Digital lending is a complex and contested ecosystem. Incumbent retail banks exerted an effective monopoly on lending for centuries. Today, there is a dizzying array of highly specialised, non-traditional providers leveraging advantages in technology to erode the market share of traditional banks, reports Douglas Blakey

This is especially the case in unsecured lending as the challengers aim to combine speed and convenience with superior customer service.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The Covid-19 pandemic has served only to enlarge the market potential further for the challengers as so many otherwise creditworthy customers were deemed uncreditworthy overnight. Specifically, traditional risk assessment models and longstanding assumptions were invalidated by evolving market events. Digital lenders optimised to serve thin-file or otherwise hard-to-assess segments and now had the opportunity to apply these techniques to mass-market customers.

Using digitally native solutions, these lenders managed to augment existing solutions more quickly, deliver more insight and automation across the entire lending value chain, and partner promiscuously to bring new sources of value to customers in times of need. Meanwhile, incumbent providers, better able to withstand ongoing disruption from a balance sheet perspective, faced overwhelming operational demands. To stay relevant, incumbent providers are reimagining their customer journeys to match the benchmarks being set by new entrants and big tech providers.

This has meant designing a lending process that is digital from end-to-end, where origination, eligibility checks, approval, and servicing can be completed within a few seconds, rather than a few days. The tech transformation necessary to deliver such outcomes is a multi-stage multi-year process, but incumbents must deliver discrete pieces of process iteratively to keep pace with new entrants and evolving consumer expectations.

Various types of new entrants are actively pursuing discrete subcategories of the digital lending opportunity under a variety of different local market conditions and business models. Adjacent verticals are deeply involved through various embedded finance propositions. Incumbents have critical roles to play in the ecosystem, even if they have a less direct customer relationship.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataUltimate competitive conditions will be determined by the firms that best understand key grid lines of change and reimagine their propositions and business models accordingly.

Aggressive automation around credit decisions

Lending, particularly mortgage lending, is an infamously manual, paper-based process. There is an enormous amount of low-hanging fruit in applying basic, proven technologies such as RPA, optical character recognition (OCR), automated document recognition (ADR), Workflow, and machine learning. Bank of America and Wells Fargo have made huge investments with RPA vendors, such as Automation Anywhere and Blue Prism, and managed to take out significant costs with no ‘broken glass’ in terms of customer satisfaction. However, at a certain level, laying RPA over suboptimal banking processes neither addresses nor fix the root cause of organisational process problems and may well generate new tensions. Case in point: most banks struggle to merge different legacy systems into a single workflow for RPA.

As such, leading incumbent banks have sought to be bold and redesign application processes end to end for digital, especially those core decision-making processes, like credit. Credit-related activities are typically divided into front-office, risk management, and back-office procedures. Integrating these actions end to end can allow institutions to conflate all credit steps into one straight-through process, backed by continually updated analytics. Digitising the credit journey in this way can help banks speed up processing, lower costs, and tailor customer offerings according to individual risk profiles. However, to deliver this front, middle, and back-office, decision-makers need to align—and stay aligned—for a number of years to deliver these results, which is why new-build projects can be easier.

Personalisation across all aspects of product and experience

Modern digital lenders compete on personalisation across all dimensions of digital experience. The pandemic accentuated the need for personalisation, as it had a highly individual impact on customers and sectors, invalidating many of the generic assumptions underpinning long-standing credit risk models. Machine learning algorithms that learn over time to inform product propensity models help providers develop customised engagement strategies, in terms of time and channel, to increase conversion rates. As part of a broader strategy of personalized financial advice, non-market algorithms can help tailor offers to a customer’s financial situation. For example, algorithms that analyse spending behaviour to detect retirement gaps or current portfolio structures to suggest where a portfolio extension shows strong potential. It is also true that the economics of digital-only propositions, in terms of lower start-up costs, means that we are seeing ever more segmented propositions—not just digital lenders focused on SMEs, but banks focused on specific types of SMEs, such as painters and decorators or pet shops, and able to advise those businesses on most common cash flow issues, or expense management problems, for that specific type of business.

Heightened focus on cybersecurity and fraud

The need to move quickly, especially amid COVID-19, has created heightened fraud and cybersecurity risks for banks. The pandemic created well-documented opportunities for fraudulent access to Covid-19 loans, the full extent of which will only become apparent in time. Part of the response is non-tech, so cross-functional teams in which credit risk and fraud work more collaboratively.

The pandemic presented a number of attack vectors incumbents were optimized to mitigate, including online synthetic fraud. To get in front of the fraud and cyber issues, defining a playbook of possible cyberattack scenarios, providers can think through issues in advance and implement solutions.

