Bank Norwegian’s 2018 financial performances underscored the threat posed by digital-only banks. Incumbent banks must improve their efficiency if they are to compete in the years to come.

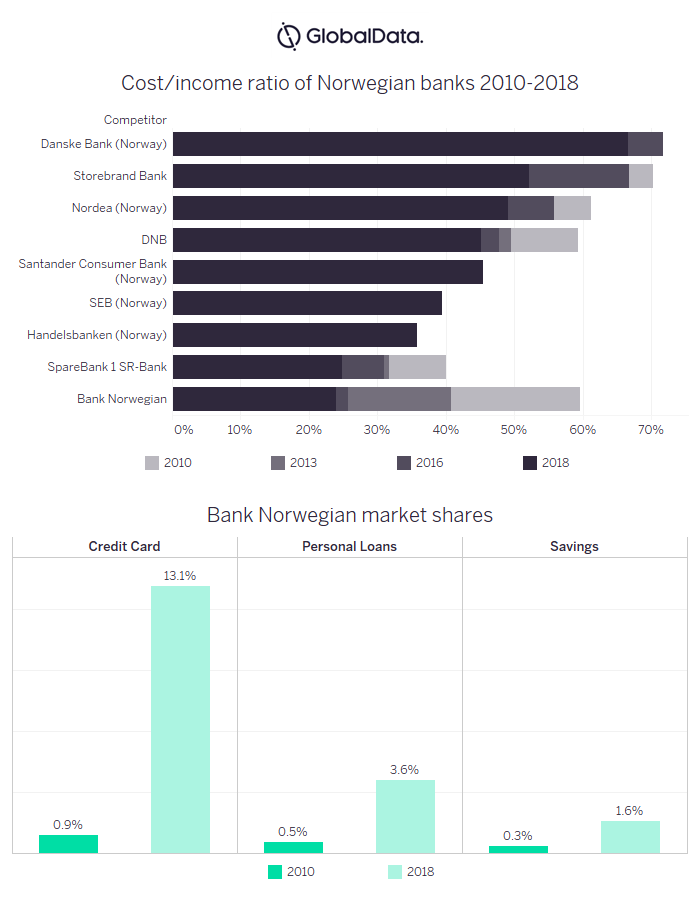

In 2010, Bank Norwegian had miniscule shares of the Norwegian personal loan, credit card, and savings markets, and its cost/income ratio was the fourth highest in the country. Since then its performance has been staggering. In 2018 it posted a cost/income ratio of 24% – the lowest in the Norwegian market. It has kept costs down with just 77 full-time employees as of 2018.

In addition, its market shares rose to 3.6% of the personal loan market, 13.1% of the credit card market, and 1.6% of the savings market.

Bank Norwegian’s lean operations enable it to offer highly competitive pricing and reward incentives. In cooperation with the airline Norwegian, it offers a combined credit card and reward card that has proved very popular with customers. The bulk of its 1.5 million customer base are credit card holders (73% in 2018), with the remaining 27% split between savings and loans customers.

What should worry Norwegian incumbents is the possibility that Bank Norwegian continues its impressive growth.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAccording to GlobalData’s 2018 Retail Banking Insight Survey, there is strong reason to believe it will. Approximately two in five Norwegian millennials and Generation Z consumers said they would be willing to use a digital-only bank in the next 12 months. Moreover, in our 2019 survey 31% of Norwegian millennials and Generation Z had not switched their main bank account because of perceived difficulties with onboarding – a key strength of digital-only banks.

To defend themselves against the threat posed by Bank Norwegian, incumbents will not only have to improve their cost/income ratios but also customer retention rates.