Ualá is casting a wide net at home and abroad with compatriot Wilobank’s game-changing acquisition significantly scaling up its business and aggressive plans to grow in Mexico and Colombia set to boost its fortunes, reports Ivan Castano

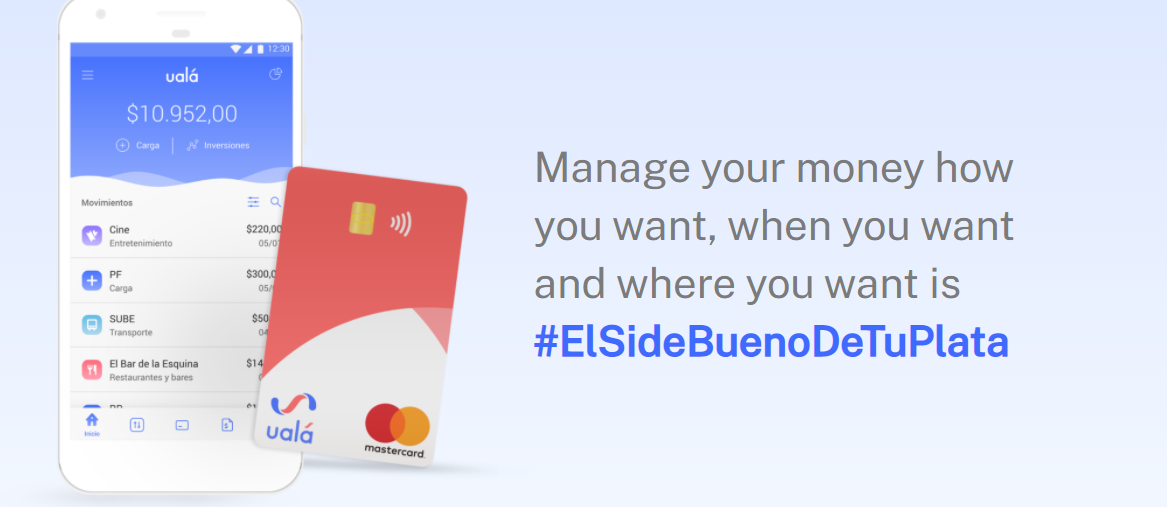

Borrowing its name from the Spanish version of the fabled French ‘Voila’ [which has multiple meanings but can mostly signify ‘here I am’ or ‘there you have it’], Argentina’s new fintech darling is set to offer a suite of a-la-carte banking services to nearly three million digital wallet customers after acquiring Wilobank for an undisclosed sum in April.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Struggling Wilobank, the only Argentinian digital bank with a banking licence, had 240,000 savings account customers and 170,000 debit and credit cards in circulation before the acquisition. Ualá will now absorb those clients, enabling it to offer a plethora of services traditionally reserved for incumbent banks such as checking and savings accounts, loans, investments and insurance products among others.

“They have been operating as a prepaid card and wallet but now they have the possibility to offer credit and debit cards, fixed savings accounts and even manage pension and welfare payments for Argentine retirees,” says Ignacio Carballo, a fintech consultant and professor in Buenos Aires.

Adding Wilobank to its growing asset portfolio, Uala’s founder and CEO Pierpaolo Barbieri will deal a fresh blow to Mercado Pago, the financing arm of compatriot online marketplace Mercado Libre. Present in 18 Latin American countries, New York-traded ML is worth $76.4bn. It is owned by Argentina’s richest man Marcos Galperin.

Financial inclusion

Armed with $150m in fresh funding valuing its enterprise at nearly $1bn, Uala is ready to take on Latin America’s hugely unbanked market. It’s a promising space. Roughly 50% of Argentines, for instance, have bank accounts while that number falls sharply to 39% in both Mexico and Colombia.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Mercado Pago does not have a banking licence in Argentina like it does in Brazil [which it recently obtained to boost its foothold there], so it cannot offer the same banking products Uala will have,” adds Carballo, confirming that Wilobank’s purchase will give the startup a big edge over MP and smaller Argentine players Brubank, Apperto or Ripio.

The two rivals will also trade punches in Argentina’s new, more inclusive payments network dubbed ‘Transferencias 3.0.’ Here, QR codes will become interoperable and open to all wallet operators, enabling Uala customers to pay at merchants once exclusive to MP (or other providers) and vice versa.

