Banking Sector and Cloud Computing from KPMG

Banks can and must close their cloud value gap with billions of pounds of cloud investment currently being wasted, Mark Corns, Partner and Head of FS Cloud Transformation at KPMG tells Douglas Blakey

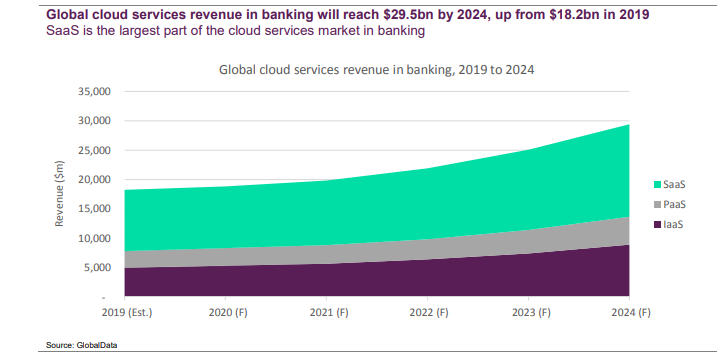

For a long time, banks have not realised the financial returns expected from their cloud migrations. Indeed, several reports estimate that as much as 35% of cloud spending is wasted on inefficient activities. Banks’ cloud spending is only going to increase this year – see GlobalData, publishers of RBI, estimates below, meaning the billions of pounds that banks are already wasting on cloud will grow at a similar rate.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Corns says that there are a number of reasons for banks’ cloud wastage, including regulatory risk that is unique to the financial services sector.

“This can be both perceived and real. Such a strong focus on risk distracts them from maximising cloud opportunities. The complexity of legacy banking technology – especially mainframes for hosting their core systems. There is now a massive focus on modernising the core systems. There is also a different cyber posture and new processes on cloud, which banks have been slow to grasp.

More than just moving IT systems

And then there is a big focus on spinning up environments and proving capabilities. Once established, however, there is then a need to implement the controls, which is harder to do after the event. Consequently, cloud environments need to be rebuilt or scrapped.”

Corns says that banks increasingly understand that this is more than just moving IT systems.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHe adds: “Banks are starting to embrace thus cloud investment through a broader business lens. They are facing into some of these challenges around risk management, security, the need to build cloud talent within their own organisations, the regulatory hurdles and also the costs around not only the migration benefits but actually ensuring that you are optimising the costs when you are there.”

To close this value gap, there are a number of steps that banks need to take.

Says Corns:

- “Create a ‘cloud value map’ to measure impact: Once you are clear on your strategic purpose in using the cloud, you need to map your current usage against it.

- Work in partnership with the risk functions and engineering teams: Agree a cloud controls framework to provide the board and regulators with confidence to move at pace.

- Develop a Cloud Control Framework: embed cloud controls with fully documented traceability from controls requirements, designs, controls epics through to controls stories. Also build in cloud controls from the outset to avoid costly rebuilds of cloud environments.

- Set up a system for regulatory notification and insights: this will capture the key areas of regulatory focus and helps to accelerate regulatory submissions and reduce risk and regulatory challenges.

- Cultivate collaboration: Bring IT and business teams together to review cloud usage, blockages and ways of kick-starting more rapid progress.

- The need to see cloud as more than just moving IT systems. The banks need to take a more holistic approach that considers how these new technologies impact on business operating business models and what this means for financial policy and investments.”

Cloud services in the banking industry market size and growth forecasts: GlobalData

GlobalData estimates the market for cloud infrastructure in the banking sector to be around $8.3bn in 2019 and expected to rise to around $11.2bn by 2024, CAGR growth of 6.2%. Private cloud services account for the most revenue at over $4.9bn in 2019 and it will remain the largest segment in 2024, growing at a CAGR of 6.3% to $6.7bn.

However, the fastest growing segment will be cloud management platforms. It will grow at a CAGR of 6.9%, from $864m in 2019 to $1.2bn in 2024, still remaining the smallest segment, behind hybrid cloud services.

Hybrid cloud services account for $2.5bn of revenue in 2019, expected to rise to $3.3bn by 2024, growing at a CAGR of 5.8%. The market for cloud services stood at around $18.2bn in 2019, almost double that of the cloud infrastructure market.

The market is expected to grow at a CAGR of 10%, reaching an overall value of $29.5bn by 2024, at which point it will be worth double the cloud infrastructure market. SaaS is the largest segment of this market, Global cloud infrastructure revenue in banking will reach $11.2bn by 2024, up from $8.3bn in 2019

Private cloud services will remain the largest segments of the cloud infrastructure market in banking.

Global cloud services revenue in banking will reach $29.5bn by 2024, up from $18.2bn in 2019

SaaS is the largest part of the cloud services market in banking accounting for 57%. It will grow at the slowest rate, however, a CAGR of 8.7%, increasing from $10.4bn in 2019 to over $15.8bn in 2024, still remaining the largest market segment. The fastest growing segment of this market will be IaaS which will grow at a CAGR of 12.3%, from just $5bn in 2019 to $8.9bn by 2024.