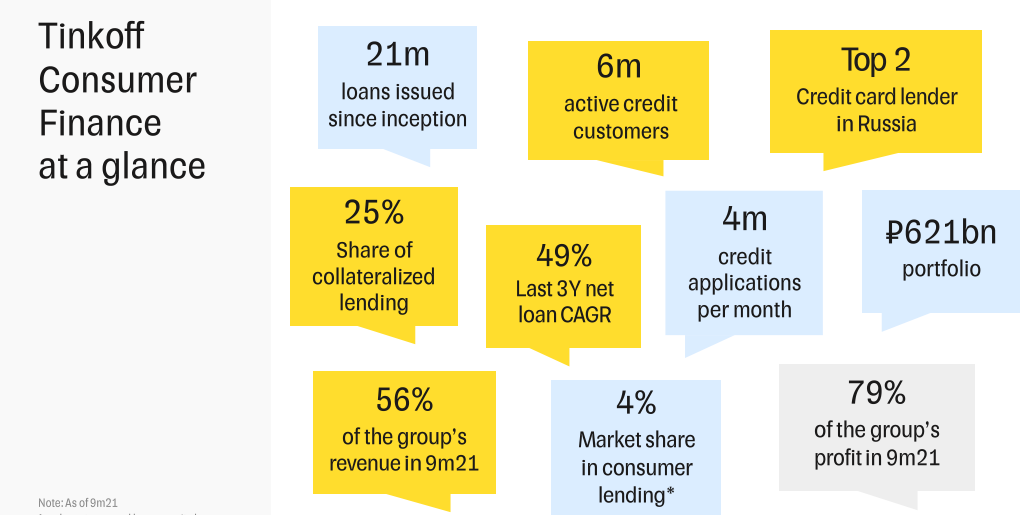

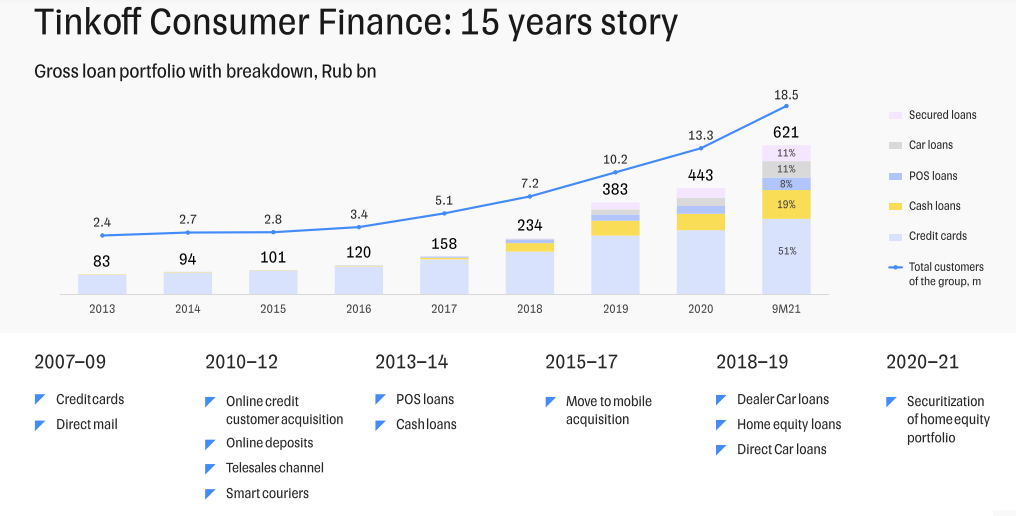

Until now, Tinkoff Bank has been one of the standout stars of global digital banking. A genuinely innovative and successful provider of online retail financial services. It includes Tinkoff Bank, mobile virtual network operator Tinkoff Mobile, Tinkoff Insurance, management company Tinkoff Capital, Tinkoff Software DC, a network of development hubs in major Russian cities, and Tinkoff Education.

The Group is currently developing the Tinkoff ecosystem, which offers financial and lifestyle services.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMoreover, Tinkoff Bank is one of the few start-up digital neobank challengers actually making a profit. That all resulted in a deserved win for Tinkoff Bank as RBI’s European Retail Bank of the Year at RBI’s 2020 global awards.

As recently as 16 February, Tinkoff claimed another Russian first, with the launch of digital mortgage loans with the process taking place entirely online, from paperwork to credit issuance.

Tinkoff’s plans to offer mortgage loan refinancing to all Tinkoff customers by the end of Q1 2022 now appears ambitious. The same is true of its plans to start issuing mortgage loans for housing in the primary and secondary markets by the end of this year.

Tinkoff international expansion?

Only last December, George Chesakov, Tinkoff’s International Expansion Lead, gave RBI a video interview to discuss why it is now the perfect time for Tinkoff to launch internationally.

Tinkoff has set aside $200m to lay the foundation for ambitious international expansion plans.

Tinkoff applied for a banking licence in the Philippines in October and is exploring potential launches in the future into African and South American markets.

Russia is the second largest user of SWIFT, after the US. Banning Russian lenders from SWIFT is a welcome and serious blow to the Russian government as no debt or trade finance payments can now be made by sanctioned Russian firms.

Tinkoff at home: a collapsing rouble and a shrinking consumer market

Until and unless Russia sees sense and can be permitted back into SWIFT, Russian lenders can forget about international expansion.

Closer to home, Tinkoff faces challenges from the inevitable collapse in the price of the rouble. The local consumer market will shrink. Goods will not be imported easily as Russian importers will find it harder to pay for them. Expect to see a slowdown in growth, if not a material reverse in Tinkoff’s domestic metrics.

More coverage of the Ukraine invasion from RBI sister title Investment Monitor:

- ‘Who’s going to travel here or invest now?’: The impact of the Ukraine crisis

- What impact will the Ukraine invasion have on wheat prices?

- Tax havens blur who Russia’s allies are when it comes to investment

- Germany’s stance on Ukraine-Russia dispute isn’t just about gas

- Ukraine: an FDI snapshot