Regions Bank combines a community bank-style approach to its customers, with the range of offerings of a national operator. Robin Arnfield talks to Shawn Bradley, Regions’ head of customer strategies and analytics

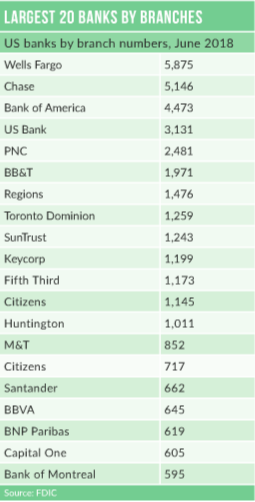

Headquartered in Birmingham, Alabama, Regions operated 1,476 branches and around 2,000 ATMs across the South, Midwest and Texas as of 30 June 2018.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Its parent, Regions Financial Corp., had assets of $125bn as of 30 September 2018. Regions has a “right-sizing” programme for its branches. “We firmly believe in branches, as they are a critical channel for our customers,” says head of customer strategies and analytics Shawn Bradley. “But it’s an important moment for the branch, as customers adopt digital banking.”

Regions has consolidated and pared down branches in markets where it has more branches than needed, or where growth rates do not justify branches. “Due to changing customer behaviours, we no longer need to run branches in close proximity,” notes Bradley. “In the past, we’d have two branches close by, because there were too many transactions for one branch to handle on its own.”

RBI’s in-house research shows that Regions had 1,492 branches in June 2017, down from 1,599 in June 2016, 1,709 in June 2013 and 1,774 in June 2010.

Simplify and grow

Regions’ Simplify and Grow branch programme, which includes deploying “reimagined branches” and a new design format along with branch closures, resulted in $5m in severance and $4m in branch consolidation expenses in the third quarter of 2018.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis followed severance costs of $34m in the second quarter of 2018, and $30m in the third quarter of 2017 relating to Simplify and Grow. Regions has built new branches in markets with economic or population growth.

“In some markets where we are sub-optimally represented, we need to add branches to be relevant and competitive in those locations,” Bradley says. Tampa, Florida, Houston, Texas and Atlanta, Georgia are examples of markets experiencing significant economic and population growth, where Regions is expanding its presence, Bradley says.

“Small business banking is a driver for us,” he says. “Our retail banking channel handles our smallest business segment, firms with revenues of under $1m. That segment comprises the vast majority of our business clients in terms of numbers. One of the benefits of looking at markets with strong economic growth is that there are strong opportunities in the small business banking segment.”

Universal bankers

In early 2018, Regions moved to a universal banker model involving a single job family, instead of its previous model of separate tellers and customer service/sales advisors.

“We see three primary benefits in going to one job family,” says Bradley. “Firstly, hugely improved customer experience and convenience, as they now have one branch associate handling all their needs. The associate can have deeper conversations with clients and work to improve their financial future during every interaction.

“For our associates, there’s now a very tangible, achievable career path through the branch network – each step upwards is related to the step before, but it adds responsibility and sophistication. Previously, if you were a teller, you just handled transactions and you had to switch to a totally different role if you became a customer advisor.”

Bradley says a single job family makes staffing Regions’ branches more efficient and easier. “We just have one job family to fill instead of two,” he says. “It’s easier to hire, train and schedule people, and we can staff at optimal levels at any point in time to drive efficiency and customer service.”

Awards

Regions has garnered accolades from various consultancies. In June 2018, Javelin Strategy & Research designated Regions as a Trust in Banking Leader for the second consecutive year, in a ranking of 17 top US banks. Javelin evaluated the level of trust account-holders reported for each bank or credit union that they identified as their primary financial institution.

In March 2018, for the fifth consecutive year, Regions was listed among the top 10% of the 318 companies across 20 industries listed in the annual Temkin Experience Ratings.

“We do quite well on customer service quality studies from third parties,” says Bradley. “With our universal banker model, customers don’t get passed from one associate to another. One associate can handle all the responsibilities that occur in the branch, and this provides a good experience for all our customers. Our mindset is to be a community bank with a personalised local touch plus a national bank’s product set and skills.”

Regions has trained all its associates to help clients with digital devices. “One of their additional jobs is to be digital ambassadors and to familiarise all of our customers in the various ways they can interact with the bank,” Bradley says.

“We get them to sign up new customers for mobile and digital services, get them a bank card and demonstrate our ATMs and video teller machines [VTMs].”

