The banking sector has averted a major crisis but is still underperforming its pre-financial crisis levels. Specifically, it lags many other industries—and a host of new competitors—in several dimensions, including financial performance, customer experience, and embracing new business, operating, and collaboration models, reports Douglas Blakey

Two years on from the outbreak of Covid, a new model for consuming financial services and accelerated digitisation across the industry demands that institutions adjust course and begin real transformation today.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

That is the key conclusion of IBM’s 2022 Global Outlook for Banking and Financial Markets report.

“Financial institutions must seek out new business models to drive incremental revenue gains, new operating models and compute environments that structurally reduce operating costs, and new approaches to improve the efficiency of capital, “says Anthony Lipp, Global Strategy Leader, Banking and Financial Markets, IBM.

The foundation for the future

And so, banks must build new customer-centric platform business models to orchestrate and integrate the many needs of ecosystem participants in a more frictionless environment. Leading financial institutions are creating their own bank-led ecosystem business models to serve attractive market segments, while deeply integrating their products and services with other companies’ well-established platforms.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

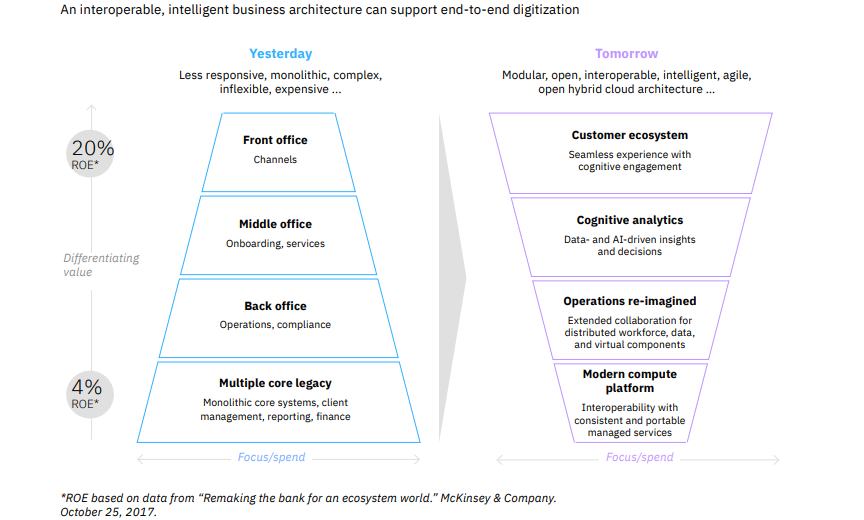

By GlobalData“Banks need to embrace end-to-end extreme digitisation to reshape operations and drive innovation. To win the race to all things digital, financial institutions are adopting new ways of exploiting exponential technologies such as automation, hybrid cloud, and AI. They drive digitisation across internal business units and their ecosystem of external partners while helping ensure security and compliance.”

Pull quote:

“Banks would like to have positive rates, unquestionably, so whenever they have negative rates, they don’t like it … The necessity to adjust the business model to digitalisation, to changes in technology, is something much more compelling than being angry about negative rates.” Mario Draghi, former Chairman, European Central Bank

In addition, they must act with urgency to increase resiliency for better risk management and to address regulatory concerns. As financial institutions pivot workloads and volumes to new channels, operations, and partners in response to the pandemic, resiliency has leapt to the forefront of industry priorities. Further resiliency improvements are required to support new business and operating models now being embraced by the industry.

Lipp adds: “Banks need to find viable sustainability models so they can launch initiatives to meet market expectations, regulatory requirements, and corporate ethical objectives—all with an acceptable cost-benefit case. And deploy AI factories and transformed data environments that put data in action to accelerate transformation.

Pull quote

“The bar [competition] has been raised higher. The big change is hyper-digitalisation.” Piyush Gupta, CEO, DBS Bank

