Banking is not normally praised for its branding. While commonplace, banks tend to be just present rather than exciting, especially compared to Coca-Cola or Disney. And while the sector has built up some brands, others have taken a postcrises tumble. Patrick Brusnahan writes

Every year, Interbrand analyses the top 100 global brands. Financial services have stagnated in the table in recent years – this is worrying, considering many financial institutions across the world have historical branding.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Brands at the top of the pile this year are no surprise: Apple leads the pack with a brand value of $214.4bn, a 16% rise year on year. Google’s brand increased by 10% in value to hit $155.5bn, and Amazon recorded an incredible 56% rise in its brand value; the online store now holds a brand worth $100.8bn.

With constant rumours that Amazon is set to launch a bank or get involved with insurance, it could soon be considered a financial brand. Of the top five, only Coca-Cola suffered a decrease in its brand value this year, dropping by 5% to a $66.3bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFinancial brands

There were 12 financial brands in the top 100 in 2018; the exact number as in last year’s rankings. At the top of the financial list is American Express, as it was the year before, in 24th place overall. Following on is JPMorgan at 26th place and Goldman Sachs in 44th. At the bottom of the sector is PayPal in 73rd place.

However, it has risen fast, given that it only joined the rankings in 2015. None of the financial brands lost value. Axa stagnated at 0% rise in brand value, but the other 11 all saw rises. PayPal recorded the largest rise (22%) in value to hit $6.6bn; last year, its brand value was only $5.4bn and when it joined the rankings, the payment platform’s brand value was just $4.2bn. Visa and Mastercard saw double digit percentage rises in their brand value, but the bank that had the most success this year was Santander.

The Spain-based lender recorded a 13% increase in its brand value to hit $7.5bn and place 69th in the rankings. Since 2013, the bank has seen nothing but rises in its brand value. In 2013, it was valued at over $4.6bn, but grew to over $6bn in 2015 and $6.7bn in 2017. The consistent rises can be attributed to three factors, according to Interbrand: commitment, relevance and consistency.

JPMorgan was rewarded with a 12% spike in its brand value. Valued at $17.5bn, the US behemoth has had a rocky ride since the financial crisis. However, it has seen rises every year since 2013.

What about banks?

According to analysts at Interbrand, banks need to be willing to use their size and take risks to stay relevant.

Elisabeth Dick Oak, senior director – verbal identity, and Andrew Miller, senior director – strategy, say: “2018 marks the 10th anniversary of the financial crisis, when the subprime bubble burst, the markets crashed, and once-storied behemoths such as Bear Stearns and Lehman Brothers closed their doors for good and rocked the financial sector to its core.

“Experts might have expected a decade of playing it safe, and the steady average annual growth rate is 6.6% from 2012 to 2018 in brand value across the sector supports that story. That being said, while those that were ‘too big to fail’ did take a step back, fintech and insurtech startups stepped up to aggressively challenge the status quo. Now that the Betterments and the Oscars are more mainstream, however, it’s time for the financial services version of The Empire Strikes Back.”

In addition, while the report acknowledges that the big banks are getting bigger, it warns that they also need to be braver if they want to be able to take on their new, leaner, digitally native competition.

One incumbent praised for its innovation was Morgan Stanley. Its use of predictive analytics and machine learning to help financial advisers help clients is an example of how it is staying relevant. Morgan Stanley’s advantage is its ability to deliver advice like that at a much larger scale than a startup.

Therefore, it is not all doom and gloom for banks now competing against digital startups.

The senior directors added: “In the face of so many options, you’d think that the bigger institutions would be at a loss: not so with mobile bank Finn, from JP Morgan Chase. Finn is geared toward young adults who want to carry out all their transactions on their phones, do not want or need to go to a bank branch, and do want help saving money.

“Much like Venmo, Finn gives people a different lens through which to view their financial lives. An invitation to get intimate with a bank may seem risky, but when targeting the oversharing generation, it’s a smart move.”

Brands over time

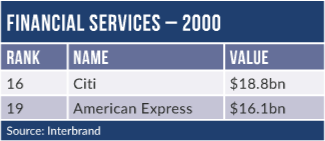

While financial services clearly have their place in the top 100 now, this was not always the case. In 2000, there were only two financial brands ranking: Citi was placed 16th and American Express at 19th with values of $1.8bn and $16.1bn respectively.

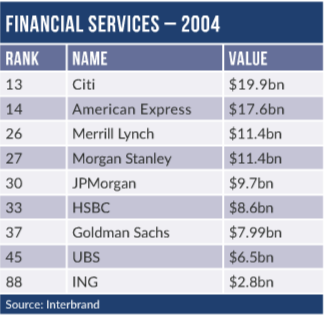

Four years later, the number of financial institutions in the top was nine with Merrill Lynch, Morgan Stanley, JPMorgan, HSBC and Goldman Sachs entering the charts in the time period. UBS and ING were in the Interbrand Top 100 for the first time. While ING was placed 88th, the other eight institutions were all in the top half of the table. Citi ranked 13th in the table with a brand value of $19.9bn, which was an 8% growth compared to the previous year.

However, in 2008, the year of the financial crisis, there were even more brands in the table. AIG, Axa, Allianz were now in the top 100, and Visa managed to just scrape in at 100th place with a brand value of ($3.3bn)

By that point, American Express had overtaken Citi as the top financial brand, placing 15th while the US lender had dropped in value by 14% in the year. Citi was in 19th place with $20.1bn in brand value. Every bank suffered drops in value that year; Merrill Lynch suffered most with a 21% plummet.

With the financial crisis in full roar, financial institutions dropped out of the rankings. AIG and ING were two casualties. However, 2010 saw a number of new entrants. Banks Santander, Barclays, and Credit Suisse, as well as insurer Zurich, were now in the top 100, which now held 14 financial brands. Santander was the highest-ranked new entrant in 68th place with a value of $4.8bn in brand.

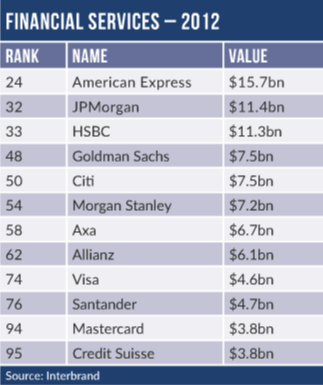

Barclays did not last long, and was out by 2012. The only new financial institution new entrant was Mastercard in 94th place with a brand value of £3.8bn. Citi, once top of the sector, was now in 50th place, behind American Express again, as well as JPMorgan, HSBC and Goldman Sachs.

Only two years later, the brand value of financial institutions was waning. The number of firms in the top 100 had reduced to 11. It became 12 in 2015 with the addition of PayPal and it has stayed at 12 since.

This is stable, but on the other hand, it is worrying for banks that the latest entrant to the top 100 for financial services is not, in itself, a bank. How many more new entrants are going to come along and displace the incumbents?

Luckily, a number of them do not have the scale to match up to banks, but this will not be the case forever. With so many new players, consolidation is almost unavoidable. If that happens, then perhaps they will have gained the scale together and they can finally compete with banks.

This is all speculation, but with old banking brands suffering against the new, such as Google, Amazon, Facebook and the like, will they be missed?