Kyndryl MD Ireland Karen Forbes discusses with RBI editor Douglas Blakey the significance of Kyndryl’s collaboration with Permanent TSB, just one of a number of headline-grabbing announcements since Kyndryl became a publicly traded independent outfit

Kyndryl: the world’s largest IT infrastructure services provider

Kyndryl starts life as the world’s largest IT infrastructure services provider-so bigger than DXC, Atos, Fujitsu and Accenture. But the IBM spin-off faces multiple challenges, such as reversing declining revenue and margins. To be fair, Kyndryl CEO Martin Schroeter has not ducked the extent of the challenge the firm faces. Specifically, he told analysts at the firm’s investor day that he does not expect revenue growth until 2025.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

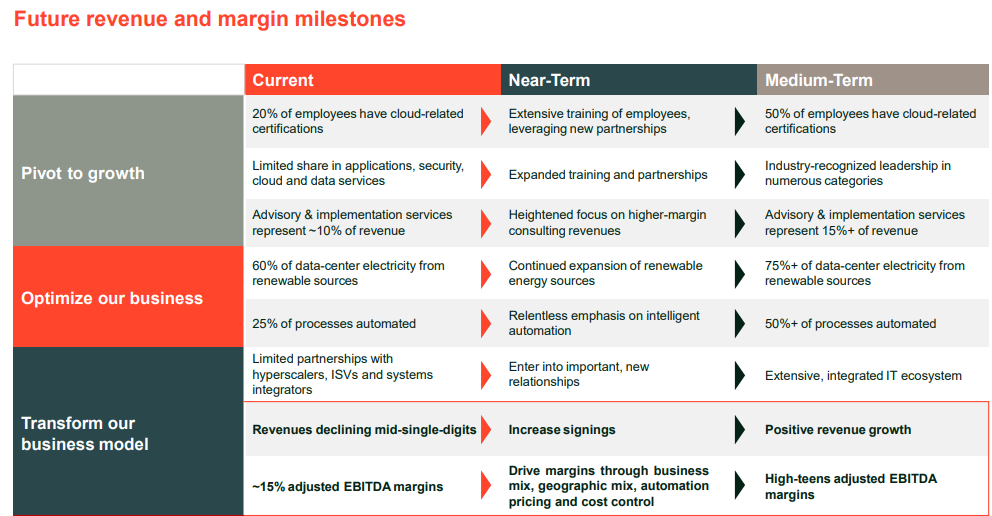

In the interim, senior management aim to transform the Kyndryl business model and it is targeting high-teens adjusted EBITDA margins within four years. The targets are clearly set out, logical and achievable-execution now will be the tricky part.

The firm’s shares began trading on 4 November last year. Kyndryl kicks off with $2bn in cash, $3.2bn of debt and with an incremental credit facility of $3bn.

$175bn: the value of Kyndryl’s new addressable markets

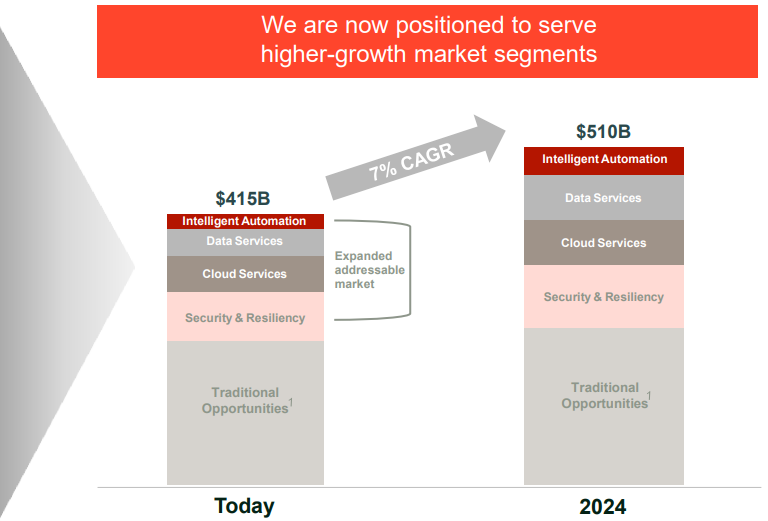

Schroeter has cause to be upbeat about the firm’s new found ability to expand-for example the spin-off unlocks some $175bn in new addressable markets on day one.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn the past four months, there have been a number of significant Kyndryl announcements-the Kyndryl PR and press team have not had a quiet start to life. Just ahead of the spin-off, Kyndryl agreed a €420m deal with Dutch-headquartered ABN AMRO. And since Kyndryl split, it has announced major deals with Microsoft and AWS.