In October 2018, Regions won the 2018 Financial Capability Innovation Award from US education technology specialist Everfi. “The award recognises Regions’ focus on financial education, the scope and impact of the bank’s efforts to make financial education accessible and available, and the commitment of its associates to deliver these programmes in their communities,” Everfi said.

Working with Everfi, Regions has provided financial education to over 214,000 people – from high-school pupils to college students and adults – since 2011. In the 2017-2018 school year, Regions sponsored digital financial education resources in 154 high schools, and provided 13,400 college students with information to help them understand finances.

It also helped 22,000 adult learners with digital tools and online resources. “Our staff are critical for our customer education and the adoption of all our channels,” says Bradley.

“Our central mission is to improve the financial lives of our customers through education. We leverage our associates inside and outside the branch – for example, at various gatherings – to teach people about financial education and to help customers be better prepared for their future.”

Technology

“We’re constantly looking at new technologies like iPads in our branches, pre-staged mobile ATM transactions, and biometrics for authentication,” says Bradley.

“But we don’t have any of these deployed at the moment. We have deployed image-based deposit-taking ATMs right across our ATM network, and our ATM network usage has grown dramatically with that technology.”

Bradley says that Regions is one of the largest deployers of VTMs in the US. “Our

VTMs are connected to a remote banker,” he says. “That increases the features and

functionality at our ATMs, as you can talk to the agent to order new chequebooks, open new accounts, update your mailing address or get a replacement card.”

Another benefit of VTMs is easier staffing. “We can extend the hours of our remote banking centre via VTMs without leaving the entire branch open,” Bradley says. “So we can serve our clients for a longer window during the day.”

Each VTM is separated from neighbouring VTMs with a divider to ensure privacy, and customers can use the keypad to convey sensitive personal data to the remote agent.

“With the VTMs, a new customer can show their driver’s licence to authenticate themselves, if they don’t have a Regions debit card,” Bradley says.

Regions offers a chat functionality in both automated and human mode. It’s also looking at robo-advisor functionalities, although it has yet to deploy a robo-advisor platform.

Regions is also keeping a close watch on the roll-out of digital standalone banks by traditional banks. “There are a wide variety of different approaches to digital-only standalone banks,” says Bradley.

“Some of the incumbents use their standalone digital banks to test technology, and others just offer savings accounts or asset growth. Some are connected to the parent bank, and others are completely separate, while several – PNC and MUFG Union Bank, for example – are building branches for their digital banks.”

Regions’ short-term objective is to continue to serve its customers through its existing digital and physical channels. “But we’ll continue to evaluate the standalone bank concept,” says Bradley.

Artificial Intelligence

Regions has developed an AI platform that is currently being deployed across all its channels.

“When a customer walks into the branch and they are identified, the AI system crunches over 350 items of data relating to that customer,” says Bradley. “Then, within a few milliseconds, the system gives the associate the most relevant topic to talk to the customer about.”

The AI system is a customer relationshipbuilding tool as well as a sales tool, as it does not just suggest products or services to discuss with a client.

“In the 350 pieces of information, there is life stage data and demographic information,” says Bradley.

“This helps our associates to anticipate what information a customer will need, such as financial education on savings, if we can see that they aren’t saving money. So the associate might say: ‘Have you thought about longterm savings?’ or ‘happy birthday,’ or ‘thanks for being a loyal customer for 10 years.’”

The AI tool also offers help with mortgages and wealth management, for example providing a referral to a wealth manage advisor or a business services advisor.

Branch refurbishment

Regions has a new design format for the branches it is currently building, to demonstrate to customers its brand attributes of being welcoming and innovative.

At the high end, Regions branches have a resemblance to Apple stores because of their use of open space and of glass, as well as their reliance on technology. However, unlike Apple stores, Regions branches do not use white as their colour, and retain the Regions livery.

“We use stone and wood in our branch design to make you feel welcome,” says Bradley. “The glass is designed to make the branch feel non-threatening and very open. We want to have a welcoming feel to avoid alienating our customers. So many banks’ branches are built like fortresses, and many customers talk about getting into a branch but

feeling they can never get out!”

Fintech partnership

‘We’ve been very open to our own fintech development and to partnering with or even

buying fintechs, if they have appropriate offerings to benefit us,” says Bradley.

A key focus for Regions is partnerships with fintechs specialising in various areas of the lending market. “We have done other things with fintechs, but lending is the biggest focus for us in the fintech space,” says Bradley.

Lending technology specialists Regions has partnered with include Avant, which uses AI

to underwrite consumer loans, mortgage and consumer digital lending technology platform provider Lender Price, and small business lending firm Fundation. Regions has also taken an equity stake in Lender Price.