Ever-more “integrated” lending

The notion of “embedded” finance—including insurance, payments, money management, and lending—has exploded in recent years. Yet ‘integration’ in this sense is not a new idea but the driving development of UX improvement and channel innovation over the last 30 years.

Decades-old companies like Synchrony and Alliance Data were “integrated” at the point of sale in the form of paper applications for store-branded credit cards. The modern equivalents are firms such as GreenSky, Bread, and Affirm that gain access to prime consumer credit via partnerships with companies hoping to sell things more efficiently. Embedded finance is the contemporary incarnation of this principle, which creates new routes to market for a variety of lenders. Various third parties without a banking license (i.e. Netflix, Uber, Airbnb) can partner to embed financial services into their proposition.

Banks can offer public APIs that make lending facilities available on third-party platforms, such as a bank offering a car loan on a car dealers’ website, or mortgage products on a property search site. Being able to offer products within the context of the purchase reduces friction for end users. The explosion of BNPL, meanwhile, is also highly integrated, with lenders paid by the channel—i.e. the retailer—and the borrower.

Banks moving deeper into underlying life goals rather than just products around lending

Faced with more “integrated” lending competition, banks will go deeper into the customer experience to protect market share. For example, rather than focus on just the core lending product—whether it be a home loan or car loan—banks are seeking to support broader life goals, with the bank orchestrating not just financial services but also services that help the customer insure, renovate, and furnish their new home, for example, all integrated into the bank’s platform. DBS, OCBC, and Tinkoff Bank have done much in this space already. These are examples of banks variously seeking to become the platform and moving from a product-centric approach to a customer-centric approach where they seek to fulfil deeper and broader life goals, of which the product is just one element.

Digital lending and the pandemic

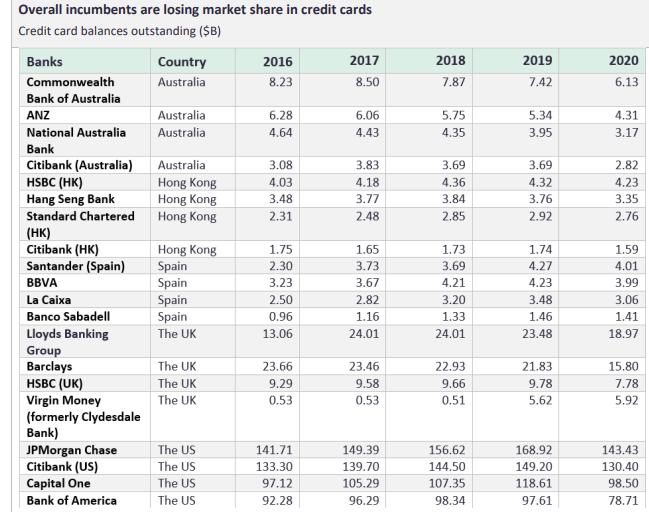

Digital lending as a whole experienced a contraction amid the pandemic. Market share evolution from 2016 to 2020 in five key markets (the UK, Australia, Hong Kong, the US, and Spain) highlights a number of fascinating trends. Across all five markets, outstanding credit card balances have declined (with very few and small exceptions), from 2018 to 2020. Those notable exceptions include Capital One and JPMorgan Chase (which both have fully digital application processes) and Capital One (which has the ability to assess sub-prime lenders using alternative data sets and maintain low single-digit percentage point non-performing loan ratios).

Virgin Money’s growth was inorganic due to its acquisition by Clydesdale Bank. Across all markets—but especially the UK, the US, and Australia—the growth of new BNPL providers is eroding the share of incumbent providers.

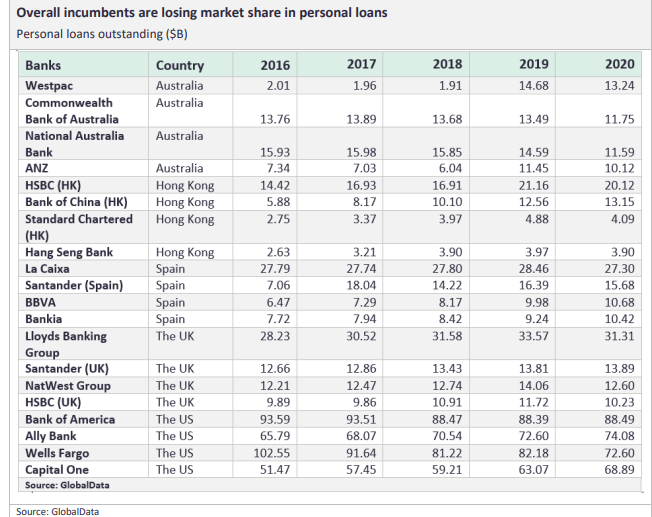

Personal loans outstanding

Personal loans outstanding follow a similar trajectory as credit card balances outstanding. Certainly in Australia, Hong Kong, and the UK, incumbent market shares declined in 2020 versus 2019. In the US, which is overall more stable for incumbents, Wells Fargo lost 10% market share in just 12 months and Capital One—due to the same factors driving its success in credit cards—is managing to grow share.