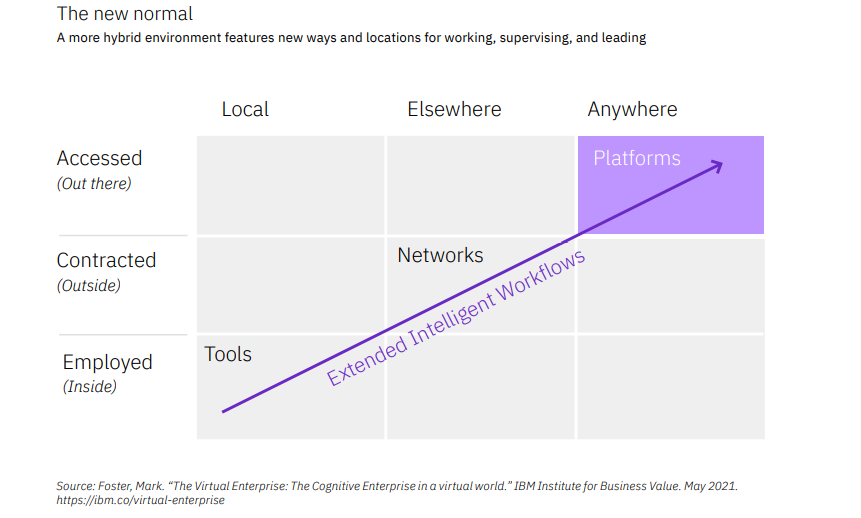

“By ethically adopting new deep analytics and AI tools, financial institutions can enhance operations and customer experiences, and better meet regulatory obligations. They must embrace the reality of a new workforce in new workplaces that redefine how, where, and when work is performed. The financial institution’s workforce now incorporates employees, subcontractors, vendors, and partner employees. New models can enable effective collaboration across this expanded workforce in changing physical and digital work environments.”

Pull quote:

“We’ve been building some muscle in the organisation to do better partnering. Because we can’t do everything ourselves. We don’t want to.” Ross McEwan, CEO, National Australia Bank

By engaging an ecosystem of partners, banks will fuel faster innovation and efficiency. As financial institutions accelerate their transformation, they increasingly partner externally to deliver better functionality at a structurally lower cost across their operating model. There is also a need to tap into the growing momentum for digital assets by working to create new customer and partner ecosystems, new products and services, and new use cases.

“Financial institutions can be enablers and product providers in the fast-growing digital asset marketplace.”

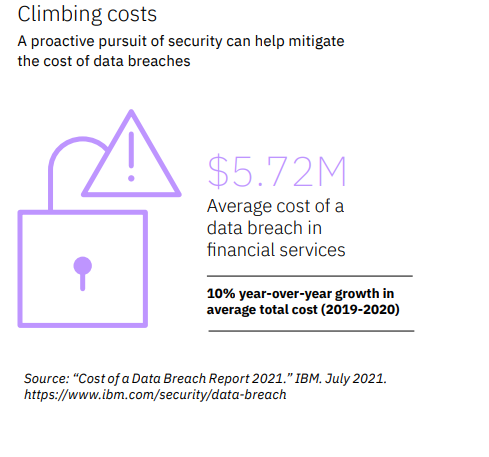

All the while, banks must stay one step ahead in the new frontiers of cybersecurity as bad actors become increasingly sophisticated. While new business and operating models are providing innovative ways to serve customers anywhere and anytime, they also create opportunities for security breaches.

Lipp adds: “financial institutions are revisiting their enterprise risk profile and deploying enhanced security capabilities within their walls and across their ecosystems. Many organisations have already started addressing some or most of these compelling needs. Others are not keeping pace.

“The industry is at a point where it has got to respond to the investor community. They are looking at the performance of the industry and saying this will not cut it.”

He notes that, across the banking sector return-on-equity (ROE) did improve in 2021 after a dramatic pandemic-driven decline in 2020, but it remains well below pre-financial crisis levels and below the industry’s cost-of-equity.

The need to embrace new, more profitable and competitive business models

Net interest margins for the industry have been declining since the 1990s, forcing banks to explore opportunities to generate non-interest income and take actions to mitigate net interest margin compression. The price-to-book ratio for the banking industry is about one times book – markedly less than that in the UK and other European markets- compared to about three times for all other industries.

“Financial institutions need to move beyond exploring new opportunities for non-interest income and take a more radical step: reinvent themselves by embracing new, more profitable and competitive business models.”

In addition to radically reducing costs as they transform their business models, developing a well-orchestrated ecosystem of partners can help accelerate this digital transformation. Looking ahead, Lipp is optimistic that the industry gets it.

He concludes: “Broadly, across most of the markets where we operate, our clients recognise that there is a fundamental shift around how customers, both consumer and corporate customers, consume financial services and the points we are making are recognised by leading global banking executives with whom we work.”