Over the past few years, banks have faced immense disruption and struggled to transform its organisation with technology. Our research with IBM found that 88% of banking executives are troubled by their bank’s commitments to multiyear projects, interoperability across technology environments and theft of sensitive data. A lack of industry standards is also causing significant problems and hindering the organisation’s ability to bring new services, at the desired speed, to market.

In 2023, banks must focus on adopting a coreless banking model, which enables the delivery of banking services that aren’t longer dependent on legacy systems. This approach will empower banks to select the software vendors required to obtain the best-of-breed for each application area without worrying about interoperability. Furthermore, this model will translate each proprietary message into one standard message model, meaning communication between services is significantly enhanced, ensuring that each solution seamlessly connects and exchanges standardised data. A system that can be reused and utilised from day one, and the ability to be used by other institutions, will mean the opportunities to connect the financial services industry are endless.

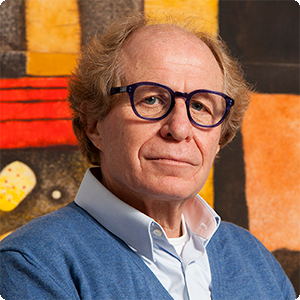

Hans Tesselaar, Executive Director, BIAN

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData