Small & Medium Enterprise Banking (SMEB), was founded by UK payment veterans to respond to the rapid reduction in local banking services that has left millions behind.

More than 5,000 bank branches have closed in the past five years, with 400 further closures expected in 2024. In response, SMEB is plotting a physical high street presence. Together with its technology solutions, it says it will provide cost effective and widespread banking to Britain’s 5.5 million SMEs.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

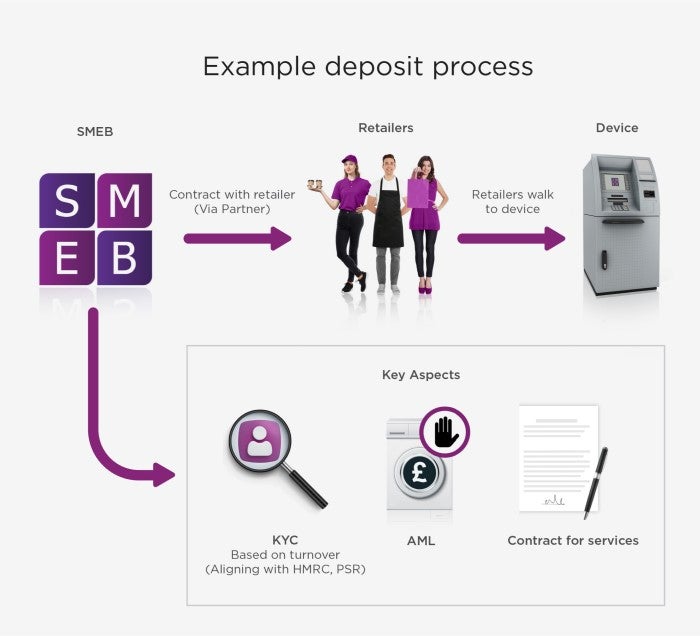

It has now secured critical regulatory approvals and certifications ahead of its planned launch. Specifically, the FCA has approved SMEB as an Approved Payment Institution. That means it can accept cash deposits from UK SMEs.

In addition, SMEB is a principal member with Visa and Mastercard through their licensing programming. This allows SMEB to directly process and accept payments from customers using Visa and Mastercard debit and credit cards-accounting for 99% of debit and credit card payments in the UK.

SMEB has also built connectivity to the UK Open Banking environment and has connection to 3,500 EU Banks for Open Banking services. This means SMEB can offer a full range of bank payments (including cash) and speed up customer sign up.

SMEB cube – financial focal point for the community

SMEB now needs to get its message out. Expect to hear a lot more about the SMEB cube, an innovative solution to replace bank branches. The cube will be located in secure locations in retail stores, council buildings enabling access for SME’s to deposit their funds.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe cubes are safe, reliable and certified by the European Central Bank to check notes for authenticity and fitness. The devices are secure and managed by SMEB’s CIT partner.

SMEB cube initially will be for cash deposits however it plans to upgrade to provide free access to cash and then banking services. In summary, the aim is for the cube to become a financial focal point for the community.

SMEB Pay

This represents the startups Open Banking payment solution. SMEB Pay is regulated by the Financial Conduct Authority as an agent. Payments are guaranteed and will offer customers a range of benefits. SMEB Pay will be supported by major UK-based retail banks, including AIB, Bank of Ireland UK, Lloyds, Bank of Scotland and Halifax, Barclays, HSBC, Nationwide, RBS and NatWest and Santander.

SMEB innovative ATM platform

Meantime, SMEB’s ATM acquiring platform bring together its data centre build with multi-vendor software allowing it to drive ATMs across EU, USA and the Middle East. This is built on its secure communications network providing advanced security.

‘Britain’s SME’s deserve better’: Andrew Martin, CEO, SMEB

SMEB CEO Andrew Martin is a payments veteran with over 30 years of experience in the sector. He highlights just how difficult it is for business owners to start and grow their business and that challenge becomes even harder with the incumbent banks abandoning the high street at scale.

He tells RBI: “Traditional banks have abandoned the high streets at the heart of the British economy. We believe that Britain’s millions of small businesses deserve better.

“We see a gap in in the market and have effectively built a solution that allows SMEs to have the full payment tools. But the bit that makes us unique is we’re also very happy to include cash. So, we will work with SMEs to give them deposit solutions in rural locations. That will mean that they do not have to drive for hours to deposit their cash. And we will give them access to the traditional and modern payment tools such as contactless and e-wallets. We are regulated under the FCA, which allows us to provide the offering in our own right, which means we can onboard SMEs and provide them with the tools. And we will also give them the care and attention from a UK based help desk that will answer their calls 24/7.”

FCA proposals to protect access to cash: ‘good but implementation leaves a bit to be desired’

Martin acknowledges UK government efforts to protect access to cash and says that as a concept it is to be welcomed. There is however, a valid point about the extent of current plans and frustration at the pedestrian rate of banking hub roll-outs.

Says Martin: “I think the implementation leaves a little bit to be desired. The solution that is currently being put into the market is very much based around post offices. And today, we’ve only seen around 37 hubs actually put into operation. So, I think it’s a good initiative, but it lacks the volume commitment to make a difference in the market.”

‘Cash remains an essential element of society’

Martin highlights, correctly, that cash usage in the UK has inched upwards amid the ongoing cost-of-living crisis. There remains a segment of the market that values its privacy and aid as a budgeting tool.

“If you’ve got £50 to last the week, it’s so much easier when it is £50 in your wallet. And that’s money that is spent locally and is then recycled back into the community. There is obviously a fee that the small businesses will pay for the service but our fees will be lower than those charged by a retail bank. We believe it is a compelling argument. But our proposition then goes further. It gives small businesses access to the more modern payments, like open banking and real time payments. We can also give access to an app to support their business with financial planning. The cash element for us is a massive gap in the market at the moment. But it’s all of the other financial tools that we feel will make the SMEs life easier.”

Cube roll-out: ultimate goal is to deploy at scale

The SMEB cube is, says Martin, based around traditional banking technology. He recognises that when somebody wants to deposit cash, it is a personal and private transaction. Accordingly, the cube is not designed to be at the front of a store or through the wall.

“This is very much a private area in a retail store where you can go into an actual room, close the door behind you, and complete the transaction in total privacy. And we will also then be able to provide you with telephony and video support. So, we have designed different sizes of cubes based on the retail premises across the footprint. And our plans are to deploy several thousands of these devices across the UK. Logistically, it is a challenge. The good news is we have the partners in place to support us. The public and small businesses can visit our website to input their postcodes to vote on the areas where they want the cube to appear. It’s the remote areas that we’ll be prioritising first. So northern Wales, northern England, rural Scotland and Northern Ireland has lots of such areas as well.”

The challenge now for SMEB is to get its message out and get cubes up and running. Word of mouth and an effective social media strategy will be crucial.

Open banking: more needed to educate consumers of its benefits

Martin argues that it is an exciting time to come to market but wants all stakeholders to do more to educate consumers about the potential benefits offered by open banking.

“One of the challenges we have is really educating the consumer to understand the benefits of open banking, and how it makes a real time payment a very secure real time payment as well. It has a lot of opportunity but I just feel that we could maybe present it better and educate the public a little bit better and encourage them to embrace the technology.”

SMEB CEO Andrew Martin speaks with RBI editor Douglas Blakey

.