Royal Bank of Canada has developed MyAdvisor, which enables clients to connect at their convenience with live advisers through their channel of choice. Since its launch last year, RBC has seen significant growth in assets under management through the platform. Robin Arnfield reports

MyAdvisor is part of RBC’s strategy of creating a digitally enabled relationship bank.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

This involves integrating digital, physical and advisor capabilities across RBC’s branch network, and enabling clients and staff to interact more seamlessly with RBC’s digital and physical channels, RBC says. MyAdvisor was originally developed with support from BCG Digital Ventures, and refined through RBC’s innovation lab in Toronto.”

Access to experts

MyAdvisor clients are provided with access to a team of financial experts at no additional cost. They choose how they want to receive advice – online, over the phone, by videoconference, or, from April 2018, in person at an RBC Canada branch.

The RBC advisors behind MyAdvisor are trained to work with the financial tools integrated into the online advice platform. Clients can track the progress they are making toward achieving their savings and investment goals, which could be saving for their children’s education or other lifestyle objectives, via MyAdvisor’s interactive dashboard. Clients also have the convenience of signing documents digitally, which enables virtual interaction between clients and advisors.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataClients and advisors see the same information on-screen. Any adjustments made on either side are viewed in real time, as the client and advisor discuss the financial future the client envisages, RBC says. The platform is updated continuously on a bi-weekly basis.

Target segments

“MyAdvisor is aimed at any of our mass retail and mass affluent customer segments,” Richa Hingorani, senior director, digital strategy at RBC Mutual Funds Distribution and RBC Financial Planning tells RBI. “Our initial pilot in early 2017 just offered MyAdvisor to wealthier mass affluent customers who didn’t have a financial advisor.

“But, once we went into pilot, we saw good adoption from the mass affluent segment as they found value in working with an adviser. Then we opened this experience up to younger, mass retail clients and found that they were also getting benefits from MyAdvisor – they were starting to plan for their future and wanting to connect with an advisor.”

Drivers

Canada has a new set of financial regulations – Customer Relationship Model 2 – which require wealth management firms to provide greater transparency about their charges – not just the percentage value of fees, but also their dollar value.

These regulations provided a key driver for introducing MyAdvisor, as it gives clients greater transparency into their investments.

Another driver is the wider change in client preferences for how they interact with financial service providers, for example via digital technology such as smartphones, iPads and laptops. Customers are increasingly busy, especially millennials, so they want the convenience of digital technology for managing their investments, explains Hingorani.

In addition, the wealth management market is experiencing competitive digital disruption due to the advent of fintech companies that offer robo-advisory services in Canada. While there is a clear distinction between self-directed (DIY) investing and full-service advice, these disruptive new entrants are beginning to fill a gap in the space.

Survey

Before launching the pilot in January 2017, RBC carried out a six-month ethnographic survey.

“We wanted to see if our clients were getting value from their end-of-year investor financial statements,” explains Hingorani. “The research showed that clients were willing to pay the fees for their investments if they were justified in terms of the value the clients were receiving.”

She adds that the ethnographic research which led to the creation of the MyAdvisor solution found that, when it comes to solving complex financial needs – especially retirement, clients trust human advisors. Also, the research showed that clients across all segments need help with saving, planning and investing for their financial future.

“Using a ‘build, measure and learn’ approach, we listened to our clients during the pilot, and then nationally launched the platform in Canada,” says Hingorani. “Additionally, we implemented a co-located agile lab that included key stakeholders such as compliance, technology, and human-centred designers to allow us to build new features for our clients. MyAdvisor is released every two weeks with product enhancements and new features.”

She notes that the team worked hard to make sure that all aspects of the bank come together in MyAdvisor – such as compliance, technology, and marketing.

“We work as one team in terms of strategy, marketing and regulatory frameworks. Being the first in RBC with its fast, iterative approach and bi-weekly releases, MyAdvisor is now being leveraged to educate others in the bank on its approach and learnings. The external relationships developed also are helping to pave the road for other ventures in evolving the way we do business.”

Rollout in the branches

In April 2018, RBC plans to roll out MyAdvisor across its branches in Canada to offer in-branch consultations with advisors.

The next step will be to offer MyAdvisor Xpress, a version of the platform with limited advisor functionality, to members of group pension schemes so they can view their defined-contribution pension plans. This will help them see the effect of contributing early on to their pension plans, Hingorani says.

RBC will also offer MyAdvisor Premium to mass affluent clients who already have a financial planner in order to deepen the relationship between the client and the adviser. MyAdvisor Premium will enable these clients to discuss holistic, complex topics like estate and income planning during retirement. In addition, in the future version of MyAdvisor Premium, there are plans to leverage MyAdvisor for high net worth clients.

Benefits

Being able to view the dashboard with their advisor makes clients better informed about their own finances, says Hingorani. They can then discuss the advice they are given by the advisor in a more educated fashion. Also, the adviser can spend more time talking to clients about their advice rather than inputting their data into the system.

When a client first starts to use MyAdvisor, they are sent an invitation to answer a few simple questions in order to generate their financial picture.

Clients are also prompted for an initial consultation with an advisor to help them complete a personalised plan with recommendations on how to achieve their goals. Currently, they can only fulfil the purchase of investments such as mutual funds or savings products when they connect with an advisor.

“As MyAdvisor is made available to branch advisors, they will also be able to identify opportunities and fulfil on other needs including bringing in the right partners to help the clients,” Hingorani says.

The platform includes an AI-based personalisation engine that captures the client’s financial data and sends them personalised automated alerts and updates about how their investments are performing compared to the goals they set. The personalisation engine also reminds them about talking to their advisor regularly, especially as a result of situations such as fluctuations in the market or key life events.

There is no additional fee to the client for using MyAdvisor. They receive the service free of charge as a result of being an RBC investment client, says Hingorani.

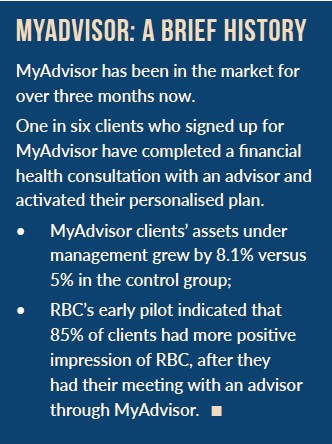

She adds that MyAdvisor is already demonstrating clear benefits to clients. “We’ve found that clients using MyAdvisor have seen their assets grow by 8.1%, compared to a control group of similar clients without MyAdvisor who had growth of 5% – a 60% net increment on the client side,” she says.