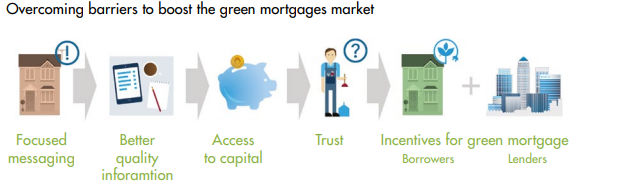

The UK government has encouraged greener living by introducing several incentives to promote energy efficiency and the use of sustainable materials in home building. However, the widespread uptake of green mortgages will require increased consumer awareness and long-term institutional commitments.

Widespread media coverage on environmental challenges has led to a change in consumer behavior towards far-reaching environmental action. There is an increasing shift by consumers towards climate-friendly activity, thereby increasing demand for climate regulations to be introduced. Several international initiatives have been put in place in order to reduce the combined effect of carbon emissions, waste, and pollution on the environment. Energy-efficient housing is one of the key measures that the UK government is hoping will achieve a reduction in emissions.

Under the government’s Green Finance Strategy, £5m in funds has been allocated to boost demand for green mortgages, which offer discounted rates to customers who improve their home’s energy rating. The move is part of the UK’s commitment to become a net zero emissions economy by 2050.

In the UK, demand for ‘green’ financial products has grown significantly. A report from Ricardo Energy & Environment states that the global low-carbon financial services annual market size could potentially reach £280bn in 2030 and £460bn in 2050.

Many industry spectators believe that more direct financial incentives are needed to persuade homeowners and mortgage borrowers to invest in efficient housing. While the stamp duty exemption on zero-carbon homes is a step forward, it still does not impact the vast majority of existing housing stock that is available in the secondary market, where the majority of mortgage deals take place.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn our view, increased awareness of environment change has boosted demand for green products. Proposed government initiatives to encourage greener living will also drive demand for green mortgages, but there is a critical need to stimulate greater awareness of green building among the general public. As the market develops further, lenders will need to partner with the government to promote awareness of environmentally friendly housing and the green financial products available to achieve it.

We will be assessing green mortgages and their feasibility of success in the UK in our upcoming report, UK Mortgage Market 2019: Forecasts and Future Opportunities.