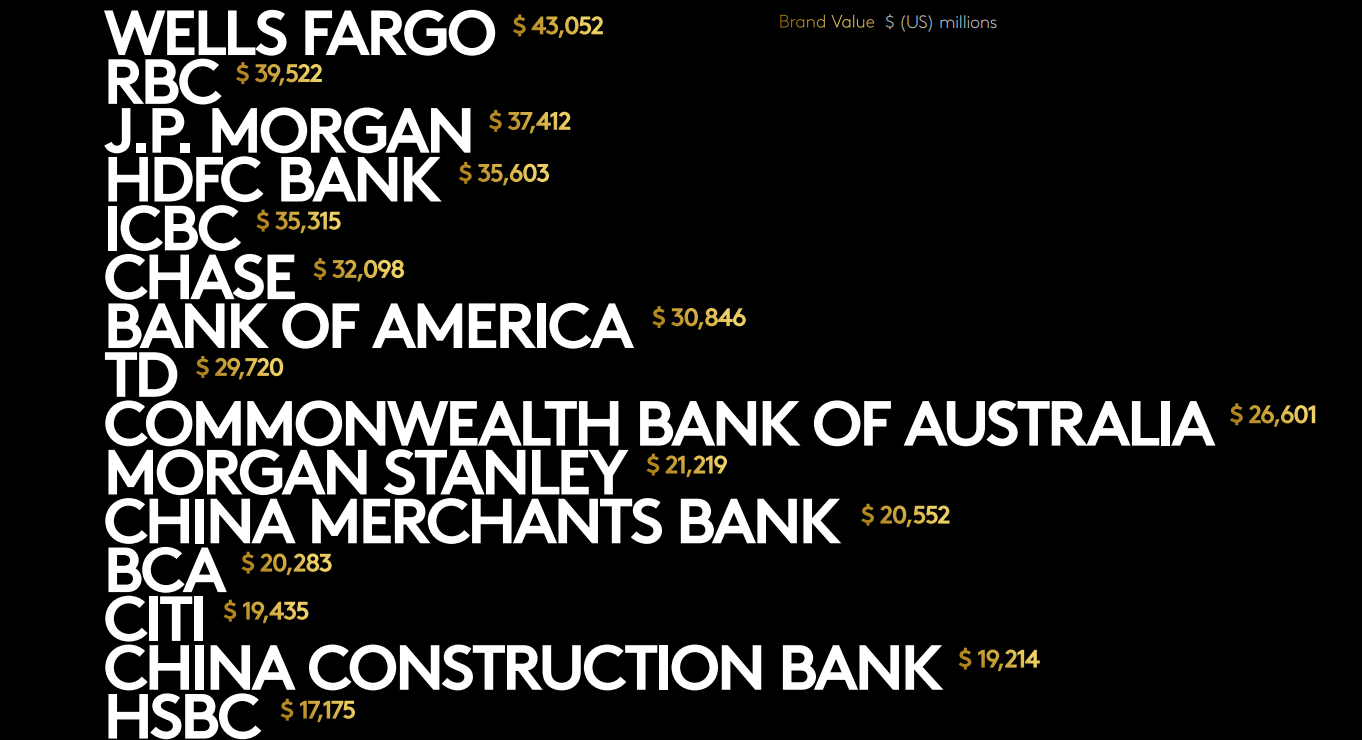

Banking Giants : Top Financial Brands in the BrandZ 100

Wells Fargo, Royal Bank of Canada (RBC) and JPMorgan rank as the most valuable banking brands, ahead of HDFC, ICBC and Chase according to the 2022 Kantar BrandZ most valuable global brands annual survey.

The 2022 report highlights a strong year for the banking sector. This year, ten banking brands feature in the top 100 overall brands, up from nine in 2021. And in 2022, the banking brands featured rise in total by more than 30% in brand value.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The top 3 bank brands: Wells Fargo, RBC and JPMorgan

In the overall top 100 ranking, Wells Fargo ranks 55th, up from 62nd last year, with a 54% rise in brand value to $43.05bn. RBC rises from 63rd last year to 57th following a 43% rise in brand value to $39.5bn. Meantime, JPMorgan rises from 74th last year to 59th this year with HDFC moving up to rank 61st from 66th last year.

Last year’s top ranked bank brand, ICBC, drops from 51st in the overall top 100 brands to 62nd this year. The other five bank brands to make the cut for the top 100 global brands all rise compared to 2021.

