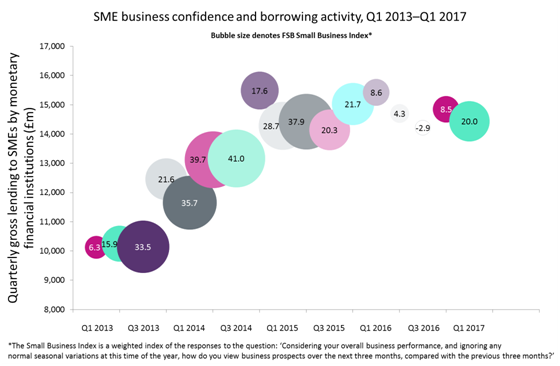

A comparison between SME lending data and statistics on SME confidence shows a clear link between the two, with business confidence acting as a key driver of the rate of growth in lending to SMEs.

SME lending, which was badly hit following the financial crisis, recovered strongly in 2013–14, a period during which business confidence, as measured by the Federation of Small Businesses’ Small Business Index, climbed to its highest levels this decade. This period coincided with modest improvements in macroeconomic performance, for example in respect to growth in employment and GDP.

However, confidence started to decline from the second half of 2015, and collapsed in 2016 following the vote to leave the EU. As a direct consequence, the strong growth in lending to SMEs came to a halt, as firms decided to adopt a defensive posture.

Although confidence has partially recovered, it remains well below the levels seen in 2013–14, and as a result lending has continued to flatline as firms defer investment and expansion plans. The general election, unexpectedly resulting in a minority government with a weakened mandate to negotiate with the EU, will deal a further blow to business confidence.

Macroeconomic indicators are also pointing towards a challenging future. Household incomes have fallen for the longest period in the last 40 years, and consumer spending is being propped by credit and raids on savings (the household savings ratio is at its lowest level since records began in 1963).

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis is unsustainable in the long term, and SMEs will experience reduced demand in the face of the inevitable fall in consumer spending. Consequently, the cycle of falling business confidence and stagnant borrowing will continue for the foreseeable future.

For more, click here