The already-extensive range of personal financial management (PFM) tools available to banks has grown significantly over the last couple of years. Given the range of options, Australian banks need to ensure they provide the right tools for their customers – as well as the ones that offer the best return on investment (ROI).

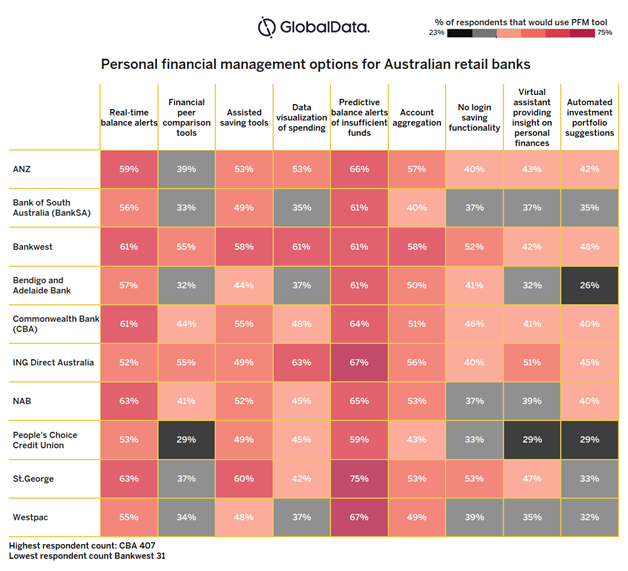

The heat map highlights the most in-demand PFM tools. What is apparent is that Australian consumers prefer day-to-day assistance with their existing PFM tasks rather than more sophisticated services such as robo-advisors or AI-driven bots. The heat map also highlights the similarities between customer bases. For example, customers of ING Australia and Bankwest have almost identical PFM needs. Analysing demand for PFM tools by each competitor can help gauge potential customer acquisition gains.

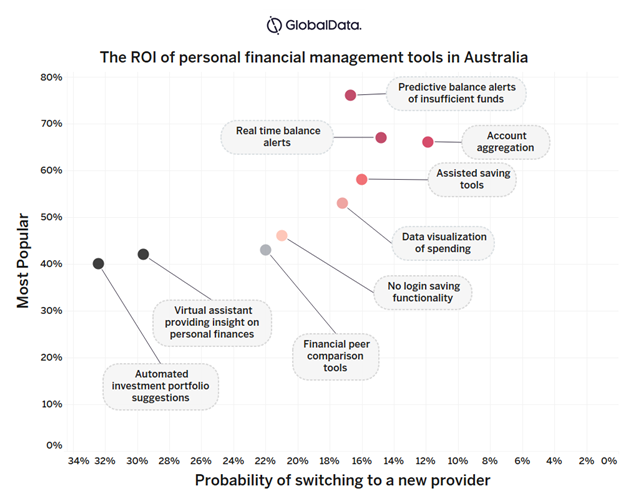

However, the popularity of a PFM tool does not always correlate with its potential ROI. For example, predictive balance alerts of insufficient funds is the most popular tool but only has the fourth-biggest impact upon retention, behind account aggregation, real-time balance alerts, and assisted savings tools.

PFM tools to regain trust

Australian banks are currently under a huge strain to win back customer trust

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe royal commission into Australian banks and their exploitation of vulnerable customers has been tagged a “burning platform” by a beleaguered bank’s chief executive. Furthermore, confidence in the whole Australian banking sector continues to haemorrhage in the light of evidence taken by the commission.