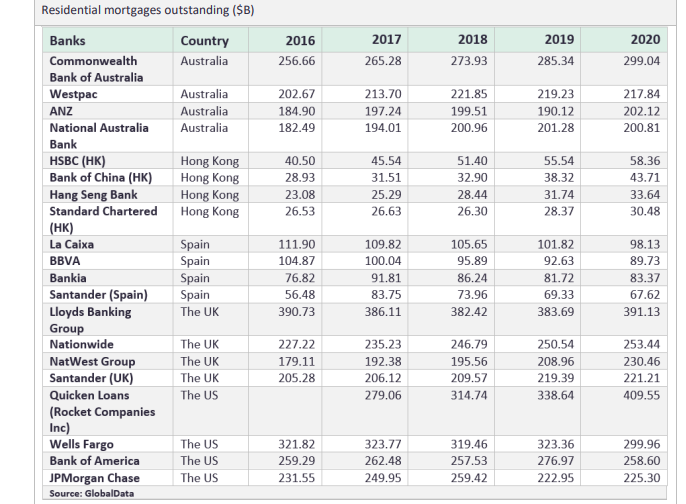

Residential mortgages outstanding

Mortgages continue to be the anchor of the customer relationship. In Hong Kong and the UK, all incumbents have increased their market share. Yet it is noteworthy that in the US key incumbents have lost sizable market share, with Wells Fargo being the biggest loser (and also the biggest loser in credit card balances outstanding). The impact of new digital entrants in the US can be felt clearly from the encroach of Rocket Mortgage, which increased its market share by 4%, with Wells Fargo down 2%. Rocket Mortgage has been the largest originator of home lending in the US from as far back as Q3 2017 and is continuing to grow.

Sector Scorecard

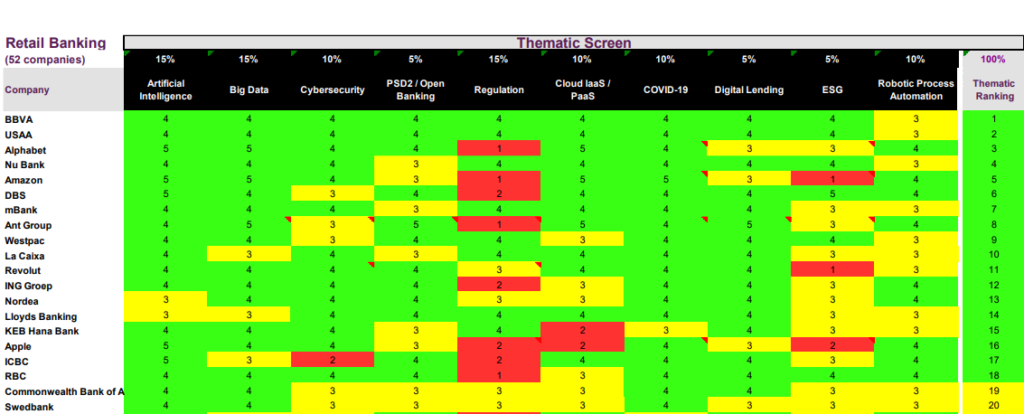

GlobalData Thematic Research applies a scorecard approach to predict tomorrow’s leading companies within each sector.

Companies that invest in the right themes become success stories. Those that miss the important themes in their industry end up as failures. Viewing the world’s data by themes makes it easier to make important decisions We define a theme as any issue that keeps a CEO awake at night. GlobalData’s thematic research ecosystem is a single, integrated global research platform that provides an easy-to-use framework for tracking all themes across all companies in all sectors. It has a proven track record of identifying the important themes early, enabling companies to make the right investments ahead of the competition, and secure that all-important competitive advantage. Traditional research does a poor job of picking winners and losers

The difficulty in picking tomorrow’s winners and losers in any industry arises from the sheer number of technology cycles—and other themes—that are in full swing right now. Companies are impacted by multiple themes that frequently conflict with one another. What is needed is an effective methodology that reflects, understands, and reconciles these conflicts. That is why we developed our “thematic engine”

At GlobalData, we have developed a unique thematic methodology for ranking all companies in all sectors based on their relative strength in the big investment themes that are impacting their industries. Our thematic engine identifies which companies are best placed to succeed in a future filled with multiple disruptive threats. To do this, we rate the performance of the top 1,000 companies against the 50 most important themes impacting those companies, generating 50,000 thematic scores. The algorithms in GlobalData’s thematic engine help to identify the long-term winners and losers within each sector.

The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

The top 20