Mexico and Colombia

The thirty-something, Harvard-educated Barbieri has also set his sights on Mexico and Colombia, the region’s other large fintech markets with more mature and flexible regulations than other fertile destinations such as Peru or Chile.

In Mexico, rival Nubank is taking the market by storm. Using the catchphrase ‘Say Nu to the traditional bank,’ the Sao Paulo-based neobank launched its Nu credit card last September, hoping to court credit-starved Mexicans shun by established lenders such as BBVA or Citibanamex.

Nubank has received 1.5 million applications for its Nu card and plans to invest $135 million to grow its Mexican franchise, with much of these funds secured recently from JP Morgan, Goldman Sachs and Bank of America.

Not to stay behind, Uala recently rolled out its namesake debit card and payments wallet, using the marketing banner ‘You use it once, you use it always.’ Customers can swipe the plastic in Mexico’s top retailers including Wal-Mart, Sams Club and convenience-store chain 7 Eleven where they can also top up their balances. The card has zero commissions and has no annual maintenance fee.

Having drawn over 30,000 Mexican customers by press time, Ualá also plans to apply for a Mexican banking licence to offer loans and other traditional banking services to future customers, analysts reveal.

Video from youtube to embed from Ualá Mexico

Increasingly congested market

That segment is already becoming crowded with competitors, notably Hey Banco, a spinoff of leading bank Banregio.

Hey Banco provides mobile checking and savings accounts, a Hey Visa credit card and investment and insurance products among other services.

“Hey Banco can provide financial products and interest on deposits which no neobank can do in Mexico,” says Mexican fintech consultant Thiago Pavia, adding that Banregio’s deep pockets and established network are helping it expand and acquire customers more quickly than other neobanks.

Banorte, one of Mexico’s largest banks, is also jumping into the fray, teaming with Colombian delivery app Rappi to offer a credit and debit card called RappiCard, which provides cash back and interest–free payment installments for purchases. It also offers credit ranging from $150 to $300 for new customers looking to build up their credit.

Banorte and RappiCard are also reportedly working to rollout their own digital bank, analysts say.

The stakes are also high in Colombia where Uala is also planning an aggressive incursion. To wit, it recently applied and is expected to obtain a banking licence in the South American country where it intends to eventually offer loans. Roughly 78 percent of Colombians can’t access credit.

“If they want to compete with Mercado Pago [which has also already obtained such a licence], they will have to come in with a multi-product offer,” says Edwin Zacipa, co-founder of Colombia’s Fintech Association.

Regulators in capital Bogota will likely grant Uala its licence as they are open to boosting competition in the banking sector, long known for high fees, head-banging bureaucracy and poor customer service, says Zacipa.

Currently, a banking license costs $2m to $3m, depending on the scope of services to be offered, according Zacipa.

‘Purple Future’

Nubank is also targeting Colombia. In September, it rolled out its purple-coloured Nu Mastercard with the catchphrase ‘Nu Colombia. The Future is Purple.”

The card boasts zero operating and maintenance fees, something incumbent banks such as Davivienda and Bancolombia had never offered but were forced to do so to avoid losing customers. Still, Nu card comes with a 25.8% annual interest rate, matching those rivals’ charges.

“They are not competing with price but through a more unique product experience and easier digital onboarding [as opposed to the bureaucratic applications seen with traditional cards],” Zacipa explains. “They also plan to link with Mastercard and offer loyalty payments and higher benefits” than competitors.

Rappi could become a more formidable competitor for Nubank and Uala in Colombia and even Argentina, where it recently teamed with Brazilian banking major Itau to introduce a digital payments wallet in the third quarter of 2021.

In Colombia, “Rappi already has a Visa credit card” through partner Davivienda, says Zacipa. Dubbed RappiPay, it targets millennial and centennials without credit history, asking for just an ID and minimal data for approval,” he adds.

M&A to rise

Amid an increasingly crowded field, Ualá’s purchase of Wilobank is expected to fuel additional M&A activity, analysts say.

“Fintech is very hot right now and a key growth driver is going to be large corporates buying smaller firms to do a better vertical or horizontal integration of their businesses,” says Zacipa.

Ualá could buy another rival in Mexico or Nubank a fintech in Colombia, he predicts, while Brazil’s StoneCo, backed by Warren Buffett, could also hunt for bolt-on acquisitions.

The region’s first SPAC could also be in the works, according to Zacipa.

“There are many players in Brazil looking to do this so we could have a VC merging with a fintech as the first fintech SPAC in Latin America, he concludes.