Following the financial crisis of 2008, significant attention has been focused on bank earnings and earning power. Many European banks have struggled with low profitability since the financial crisis, which has weakened their ability to finance the wider economy. This in turn has further weakened the overall economy. One factor squeezing revenue is, falling net interest margins – the difference between the interest income generated on average interest-earning margin financial assets (lending) and the amount of interest paid on average interest-bearing financial liabilities (borrowings) relative to the amount of interest-earning assets.

How has AIB combatted the net interest margin blues?

Though, Irish banks recorded the biggest turnaround in average profitability in 2015 and have returned to financial health. 2016 financial results from major Irish bank AIB confirm a very strong performance by the bank, with sustainable profits, strong capital generation, and very significant lending into the Irish economy. The bank’s net interest margin was boosted by lower funding costs, increased levels of new lending, and restructuring of impaired loans at sustainable margins.

Additionally, AIB intends to pay a €250m dividend to shareholders, the first bank to do so since the global financial crisis in late 2008. This dividend payment is supported by the bank’s strong profitability.

What is driving this performance?

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

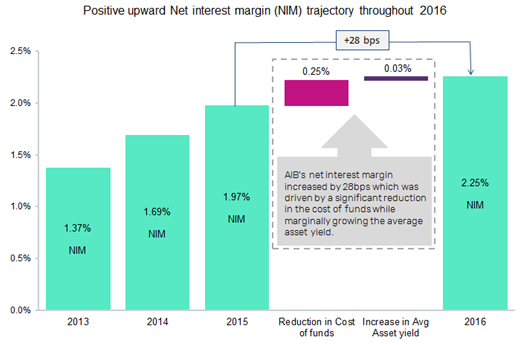

By GlobalDataAIB’s net interest margin, a key measure of profitability which shows how profitable lending is rose consistently from 1.37% in 2013 to 2.25% in 2016. The net interest margin is calculated by dividing net interest income by total assets.

The increase in AIB’s net interest margin from 1.97% as of 2015 to 2.25% in 2016 was driven by a number of factors including a stabilization in bond yields, lower funding costs, repayment of contingent capital notes in the year, and growth in the customer accounts base. This allowed the bank to maintain market share while reducing average cost of funds.

The Irish economy has quickly rebounded and the banking system has also returned to profitability. However, it is not easy for banks to achieve these improvements, not least at a time when net interest margins are under increasing downward pressure from lower interest rates. The weak economic environment may lead to a higher rate of non-performing loans; regulatory requirements continue to push up banks’ funding costs; and competitive pressures from existing banks, new entrant banks, and non-banks remain strong.

As pressures on profitability persist, other Irish majors will have to follow in AIB’s footsteps and work hard to drive similar competences in their retail banks to remain profitable.