And in February alone, just in the financial services sector, Kyndryl has announced deals with Finland’s Savings Bank Group, Spain’s Kutxabank and Ireland’s Permanent TSB.

Kyndryl IBM spin off at a glance, Microsoft, AWS partnerships

- Distribution of Kyndryl shares completed on 3 November 2021;

- Kyndryl shares began trading on 4 November 2021;

- Kyndryl joined the S&P MidCap 400 Index on 5 November 2021;

- Separation more than doubles Kyndryl’s addressable market from $240bn pre-spin to $510bn by 2024;

- Kyndryl is a partner to over 4,000 blue-chip customers, including 75% of the Fortune 100;

- $19bn in annuity-like annual revenues and investment-grade credit ratings;

- Microsoft and Kyndryl jointly announced a landmark global strategic partnership in service of enterprise customers. The companies will together bring to market state-of-the-art solutions built on the Microsoft Cloud. Microsoft becomes Kyndryl’s premier global alliance partner.

- Kyndryl and AWS agree a strategic partnership; Kyndryl and Amazon will establish a Cloud Center of Excellence to develop joint solutions including services for mission critical infrastructure, mainframe, network and edge computing services and ERP

The Irish lender’s collaboration with Kyndryl is part of its drive to transform the bank’s infrastructure to deliver a seamless, integrated hybrid cloud management solution.

Permanent TSB: €150m investment in digital transformation

Permanent TSB’s vision is to expand its personalised, digital banking offering through a modernised technology architecture and a more resilient platform to host a new generation of applications.

The Kyndryl deal builds on the bank’s €150m investment in enhancing its IT system and digital capability. Permanent TSB partnered with EY and service integration partners Infosys and Finacle in a multi-year investment programme.

This investment programme has delivered an upgrade of the bank’s core platforms, increased security for customers through the introduction of Secure Customer Authentication, integrated a new API platform to enable open banking, and has made significant improvements to digital services via the Permanent TSB mobile App and web portal.

Kyndryl Ireland MD Karen Forbes tells RBI that Permanent TSB engaged Kyndryl to advance its digital transformation with an agile and secure environment that is built for the future of banking.

Kyndryl, Permanent TSB: collaboration to achieve significant business transformation

The bank engaged Kyndryl to transition its critical workloads to the cloud and deliver seamless management of data across its infrastructure using cloud services. By collaborating with Kyndryl to achieve this significant business transformation, Permanent TSB will be able to deploy adaptive digital tools to modernise and power its banking operations.

Using the solution’s cloud-based functionality, Permanent TSB can now respond more quickly to changing market developments and support the evolving digital needs of its customers. It will launch more personalised digital offerings, while maintaining strong security and data protection that enhance its operational resilience.

Agile, flexible, expert-led approach

Forbes highlights Kyndryl’s deep experience in advancing enterprise digital journey while taking an agile and flexible, expert-led approach to cloud modernisation.

Central to this collaboration from the outset has been the integration of Kyndryl’s deep experience and expertise in running some the world’s most critical infrastructures across multiple industries, especially in financial services.

Some 75% of the Fortune 100 are Kyndryl customers; the average customer relationship is more than 10 years.

Forbes adds: “In bringing Kyndryl’s expertise and global reach for cloud services, resiliency, and security to Permanent TSB, we are excited to design, create and manage a flexible, innovative and agile cloud infrastructure to enable the banks digital transformation.

“Our integrated services are designed to protect, while enabling the bank to efficiently create more personalised digital experiences for their customers, in a highly regulated industry.

“We have built a scalable private cloud for the bank to enable them to achieve their anticipated growth. We are really excited to partner with PTSB as they have a really exciting vision. We engaged really early on with the bank and that was key as to why we won the deal. We have deep expertise in this space and have proven this over multiple complex data centre migrations across the globe.

“We bring 30 years of expertise, 4,000 patents and 88,000 digital engineers from IBM. Confidence and the trust were there-the regulators in Ireland and the UK and EU know us-now it is our job to grow.”

As the Kyndryl spin-off was hugely anticipated, it is a safe forecast to say that there will be much comment among the among the tech and investor communities and much number crunching by analysts as Forbes, Schroeter and the rest of the senior management team set out to deliver the firm’s 2025 targets.