Lifesaver’s goal is to help consumers better manage their finances. However, its business model also throws a Lifesaver at America’s waning community banking sector, with a partnership model for all non-tier-one banking institutions to follow.

In 1984, community banks with less than $1bn in assets controlled 30% of all industry assets. Today, that figure is down to less than 10%. In a world of increasingly large banking players, community banks, along with credit unions and building societies, feel their long-term survival is at stake.

Embracing new technology remains the best remedy for extinction, finding new ways to serve customers that are overlooked by the main banks. This was echoed at the Federal Deposit Insurance Corporation’s Community Banking Conference way back in 2016, which stressed the need to explore new channels like mobile and appeal to more digitally savvy millennials.

Lifesaver is a free mobile service that offers just that remedy. The app itself combines a range of personal financial management tools like budgeting and savings goals with a financial marketplace. Users can choose well-known names such as Marcus GS or Chase, though the app specialises in showing customers their local banking institutions.

Consumers who previously faced a trade-off between a modern digital interface and a good relationship with their bank can now choose both. While community banks and credit unions have become a niche market, they do a much better job at serving their customers.

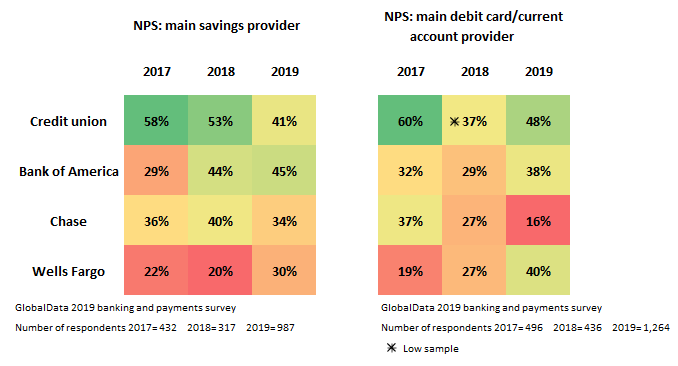

GlobalData’s 2019 Banking and Payments Survey shows that credit unions typically receive higher net promoter scores (NPS) than the main US banks.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Institutions that sign up to Lifesaver’s platform will enjoy numerous benefits. For a paid subscription, Lifesaver provides a new acquisition channel at a much lower cost, allowing companies to interact with more people looking for their kind of product.

The marketplace also offers an engagement channel for existing customers, where as well as new cross-selling opportunities, the bank can lower the cost of business by transitioning customers onto Lifesaver’s platform. This in turn helps banks achieve higher levels of growth with lower marketing and technology investment spend.

Speakers at the 2016 Community Banking Conference were outsourcing business loans under $250,000 to fintechs. This follows the broader trend of these institutions lending via peer-to-peer sites like Lending Club and Funding Circle. By combining new technologies like these and Lifesaver with their superior customer service, local banks and building societies can survive and thrive, gaining the edge over incumbent players.