All articles by Verdict Staff

Verdict Staff

For banks, customer data is the new king

One common theme in many of the new banking regulations and standards is the requirement for banks to collect, analyze and store more data on their activities and customers. But rather than viewing this as justa compliance exercise, savvy banks are transforming these mandates into an opportunity to learn more about their clients to drive new revenue opportunities.

Cyber attacks on banks: beware the wolf in sheep’s clothing

Banks spend plenty of time and effort on security measures to protect their physical premises. Sophisticated safes, cash handling protocols, security doors and smoke screens are all commonly deployed to protect cash in-branch.

Selling and tracking customer data: it’s not personal

A system that tracks your everyday transactions, each click on online banking, and patterns in making payments might sound sinister at first glance – but is part of a metadata revolution that doesn’t target individuals and has the potential to benefit bank customers. Kate Palmer writes

Splitting out banks: the good, the bad and the risky

As our financial systems begin to emerge from the ashes of the credit crunch, governments across the world are looking to improve stability in the banking sector. There are a number of ways of doing this. Yet the Commission on the Structure of Dutch Banks, established by the Dutch Minister of Finance, may be one of the first to formally suggest the implementation of Enterprise Architecture as one such solution, writes Hans Tesselaar

Mobile banking: where time stands still

We can see all kinds of cool mobile apps these days – great apps for sports, stunning games, crazy social apps and anything else you could think of. They provide a fantastic new approach to resolving our day-to-day problems and are dearly loved. Additionally, the media will never stop praising them and describing how creative developers are. Oh, sweet fruits of the mobile revolution, writes Denis Margolin

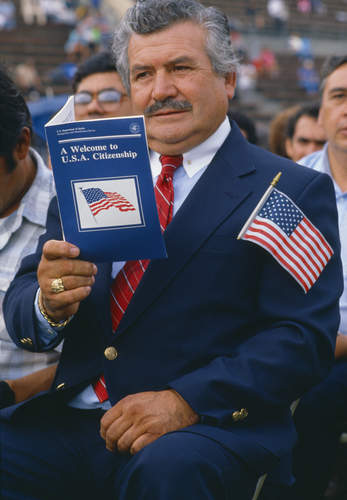

Pan American Bank continues to help lawful residents become citizens

Pan American Bank is to continue to extend microloans to lawful permanent residents through the Citizenship Microloan Program.

New Zealands Westpac bank to crowdsource mobile banking apps

Westpac is launching an initiative to crowdsource ideas for mobile banking apps from New Zealand developers and designers with up to NZ$70,000 ($56,000) of incentives and the opportunity for those chosen to take their app to the world.

Community banks fail to embrace m-banking – Bluepoint Solutions

A while paper from technology company, Bluepoint Solutions, ‘The Future of Mobile Banking’, has found that community banks are slower than larger banks when it comes to implementing mobile banking.

Braintree collaborates with Simple to offer one-touch mobile banking with Venmo Touch

Global payment platform Braintree has collaborated with mobile bank account provider Simple to offer customers access to Venmo touch.

MasterCard appoints M2M SPS as partner to increase card acceptance in Morocco

MasterCard appointed M2M SPS, a leading provider of secure e-transaction processing solutions, as a Principal Member in Morocco.