Chase 68th this year rises from 80th last year, with Bank of America 69th (98 in 2021), TD 72nd (90th), CBA 80th (97th) and new entrant this year Morgan Stanley in 100th.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

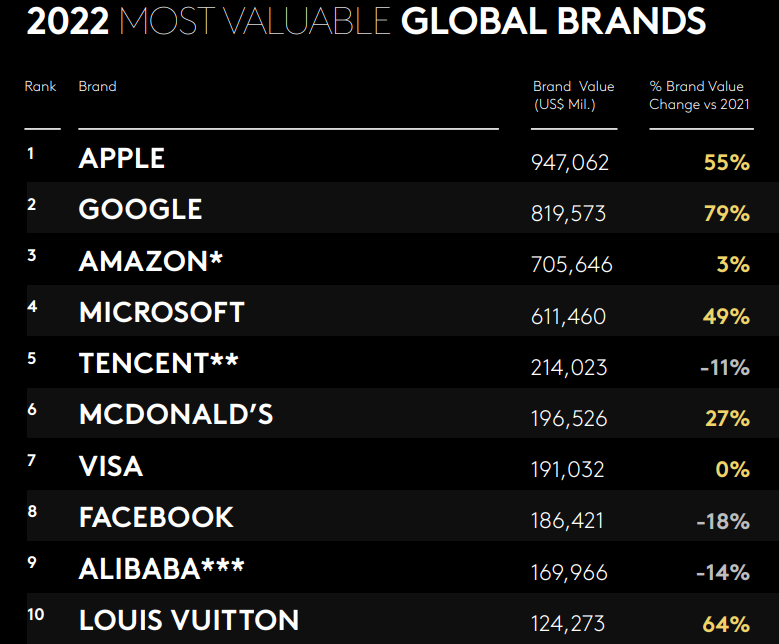

By GlobalDataThe total value of the overall top 100 brands rises by 23% to reach almost $8.7trn.

This represents the second-greatest annual rise in the survey’s history, following last year’s benchmark of 42%. By contrast, in 2019 and 2020 the annual increases were a more modest 7% and 6% respectively.

Apple is the world’s number one most valuable brand, growing 55% to $947bn, followed by Google $820bn +78% with Amazon and Microsoft third and fourth respectively.

Card programmes Visa, Mastercard and Amex also feature prominently. Visa rises one place from 8th last year to 7th with Mastercard dropping from 10th to 12th with American Express up from 61st to 54th.

It is becoming increasingly difficult for brands to qualify for the top 100. In 2006, the brand value threshold for ranking in the Global Top 100 was $4.2bn. Today, Morgan Stanley scrapes in in 100th place with a brand value of $21.2bn.

A number of well-known banking brands featured prominently in the original 2006 survey but have struggled in the interim. For instance, in 2006 Citi ranked 9th overall. Today, it fails to feature in the top 100. Meantime, Bank of America is down from 12th in 2006 to its 69th place today.

Citi, HSBC fail to make the cut for the top 100 brands

There was a time when Santander, ING, BBVA, UBS and Barclays ranked in the top 100. All five fail to make the cut in 2022 and are not even ranked within the top 15 banks. HSBC is another notable absentee from the top 100 brands. In the banks only section of the top 15 brands, it scrapes in in 15th place, behind Citi and China Construction Bank.

Again, back in 2006, Deutsche Bank featured prominently, ranking 40th but is not close to the top 100 today.

Kantar reports that national banking brands tend to overperform in its bank brands lists. Brands such as RBC are benefiting from its longstanding work on community, client, colleague and investor balance. And the 2022 report highlights that RBC’s moves this past year are a strong example of how BrandZ data insights can align with strategic initiatives.

RBC scores with Ideas Happen Here brand platform

“In RBC’s case, there is a clear incentive to raise the bank’s Difference perceptions up to meet its high scores for Salient and Meaningful. To that end, the brand’s new “Ideas Happen Here” brand platform aims to highlight innovative offers across a range of marketing touchpoints. To date, ads have highlighted initiatives like the brand’s redesigned app and integrated loyalty rewards program, as well RBC’s start-up incubator and small business tools.”

Examples of the brand platform in action included the bank’s marketing activity around the Tokyo 2020 Olympic Games. The marketing asserts RBC’s abiding belief in the power of people and their ideas, and RBC’s pivotal role in harnessing them to help clients thrive and communities prosper.

Mary DePaoli heads up RBC’s marketing for RBC’s retail, insurance, and wealth management divisions and oversees the brands global sponsorships, corporate communications and citizen initiatives. With the RBC brand value rising 43%, she has had a blinding year and tells Kantar:

“Several years ago, we did a full review of our retail banking brand in Canada and discovered something interesting. Overall, we had very good brand perception among our existing customers, who demonstrated a strong predisposition towards choosing RBC, especially after getting to know us.

However, among non-customers, and younger consumers in particular, we also surfaced a perception that perhaps RBC was not as approachable or as friendly as some of our key competitors.

“This insight drove wholesale change, starting with the recognition that we needed to focus more on the top and middle parts of the funnel to make our brand more approachable to noncustomers. From the messages we used to tell our brand story to the assets in our sponsorship portfolio, we were determined to make our brand more relevant and approachable in ways that linked back to our values and purpose as a positive force in the lives of our clients and communities.”

Elsewhere, in India the report references HFDC Bank building on lockdown-era breakthroughs in mobile banking and hyperlocal service to improve its BrandZ reputation scores – all while continuing to grow its bottom line and invest in new branches.

The BrandZ Top 100 most valuable global brands study analyses firms financials and draws on a consumer survey.